The following is David Koch’s personal views, as published in his ‘Your Money Digest’ newsletter.

Hi everyone,

I reckon you can ink in an interest rate rise when the Reserve Bank Board meets on Melbourne Cup Day, 7 November.

Last week I said Wednesday’s September quarter Consumer Price Index would be the trigger for any rate increase if it came in higher than expected… well, it did.

The CPI rose by 1.2 per cent for the September quarter, which was up on the expected 1 per cent rise. Annual inflation continued to fall to 5.2 per cent, but it’s not falling fast enough.

As new RBA Governor, Michelle Bullock, reminded us earlier in the week, the RBA needs to be tough on inflation and will not hesitate to lift rates if inflation doesn’t fall quickly enough: “The Board will not hesitate to raise the cash rate further if there is a material upward revision to the outlook for inflation.”

That’s what they’ll do on 7 November.

Only 22 of the 87 items measured in the CPI basket fell in price in the September quarter, with the biggest fall being child care (down 13.2 per cent) due to the government’s Child Care Subsidy.

Vegetable prices fell 5.6 per cent, followed by lamb & goat (down 47 per cent). In terms of vegetables, the ABS notes “berries, grapes, and salad vegetables such as tomatoes, broccoli and capsicums drove the fall.”

The biggest increase in prices was in postal services (up 8.2 per cent), petrol (up 7.2 per cent), water & sewerage (up 4.7 per cent) and property rates & charges (up 4.4 per cent).

While insurance, energy and petrol prices were driving the CPI, supermarket giant Woolworths provided a trading update this week: “Importantly for our customers, inflation in our food businesses continued to moderate over the quarter, driven mainly by deflation in fruit & vegetables and meat, as lower input costs in these categories have led to lower retail prices.”

So good signs from the coalface that supermarket price increases could be heading back to normal.

How to fight the banks if they put up your home loan rate

There’s a good chance the next RBA meeting will put up rates on 7 November – and the banks will naturally pass it on to borrowers – so now is the time to start putting together a strategy to ease the pain.

The first thing to understand is that the big banks are earning billions of dollars each year from long-term customer complacency, which may have even increased since the Reserve Bank’s 12 cash rate rises since May last year.

Since then, lenders have been fighting harder than ever to attract new customers with lucrative cashback offers and discounted interest rates, while existing customers have been left in the lurch. It is a classic case of loyalty not being rewarded.

Research from Compare the Market has found that almost half of Australian homeowners could be getting stung with higher “back-book” rates and fees because they’ve never refinanced. That refers to existing customers already on the financier’s books getting the very worst rates and being at the back of the queue or priority list.

Lenders regularly profit from borrowers’ apathy by reverting to higher interest rates for customers already on their books.

For example, one of the big banks has a net interest margin of 2.39 per cent. That’s approaching the size of the 3 per cent serviceability buffer banks stress test you with… which is a lot.

Compare the Market analysis of some of the rates available from the big four banks showed the average difference between front-book (new customers) and back-book (existing loyal customers) rates is a whopping 2.2 per cent. Yep, 2.2 per cent difference, which is enormous.

What that means in terms of dollars is a person with an owner-occupier $750,000 loan could be saving $1,123 a month when they switch from a rate of 8.45 per cent to 6.25 per cent.

If you’ve been with your current lender for a while, there’s a good chance you’re on a back-book rate, and there’s a much better deal out there for you.

Do your research and find your current lender’s front-book (new customer) rate and ask them to match it.

If they don’t at least offer you a discount, be prepared to walk. The bank will often say they can’t match their front-book rate because that’s only for new customers, but that’s a load of rubbish.

They should be able to. They just don’t want to because they’re making more money off your loan on a higher interest rate.

