The Burrow

No matter where we’re from, we all love our pets. According to data gathered by Statista, there are more than 471 million dogs in the world kept as pets and 373 million cats.1 That also doesn’t include other pets like fish, birds, lizards and the odd basement goblin or two.

Anybody who has a pet would tell you how they’re a part of the family and they’d do anything to save them. But the reality isn’t always so simple, and when faced with a vet bill in the thousands of dollars, tough choices often need to be made.

Pet insurance is designed to help cover a portion of your vet bill if your pet ever ends up there, which they should at least once or twice a year! At the cost of an ongoing premium, a good pet insurance policy is meant to help pay for accidents and illnesses. Some providers also allow you to add additional cover for routine care, dental care and even behavioural problems. However, they can be subject to exclusions, restrictions and limits, so be sure to check the Product Disclosure Statement (PDS) prior to purchasing.

Yet despite the potential for these things to happen to our pets, some of which can cost thousands of dollars, it seems that pet insurance may not be a very popular type of insurance policy:

These numbers seem low, especially when you consider the key benefits of having a policy. It can save you from having to face huge out of pocket expenses if your pet becomes ill or is seriously injured, which can add insult to injury in a time of stress for you and your family.

As an example, the common practice of scaling and polishing your dog’s teeth could be as high as AU$1,800 – something that could become much more affordable if you had a pet insurance policy that included cover for such a procedure.9 And that’s not even an emergency! Costs for those can be much more exorbitant.

And yet, our data shows still that there are many people out there who would spend those thousands – and even risk going into debt – just to keep their beloved pets alive. And as it turns out, some countries might love their pets just a bit more than others. As pet insurance experts, we surveyed more than 2,500 adults across Australia, America and Canada.

In doing so, we set out to discover which country would fork out the most to save their pet. Here’s what we found.

