Student loans could shrink high-income earners’ borrowing capacity by almost $100,000, according to new Compare the Market research.

A single income earner on $125,000 with no dependants could see their borrowing power reduced by $95,900 if they’re paying off an average HECS debt of $26,494.

How HECS debts impact borrowing power based on salary size

| Income | HECS debt repayment pa | Borrowing Capacity – with HECS (est) | Borrowing Capacity without HECS (est) | Difference |

| $75,000.00 | $2,625.00 | $381,700.00 | $408,500.00 | $26,800.00 |

| $100,000.00 | $5,500.00 | $492,500.00 | $548,800.00 | $56,300.00 |

| $125,000.00 | $9,375.00 | $583,100.00 | $679,000.00 | $95,900.00 |

| Calculations assume: a single applicant with no dependents, an average loan size of $641,000, the loan type is owner occupied, principal and interest, with a variable rate of 6.14% and the loan term is 30 years. An average HECS debt of $26,494 was used. | ||||

As property prices rise and saving for deposit gets harder, home buyers are looking for different ways to boost their borrowing power, leading some to consider clearing their student debt.

But this might not be an easy feat with Australian Taxation Office (ATO) data showing the grim number of people with a six-figure HECS-HELP debt skyrocketing from 47,847 last year to just under 56,700 this year.

Compare the Market’s Economic Director David Koch said paying off student debt could be a good way to boost borrowing power and avoid the sting of indexation.

“Historically, HECS has been seen as a benign debt that you pay off gradually through your salary,” Mr Koch said. “There’s no interest on the loan, there’s no deadline, and it’s the only debt that’s written off when you die. But the “harmless” image has started to change in light of the huge sums added to debt each year due to indexation.

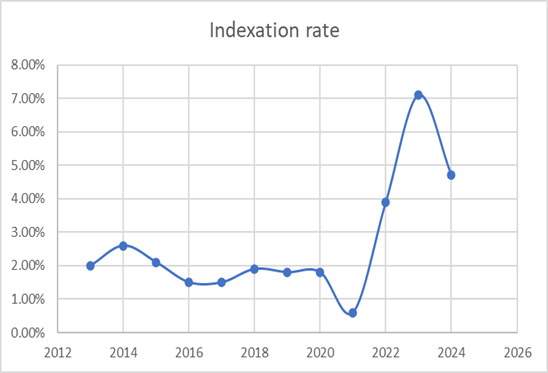

Historical indexation rate sourced from the ATO’s website.

“Last year, when the indexation rate surged by an eye-watering 7.1% the government promised to reduce the rate to 3.2% and manage any unfair adjustments in future.

“But when the average time to repay a student debt has blown out from 8.2 years in 2011–12 to 9.5 years in 2021–22 most people will continue to pay hundreds or thousands of dollars more due to indexation.”

While someone on a higher income of $150,000 might be able to borrow more money from the bank than someone on a lower income of $65,000 – Their HECS repayment rate is almost 8% higher.

“Generally speaking your borrowing power is reduced by the percentage of your income you’re required to pay towards your HECS. Therefore the higher income earners could be more restricted by their HECS debt than lower income earners.

“If you have money sitting in the bank that you could use to pay off your student loan in one go, then it might be worth considering. It’s something to weigh up based on your personal circumstances.”

Kochie’s tips for boosting borrowing power:

Pay off high interest debts first

If you have credit card debt, a car loan or personal loan – this should be your first priority not your HECS debt. If you work to reduce or eliminate your high-interest-rate debts, you may be able to increase your borrowing capacity.

Reduce your credit card limit or get rid of it

Reducing your limit or closing your credit card may help boost your borrowing power. According to a Compare the Market analysis, a $10,000 credit card limit held by someone earning $100,000 would reduce their borrowing capacity from $552,000 to $505,000.00 – a difference of $47,000.

Know your credit score

Websites like Compare the Market provide free credit score checks to help you understand how strong your borrowing position is. It’s one of the measures lenders use to calculate the risk of your application. Improving your credit score is one way to improve your chances of being approved.

Consider a joint purchase

Two incomes are usually better than one – so you may find your borrowing power increase with an additional person on the loan. You could team up with a family member, partner or friend.

For more information, please contact:

Natasha Innes | 0416 705 514 | [email protected]

Compare the Market is a comparison service that takes the hard work out of shopping around. We make it Simples for Australians to quickly and easily compare and buy insurance, energy, travel and home loan products from a range of providers. Our easy-to-use comparison tool helps you look for a range of products that may suit your needs and benefit your back pocket.

Hypothetical scenario 1

Bob earns $100,000 per year and also has a $100,000 HECs debt. He has a $600,000 home loan with a variable rate of 6.3%. Bob might benefit from putting $100,000 in his offset account as opposed to paying off his HECs. Assuming the 6.3% interest rate remains unchanged, over a 30 year loan term Bob could save around $367,000 in interest on his mortgage.

Hypothetical scenario 2

Kirsty earns $125,000 and has $10,000 of HECS debt left. She is looking to buy her first property and has no other debt aside from her student loans. She might benefit from paying off her HECs debt as it will improve her borrowing power.

Survey of 1,010 Australian adults, conducted in April 2024.

Repayment rates for the 2024 – 2025 financial year:

| Repayment income (RI) | Repayment rate |

| Below $54,435 | Nil |

| $54,435 – $62,850 | 1.00% |

| $62,851 – $66,620 | 2.00% |

| $66,621 – $70,618 | 2.50% |

| $70,619 – $74,855 | 3.00% |

| $74,856 – $79,346 | 3.50% |

| $79,347 – $84,107 | 4.00% |

| $84,108 – $89,154 | 4.50% |

| $89,155 – $94,503 | 5.00% |

| $94,504 – $100,174 | 5.50% |

| $100,175 – $106,185 | 6.00% |

| $106,185 – $112,556 | 6.50% |

| $112,557 – $119,309 | 7.00% |

| $119,310 – $126,467 | 7.50% |

| $126,468 – $134,056 | 8.00% |

| $134,057 – $142,100 | 8.50% |

| $142,101 – $150,626 | 9.00% |

| $150,627 – $159,663 | 9.50% |

| $159,664 and above | 10% |

| Repayment income calculator: https://paycalculator.com.au/student-loan/ | |