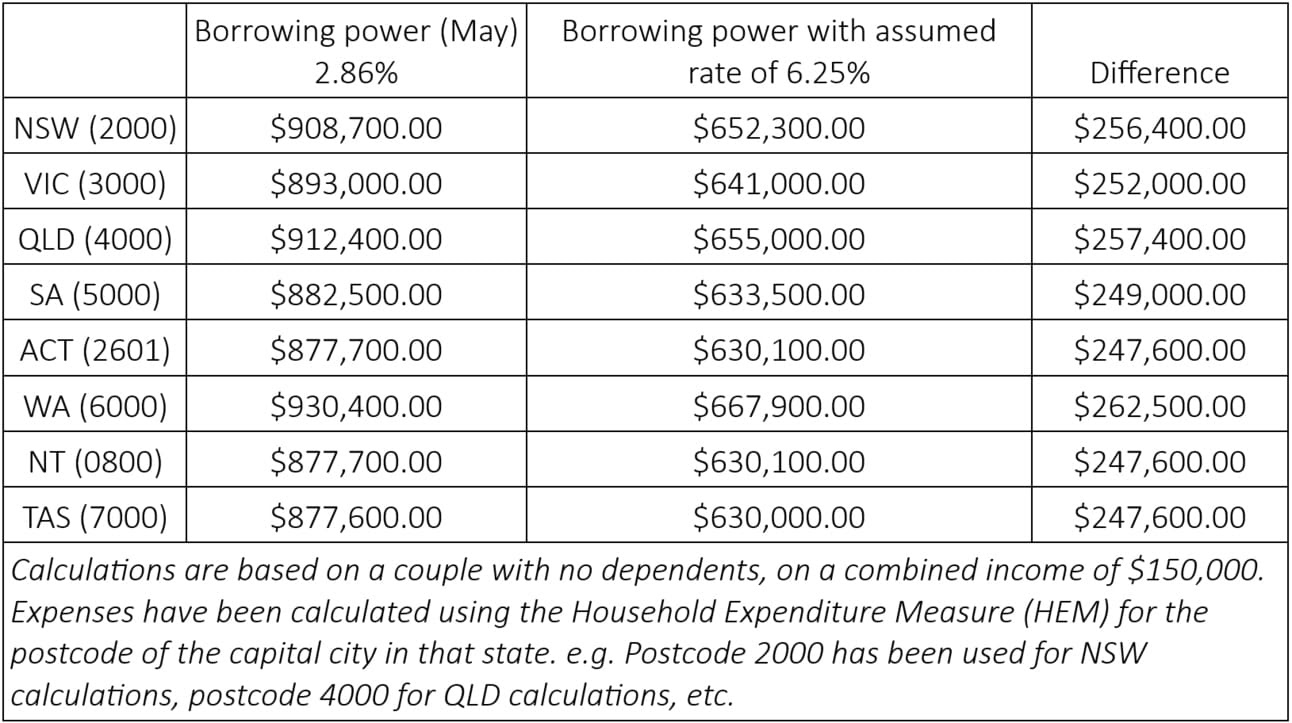

And don’t forget as home loan rates rise, your borrowing capacity falls as well

Borrowing power has plunged over $260,000 for some Australian families, trapping many mortgagees that can’t qualify for better rates, and hampering house hunter hopefuls.

Lenders have been far more cautious in an effort to offset the risk of recession and higher rates that could impact long-term serviceability.

Fixed rate borrowers who have just had their record low-interest rates expire may have been subjected to a 4 per cent increase in one hit. Banks typically stress test borrowers at 3 per cent… the cash rate has surged beyond this, so many borrowers may be in mortgage stress right now.

A couple from Western Australia with no dependents on a combined $150,000 income saw their borrowing power plummet by 28.2 per cent – that’s a decrease of $262,500 since May last year.

It’s a similar story for a Queensland couple with no dependents on a combined $150,000 income who experienced a $257,000 drop in their borrowing power.

Meanwhile, a New South Wales couple with no dependents on a combined $150,000 income had their borrowing capacity squashed by $256,400.

But there are things borrowers can do to help improve their borrowing power and boost their financial fitness.

Know your credit score

Websites like Compare The Market provide free credit score checks to help you understand how strong your borrowing position is. It’s one of the measures lenders use to calculate the risk of your application. Improving your credit score is one way to improve your chances of being approved.

Reduce your credit card limit … or get rid of it

When lenders calculate borrowing power, they use the entire credit card limit, rather than the balance, as part of their serviceability calculations. Therefore, reducing your limit or closing your credit card may help boost your borrowing power.

Pay off any debts

Banks must include all financial obligations when calculating your ability to repay debt including credit cards, car loans or personal loans. If you work to reduce or eliminate your high interest rate debts, you may be able to increase your borrowing capacity.