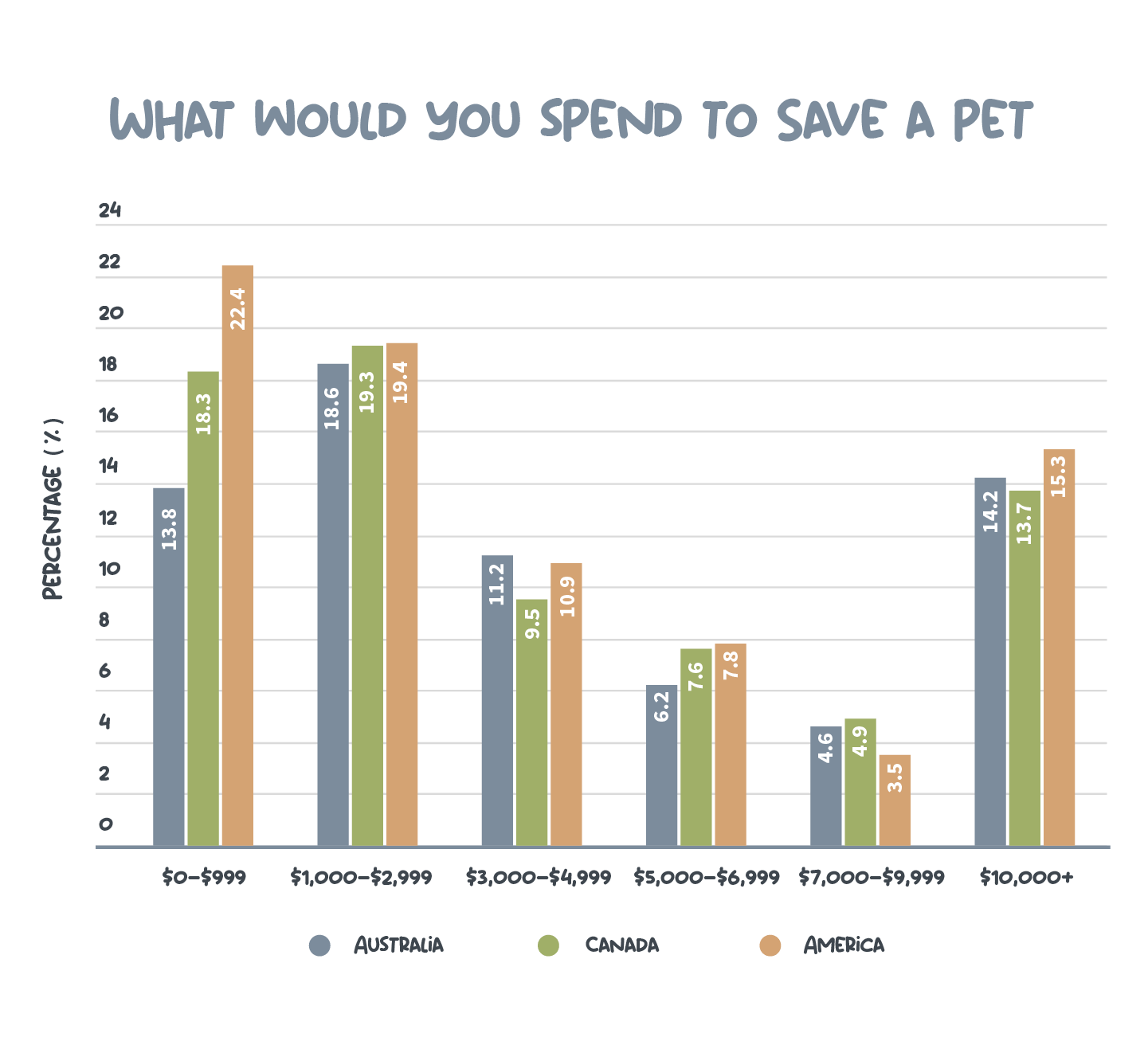

Our survey asked Australians and North Americans to indicate how much money they’d be willing to spend on a pet if it was in a ‘life-threatening’ situation, and there was a medical procedure available to ensure they would be healthy once more.

The responses ranged from $0-$999 all the way up to $10,000+ (in each country’s respective currency), and interestingly, Americans were willing to spend both the most and the least on their pets’ vet bills.

Our research also found that well over half (57%) of Americans would spend over $1,000 overall, while that number is slightly less for Australians (54.8%) and Canadians (55%); the similarity here can be explained by pet owners in the latter two countries being more willing to spend more moderate amounts (between $1,000 and $10,000) on their pets’ wellbeing.

See the charts below for a full breakdown of the results.

