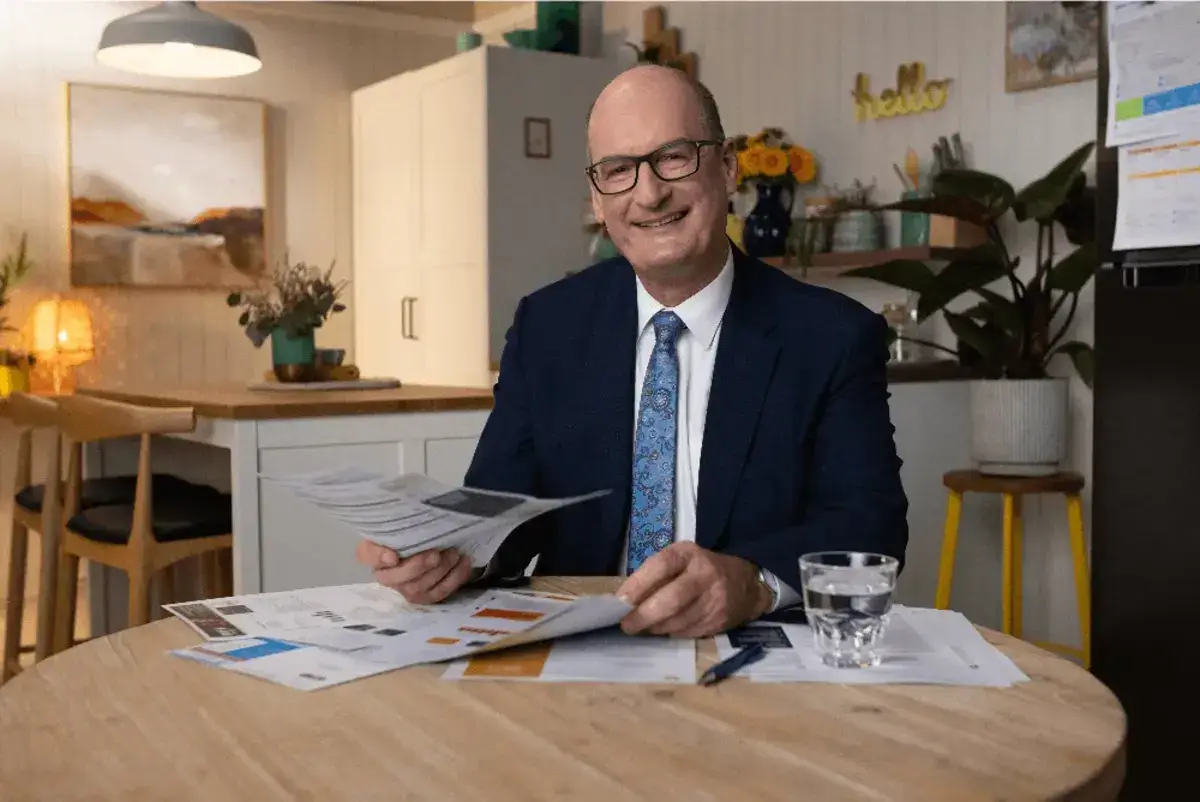

Australian families could pocket or miss out on hundreds of dollars in savings depending on a series of recent and upcoming pricing decisions from authorities, according to Compare the Market Economic Director David Koch.

Mr Koch said three big events – the Reserve Bank’s recent rate cut decision, the energy regulators’ draft pricing announcements, and the call that health insurance premiums are increasing by an industry average of 3.73% from 1 April – could have a major impact on household finances for the rest of the year.

“It’s crunch time for decision makers tugging at the purse strings of Aussie families,” Mr Koch said. “These authorities have the power to deliver considerable relief, or issue fresh pain to people battling the cost of living.

“While there is a lot to weigh up, we’re calling on decision makers to be fair and reasonable with their choices, as well as transparent about the reasons changes are made.

“Australians deserve to know why prices continue to be put up, because ‘inflation’ simply isn’t good enough of an explanation in my books.

“It’s an election year, so the good news is there will be plenty of scrutiny over each decision that’s made.”

Health insurance premiums

A “perfect storm” of inflationary pressures and political tensions added heat to health premium pricing negotiations this year, which was confirmed to be an industry average of 3.73% last week.

Health Minister Mark Butler previously rejected initial proposals from health funds, urging them to come up with a more “reasonable” average figure to reduce the strain on household budgets.

Australians have until 1 April to compare their options before the changes take effect.

“We’re urging customers to be prepared as shopping for cheaper deals may be one of the only ways for some to avoid the sting,” Mr Koch said.

“While the headline average figure is what everyone talks about, we know that there can be huge discrepancies between insurers and policies. Last year, we saw increases as low as 0.27% and as high as 5.82% at individual funds, so doing some research can make a big difference.

“Some health insurers will even allow you to pay for your policy a year in advance, which means you can effectively lock in last year’s cheaper prices for the next 12 months.”

Energy price

New pricing “safety nets” will come into effect in July this year but consumers will get the first indication of what could come when regulators release their draft decisions in early March.

The Default Market Offer (DMO) acts as a cap on what energy retailers should charge consumers for a standing offer electricity plan in New South Wales, South East Queensland and South Australia, and the ACT.

Meanwhile the Victorian Default Offer (VDO) is considered a fair price for a standing offer electricity plan, to help consumers discern whether they are on a good deal or not.

Mr Koch said recent reports of higher than normal demand for electricity triggered by extreme weather conditions on the east coast were an early indication prices could increase this year.

“We haven’t seen demand like this for nearly a decade and that volume has been compounded by reduced coal availability and transmission issues,” Mr Koch said.

“Higher wholesale prices could mean bigger bills for households and when the government rebates finally start to roll off the difference could be a real rude shock.

“It’s important to remember, while the DMO provides a safety net for consumers, there are often much more attractive deals on offer for consumers willing to compare and switch.”

Interest rates

We finally saw some good news on the cash rate front at last month’s RBA interest rate decision.

The RBA chose to cut interest rates by 0.25% at the latest board meeting.

If passed on, a 0.25% could reduce monthly repayments on an average loan of $642,000, by $104 – or around $1,248 over the course of the year according to analysis by Compare the Market.

Mr Koch said that would come as welcome relief for mortgage holders and mean extra cash will help ease the cost of living pressures.

“Australian mortgage holders have been doing it tough for too long, with rates climbing more than 4% since 2022 and adding hundreds of dollars onto mortgage repayments each month,” Mr Koch said. “Inflation has been creeping back to the RBA’s target range for some time, so this move is going to help millions of Australians with a mortgage.

| Impact of a 0.25% rate cut | |

| Loan size | Difference in monthly repayments |

| $500,000 | $81 |

| $600,000 | $97 |

| $750,000 | $122 |

| $900,000 | $146 |

| $1,000,000 | $162 |

| *Calculations assume an owner-occupied loan of $642,000 with a variable interest rate of 6.3%, 30 year loan term, with no ongoing fees. Monthly repayment calculations assume the lender has passed on the rate cut in full and do not take into account the reduction of the loan balance over time. | |