Although the Higher Education Loan Program (HELP) can’t accrue interest like credit cards, it can be brought in line with inflation. For example, in July this year, millions of Australian university students or people who are still paying off their HELP debt were slapped with a cruel 7.1 per cent increase in the amount they owe.

If you have the ability to pay off your HELP debt, then consider doing so as it may boost your borrowing power.

Consider a joint purchase

You could team up with a family member, partner or friend if your borrowing capacity isn’t high enough and you’re struggling to meet the lenders income requirements.

Joint purchases have become a popular way for many to break into the property market. Two incomes are usually better than one, so you may find your borrowing power increases with an additional person on the loan.

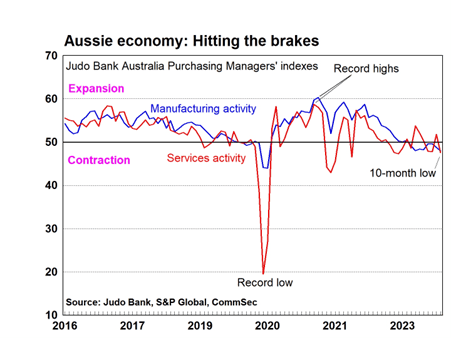

While inflation is still too hot… the economy is starting to hit the skids

It really is a tricky economic balancing act: how to fight inflation without destroying the economy, sending businesses broke and forcing people out of work.

The Judo Bank Australia Purchasing Managers Index (PMI) measures what employers produce; it’s called the Purchasing Managers Index because they are the ones who look after buying and selling in a company.

An index figure below 50 means business is contracting and cutting production, which inevitably can lead to job losses.

So the October PMI came in at 48 (previously 48.7) for Manufacturing; Services at 47.6 (a 10-month low, prior: 51.8); Composite at 47.3 (prior: 51.5).

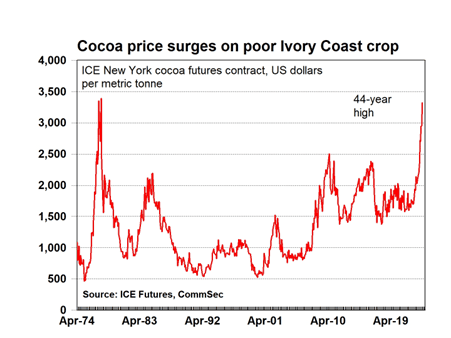

Oh no… chocolate prices are set to rise steeply

I came across this during the week, from CommSec, which is devastating news for chocolate lovers. Cocoa prices hit a 44-year high.

Poor crops in major producing countries like Ivory Coast and Ghana are leading to a supply shortage which, when combined with increasing demand from inflation-stressed consumers, is pushing prices higher.

