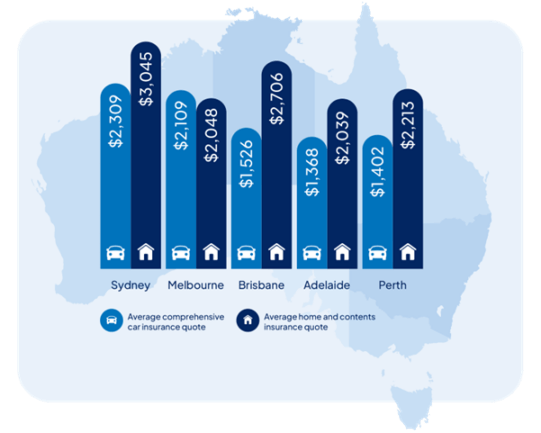

The average cost to insure a house and car has exceeded $4000 in three capital cities, with the highest combined average in Sydney at $5300 according to Compare the Market’s new Insurance Quote Index.

The quarterly index draws upon hundreds of quote search results to understand the average cost of insurance for a common car model and typical four-bedroom homes in each of the capitals.

Brisbane and Melbourne had the next most expensive insurance quote averages, with car and home and contents averaging $4,232 and $4,157 respectively.

Home and contents policy quotes were more expensive than car cover quotes in four out of the five cities analysed, with the dearest averages reported in Sydney and Brisbane.

Compare the Market Economic Director David Koch said that many Australians had accepted higher insurance premiums as a consequence of inflation and recent catastrophic disasters that had fuelled billions of dollars in claims.

However, he warned that justification was no reason for Australians to acquiesce to higher costs.

“When it comes to your insurance, you should never take a price hike lying down or accept a renewal notice at its face value,” Mr Koch said.

“The recent revelations about reportedly bogus loyalty discounts, used to retain trusting customers, is a much-needed wake-up call to Aussies.

“We should never assume that we are getting the best value when the most generous offers are often reserved for those who shop around.”

Compare the Market’s research found that in every case, there were one or more quotes below the average quote price, with the difference between the cheapest and most expensive quotes ranging from several hundred to several thousand dollars.

In one instance, there was a difference of $7,493 between the cheapest and dearest quotes for policies to insure one four-bedroom Sydney home.

“All insurance underwriters calculate premiums differently – taking account of factors like local crime, historic data, flood risk and putting more or less weight on certain issues to bet on your likelihood of making a future claim,” Mr Koch said.

“It means we can see big discrepancies between brands. So never stop your research after running a single quote – keep comparing and looking for better value.”

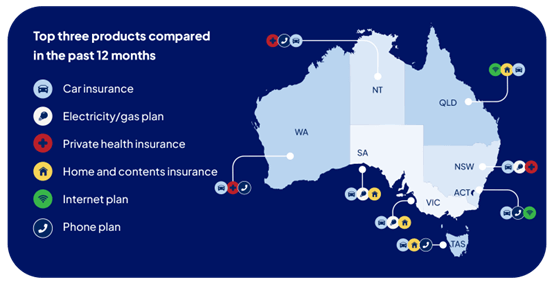

According to Compare the Market’s Household Budget Barometer car insurance, energy plans, and home and contents cover were the top three bills Aussies had compared over the past 12 months.

Still around a quarter of people surveyed (24%) said they had not taken any action to compare and switch service providers this year.

For more information please contact:

Sarah Orr | 0401 044 292 | [email protected]

Compare the Market is a comparison service that takes the hard work out of shopping around. We make it Simples for Australians to quickly and easily compare and buy insurance, energy, and home loans products from a range of providers. Our easy-to-use comparison tool helps you look for a range of products that may suit your needs and benefit your back pocket.

Methodology

Compare the Market’s Household Budget Barometer was based on a survey of 3,000 Australians in August 2024. The survey sample is nationally representative in age, gender, location and income.

Disclaimers:

> Car insurance quote index

Based on average indicative comprehensive car insurance quotes available from Compare the Market and also from selected popular industry brands. We used a target excess of $1000 or as close as possible where this was not available. Quotes for a white 4-door 2020 Toyota Corolla driven 12,000 km on average per year by a 30 year old male driver. See notes for further information relevant to the pricing of the policies. Quotes collected on 30/08/2024 – 01/09/2024. Your quotes will vary depending on your unique circumstances.

Average indicative quote prices were based on comprehensive car insurance quotes available through Compare the Market and also from three popular industry brands not available through Compare the Market. Quotes for a white 4-door 2020 Toyota Corolla sedan (no modifications) driven by a hypothetical 30 year-old male who is employed full time, obtained their licence at age 17 and has no previous claims. The car is used primarily for private or commuting purposes and is driven 12,000kms per year and is parked overnight in the following suburbs which were selected as approximately 15km north, south, east and west of the nearby city centre:

• Brisbane, QLD – Bridgeman Downs, Sunnybank Hills, Ferny Grove, Wynnum;

• Sydney, NSW – Frenchs Forest, Sans Souci, Punchbowl, Marsfield;

• Melbourne, VIC – Tullarmarine, Hampton East, Altona, Yallambie;

• Adelaide, SA – Stirling, Kingston Park, Largs Bay, St Agnes;

• Perth, WA – Kenwick, Fremantle, North Beach, Caversham;

Only policies with an excess of $1000, or as close to this figure as was possible with the relevant insurers, were used to calculate averages for these different locations. Quotes collected on 30/08/2024 – 01/09/2024. Your quotes will vary depending on your unique circumstances.

> Home and contents insurance quote index

Based on average indicative home and contents insurance quotes available from Compare the Market and also from selected popular industry brands. Quotes for a typical low-set, 4 bedroom 2 bathroom, freestanding brick veneer home with tiled roof, insured for $700,000 with $80,000 in contents with a target excess of $1000 for both home and contents. Our home owner was a 30 year old male who lives alone with no previous claims.. See notes for further information relevant to the pricing of the policies. Quotes collected on 30/08/2024 – 01/09/2024. Your quotes will vary depending on your unique circumstances.

Average indicative quote prices were based on home and contents insurance quotes available through Compare the Market and also from three popular industry brands not available through Compare the Market. Quotes for a typical low-set, 4 bedroom 2 bathroom, 2 undercover carparks, freestanding brick veneer home with tiled roof, insured for $700,000 with $80,000 in contents with a target excess of $1000 for both home and contents. Where these sum insured values or target excess were not available we used the closest possible option with the relevant insurer. Our hypothetical home owner was a 30 year old male who lives alone with no previous claims. The following suburbs which were selected as approximately 15km north, south, east and west of the nearby city centre:

• Brisbane, QLD – Bridgeman Downs, Sunnybank Hills, Ferny Grove, Wynnum;

• Sydney, NSW – Frenchs Forest, Sans Souci, Punchbowl, Marsfield;

• Melbourne, VIC – Tullarmarine, Hampton East, Altona, Yallambie;

• Adelaide, SA – Stirling, Kingston Park, Largs Bay, St Agnes;

• Perth, WA – Kenwick, Fremantle, North Beach, Caversham;

Only policies with an excess of $1000, or as close to this figure as was possible with the relevant insurers, were used to calculate averages for these different locations. Quotes collected on 30/08/2024 – 01/09/2024. Your quotes will vary depending on your unique circumstances.