It’s unlikely, but not impossible, for Australian interest rates to fall even further, and a key regulator has warned the banks to prepare for rates below zero.

The Australian Prudential Regulation Authority (APRA) yesterday released a draft consultation for Australian banks on their preparedness for zero and even negative interest rates1, and found while most of them would be fine, some would face ‘operational challenges’.

According to APRA’s Executive Director of Banking Therese McCarthy Hockey:

“In order to ensure that ADIs [authorised deposit-taking institutions, aka banks] can operate with zero and negative interest rates, if required, APRA expects ADIs to take reasonable steps to prepare for scenarios in which the cash rate and/or market interest rates may fall to zero or become negative.”

The Reserve Bank of Australia has repeatedly said before that the current record-low cash rate of just 0.10% would not fall any further, before eventually being increased in 2024.

In March 2020, RBA Governor Philip Lowe said Australian interest rates going negative was “extremely unlikely”, and that Australia had “no appetite” for it2.

That doesn’t mean it will never happen, and as Ms McCarthy Hockey said, “it is possible that other interest rates determined in the financial markets could fall to zero or below zero at any time.”

But this all sounds very high level: What exactly are negative (or zero) interest rates, and what does it mean for the average household?

In short, it could have a material impact on mortgage interest rates and repayments.

What are negative interest rates?

Negative interest rates are essentially when a country’s central bank lowers the official cash rate – the cost of borrowing money for Australia’s banks – to below 0%.

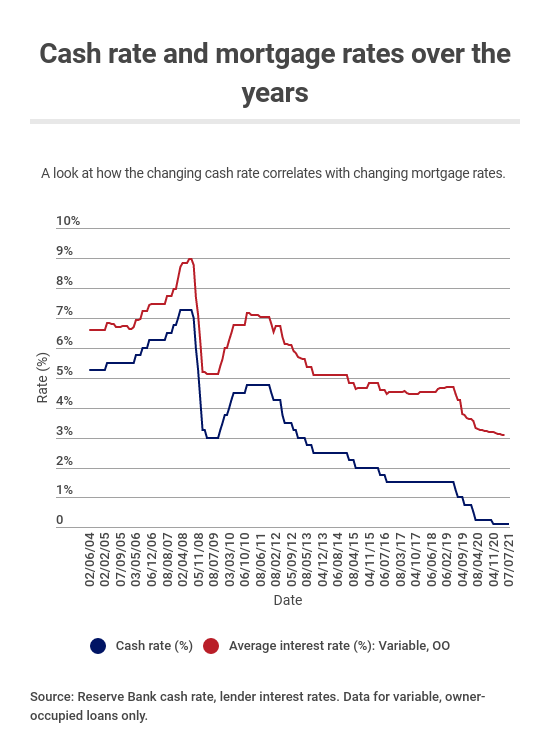

Cash rate movements are big news, since any changes are usually passed onto banking customers in one way or another, either through higher or lower mortgage interest rates and savings rates.

Australia’s cash rate is currently at a record-low of just 0.10% and looks set to stay that way for some time, but it is still technically possible for it to go lower, to 0% or even into the negatives.

Negative interest rates are unconventional, but the theory behind it can be relatively simple: central banks make it extremely cheap (or even pay the banks) to borrow and lend money to customers instead of hoarding it.

This, in turn, should boost economic activity, inflation and encourage people to spend more of their own money.

Do any countries have a negative cash rate?

Governor Lowe once said negative interest rates were mostly a “European phenomenon”, and he’s essentially correct.

Based on OECD data3, there are several different countries with negative cash rates at the moment, and all but one of them (Japan, at -0.03%) are European.

As of June 2021:

- The Euro area (19 countries) has a lending rate of -0.48%

- Estonia, Latvia and Slovenia have lending rates of -0.48% also

- Denmark has a lending rate of -0.38%

As of May, Switzerland had a cash rate of 0.85%, which is the lowest in the OECD.

Although it no longer has a negative cash rate, Sweden was actually the first to take the plunge, dropping to -0.25% in 2009.

Australia’s current 0.10% rate is still quite low, sitting 11th behind the likes of the United Kingdom (0.07%), Turkey (0.05%) and Norway (0%) who haven’t quite gone negative yet.

What do negative interest rates mean for home loans?

One of the most interesting things about negative interest rates is that banks can essentially pay people to borrow from them (more or less).

Jyske Bank in Denmark is a famous example, offering negative interest payments to customers on a 10-year fixed home loan at -0.50% in 2019.

That means the money owed by the customer falls by more than the repayment each month.

“We don’t give you money directly in your hand, but every month your debt is reduced by more than the amount you pay,” Jyske’s housing economist, Mikkel Høegh said4.

Another Danish Bank, Nordea Bank Abp, can get a 20-year fixed loan with a 0% interest rate.

While actual home loans with zero or negative interest rates are uncommon, the countries with negative cash rates do have lower home loan repayments than Australia on average.

With an average mortgage interest rate of 3.69% p.a as of January 2021 (across all residential loans, new and existing), Australia ranks 26th out of 35 in the OECD, with the likes of Luxembourg (1.45% p.a) Slovakia (1.46% p.a), Switzerland (1.46% p.a) and France (1.51% p.a) all offering cheaper mortgages.

Changes in Australia’s mortgage rates are closely correlated with changes in the cash rate.

What do negative interest rates mean for savings?

Negative interest rates might spell home loan heaven for home loan customers, but they’re not so good for those who like to store their cash in the bank.

Australian savings account and term deposit rates are already at record lows, with the RBA’s latest deposit data for May 20215 showing an average interest rate of just 0.25% (among the major banks).

That’s less than a quarter of the current rate of inflation (1.1%), meaning money stored in these accounts is going backwards in terms of its real value.

But it could be worse: with a negative cash rate, banks could charge customers for the convenience of having a bank account with them.

In Switzerland for example, UBS told its customers in 2019 it would introduce an annual 0.6% charge on cash savings of more than €500,000 (£461,000), and more for even bigger deposits.

It’s also likely that customers with smaller deposits would simply receive a 0% interest rate, which is still almost worthless.

In the long run, negative rates can discourage savings and lead to people flocking to riskier asset classes, including houses, which can push prices up even further.

Should you prepare for negative interest rates here?

It’s still very unlikely this will happen in Australia any time soon.

As Compare the Market detailed last week, the most likely change to occur is a cash rate increase, with some economists saying it could happen as early as 2022.

Stress testing your home loan repayments against any potential increases could be a better idea, as up to 68% of mortgage holders have not done one for their mortgage.

Refinancing to a lower interest rate now, or a loan with fewer fees could also be worth considering.

Sources

- Australian Prudential Regulation Authority (APRA), ‘Consultation on zero and negative interest rates’. Monday 12 July 2021.

- Reserve Bank of Australia (RBA), Address to National Press Club of Australia, February 2021.

- Organisation for Economic Co-operation and Development (OECD), Monthly Monetary and Financial Statistics. Accurate as of 13 July 2021.

- Jyske Bank, August 2019.

- RBA Statistical Tables, Retail Deposit and Investment Rates. Accurate as of May 2021.