A property for under $500,000 or a rental under $500 a week? Yes, they do exist

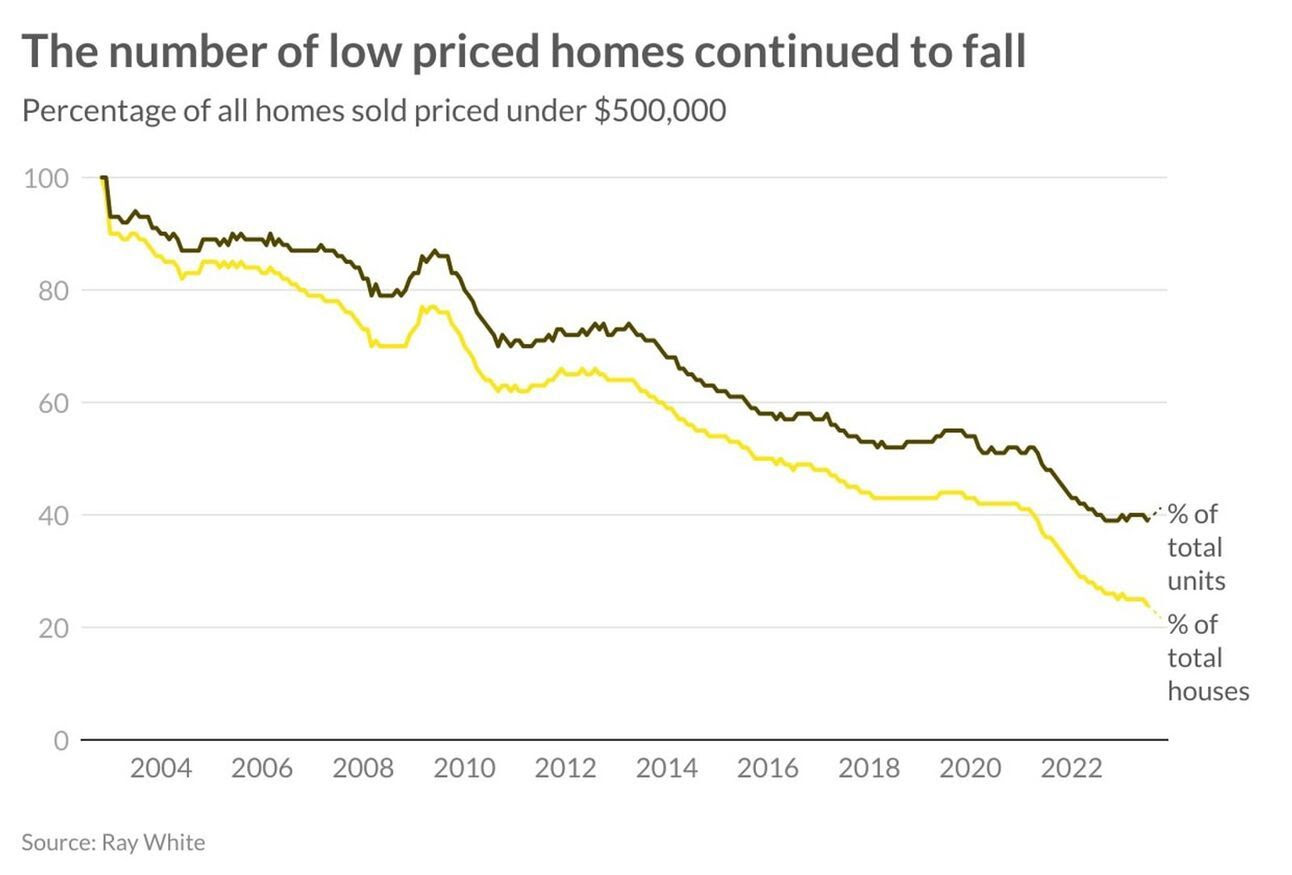

With our cheapest capital cities, Adelaide and Perth now recording the strongest growth in prices over the past 12 months, is there anywhere you can still find a cheap home? Looking at homes priced under $500,000, the answer is that it is becoming far less likely, particularly for houses.

But, according to Ray White chief economist Nerida Conisbee, there are still places you can look.

In 2002, almost all houses and apartments sold in Australia were priced under $500,000. Fast forward to 2015 and just half were sold at this price. Over the past 12 months, the proportion hit an all-time low with less than a quarter of houses now sold for under $500,000. The situation is slightly better for units with 39 per cent sold for under $500,000.

Not surprisingly, finding a cheap home in our capital cities is even more difficult. Over the past 12 months, less than 10 per cent of all properties (including houses and units) sold for less than $500,000 in Sydney. Canberra’s rapid building program has meant that the proportion of apartments sold under $500,000 drastically exceeds the number of houses sold under this price point.

Affordability is better in regional Australia, although finding a low-priced home in regional NSW is getting particularly difficult. Well under a third of all properties are now priced under $500,000.

While it is getting a lot harder to find cheaper homes, there are places to look and things to buy.

The most obvious is to buy an apartment. While just 24 per cent of houses sold were priced under $500,000, that proportion increases to 39 per cent for apartments.

Although Darwin and Perth don’t have many apartments, they are generally low priced with more than two thirds priced under $500,000. Similarly regional areas of South Australia and Western Australia have very few apartments, but those that are there are very low priced.

While the number of properties selling for under $500,000 is rapidly diminishing, so are the are the number of properties available for rent for under $500 a week.

You just need to see how rents have become a major inflation driver to know they are skyrocketing quickly.

Property research group, CoreLogic, have trawled the current rental offerings and come up with the best suburbs within a 20km radius of a capital city CBD.