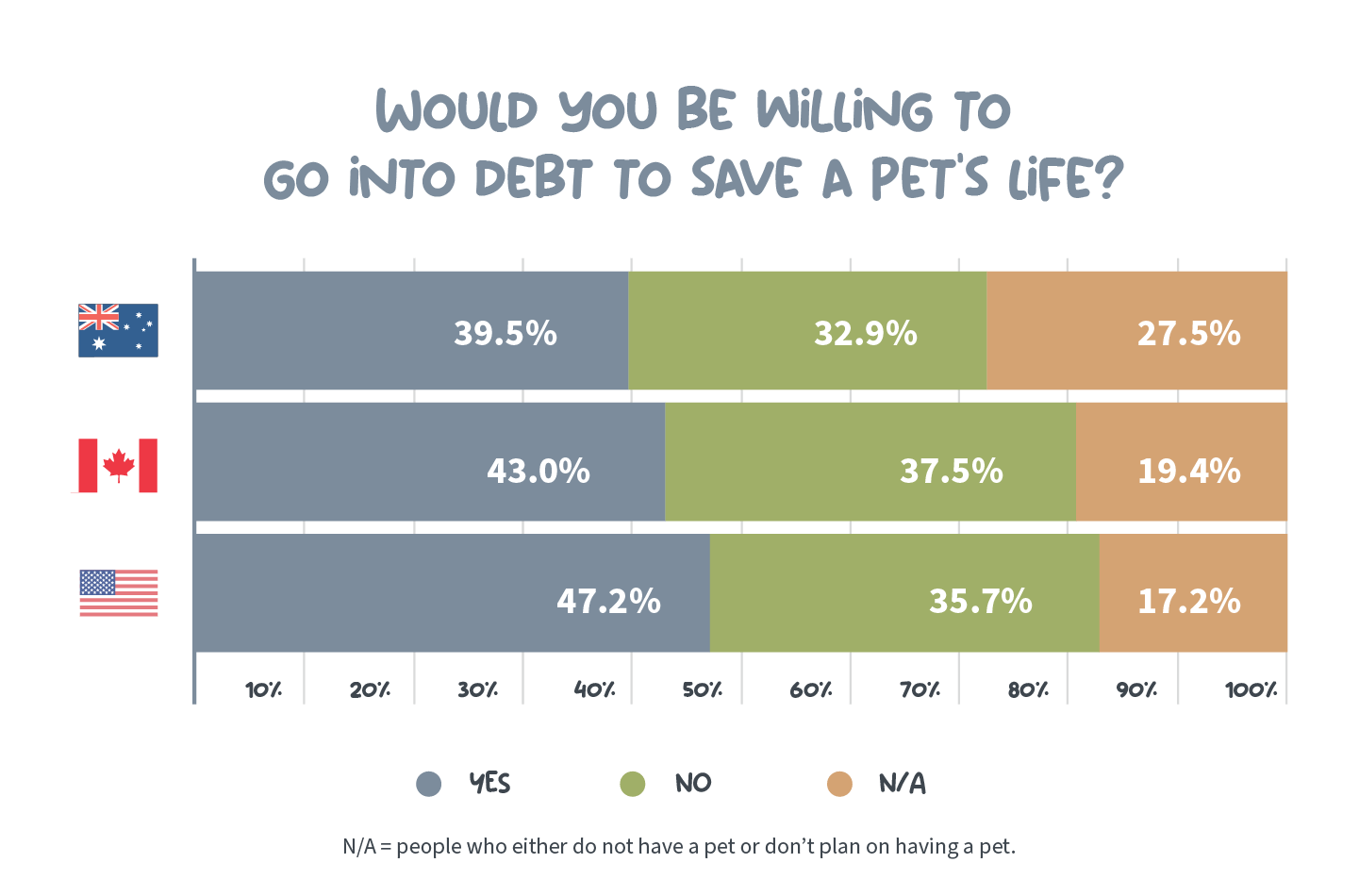

When faced with these high vet bills, many respondents said they’d be willing to fork out thousands of dollars for a pet emergency. But when it comes down to it, how many of them would actually have the money on hand? When faced with having to part with several thousand, there’s plenty of research to suggest that many would not actually be able to afford to do so.

In America for example, just 39% could afford an unexpected $1,000 expense,2 while one in five Australians couldn’t raise $1,000 within a week for something important.3 Shockingly, in Canada that number rises to 51%!4

With this in mind, Compare the Market thought it was necessary to ask if people would be willing to go into debt to save their beloved pet, whether that be through a credit card, a payment plan, a personal loan, buy now pay later, or another method.

Once again, it was Americans who were the most likely to sacrifice their own finances for their pet, with nearly half (47.2%) saying they would go into debt for them. Comparatively, 43% of Canadians and 39.5% of Australians would do the same.

We already know how many people have an existing pet insurance policy. However, when we asked those without one if they would consider it, at least half said yes in each country. Americans were the most likely to consider a pet insurance policy at 59.9%; next were Canadians at 57.7%, with Australians bringing up the rear at 50.1%.

These results are interesting given a higher portion of Australian pet owners currently have insurance than the other two, but why is there such a disconnect between the number of people who have pet insurance and the number of people who would get it?

Compare the Market’s insurance expert Stephen Zeller says the reasons people don’t take out pet insurance are very similar in many countries.

“Key reasons for not getting pet insurance are often a lack of affordability, questions about value for money, a lack of interest in actually applying for a policy, and in some cases, many people just aren’t aware that it exists,” Mr Zeller said.

“We also see a general trend in pet owners not understanding the possibility of illness or injury to their pet, and how exorbitant the costs can be – sometimes, thousands of dollars.

“While it may not always be right for you, there are benefits to finding the right pet insurance policy. Generally speaking, the higher your level of cover the more you’ll be covered for.

“The number of pets purchased during the pandemic has soared, but this means spending on our pets has risen too. And pets are even more unpredictable than people when it comes to landing themselves on the operating table.

“So do your furry family member a favour and take a few minutes to compare pet insurance policies available to you, wherever you are.

It could make the decision to seek vet treatment much easier and end up being the thing that helps you to afford the treatment they need in order to save their life.”

Compare the Market commissioned Pure Profile to survey 501 Australian, 1,001 American and 1,004 Canadian adults in April 2022.