The Burrow

Most people across the world have a bucket list of activities they want to complete before they die. Sky diving, speaking another language or traveling are common activities which might be on many people’s bucket list.

So, as experts in life insurance, we were interested in what goals individuals might have before they pass away. We asked more than 3,000 respondents from Canada, Australia and the United States of America to get an idea of what they’ve already achieved, what else is on their wish list and what’s stopping them from achieving everything they hope to.

Here is what we found out.

The most desired bucket list activity for Australians was traveling to a foreign destination (55%), while the second most desired item on the list was owning a home (34.3%). Interestingly, more Aussie women wanted to own a home compared to their male counterparts (36.6% vs 31.6%). Also a highly popular activity on many ‘do before you die’ lists was seeing the Northern and Southern Lights (31.4%). This was especially popular for people aged 26 – 41 years old (37.2%).

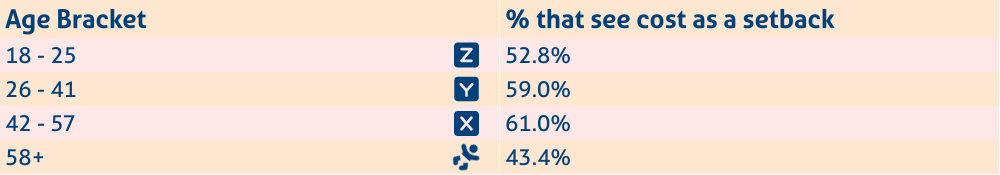

The biggest issue stopping Aussies from having ticked more off their list was the cost, with expenses being the biggest obstacle for 46.5% of men and 60.2% of women. It was also the biggest setback across all ages.

The data showed it was an issue for:

There was a similar concern between two generations for the second-biggest issue. Gen Z (40.2%) and Millennial respondents (44.5%) saw limitations with work/family as a key issue, while for Baby Boomers, the second biggest limitation was age (43%).

Similarly, another setback for 18 – 25-year-olds and 26 – 41-year-olds was personal fears (25.2% and 17.6% respectively). Interestingly, there was a similar trend with older Aussies regarding health ailments. Gen-X respondents aged 42 – 57 years old, believed their third-biggest issue was age (19.9%).

The most popular bucket list activity for men (52.3%) and women (58%) in Canada was travel. The survey revealed the age groups that were the most inclined to have jet setting at the top of their list were:

There was a slight difference for 18 – 25-year-olds, where owning a home was their biggest goal (60.4%).

Most Canadian men (40.4%) and women (44.6%) admitted they had achieved some of their goals already and wanted to complete the rest. Interestingly, there was a slight change with Baby Boomer and older respondents believing they had achieved most of their goals already (30.4%).

Canadians were also very optimistic about completing all of their bucket list goals, with only 14.3% of respondents believing they would be unable to complete all items on their list. Looking at age demographics, 42 – 57-year-olds were the most pessimistic, as one in five (21%) of the age group don’t feel overly confident about ticking everything off their list.

The most popular bucket list activity for Americans was traveling to a foreign destination (48.4%), closely followed by owning a home (34.3%).

Three generations who wanted to travel the most were:

Interestingly, there was a slight difference with Generation Z (18 – 25 years), where owning a home was considered their biggest goal (65%).

There was more variety when it came to the second-most popular activities for all generations. For 18 – 25-year-olds it was getting married (51.8%), whereas for 26 – 41-year-olds (35.9%) and 42 – 57-year-olds (31.9%) it was owning a home, and finally for Baby Boomers and older respondents, they wanted to go on a cruise (29.8%).

There was also some variety in the different bucket list activities when it came to the third-most popular goals. For Generation Z it was travel (51.1%), while Millennials wanted to go on a cruise (32.4%). The third-most popular item for Generation X and Baby Boomers was seeing the Northern/Southern Lights (25.2% vs 22.2%).

Most American men (39.2%) and women (42.3%) felt they had achieved most of their goals and planned to complete the rest. Looking at an age breakdown, the most common answer from 18 – 25-year-olds (45.3%) and 26 – 41-year-olds (49.5%) was that they have achieved a few goals with plans to complete the rest.

Meanwhile, people aged between 26 – 41 years old (44.1%), Baby Boomers and older respondents (31.6%) felt they had achieved most of their goals already.

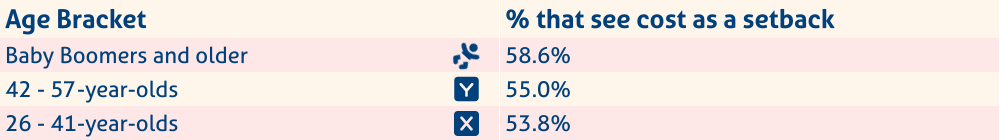

The most common answer for American men (44.8%) and women (55.1%) was that their goals were too expensive. Interestingly, the second-biggest issue for men and women was limitations with work/family commitments (28.9% vs 27.9%). The third-biggest issue for both men (27.3%) and women (25.1%) was age. While Baby Boomers and older respondents (3.6%) believed there were too many tasks which were stopping them from completing their goals.

Compare the Market’s Head of Health, Life & Income Protection Insurance, Lana Hambilton, understands the unexpected nature of life and encourages individuals to make time to achieve the goals that are important to them.

“Life truly can change at any moment, which is why we see value in having an ambitious list of goals and working towards them, as it can be immensely gratifying to check them off the list,” she explains.

“But with the highs of life, there can also be unexpected lows – you never know when you could be faced with challenging news, such as a serious health issue or a terminal illness. Often, these types of diagnoses are what trigger people to chase their bucket list goals.

“In the unfortunate circumstance that you face such a diagnosis, having a life insurance policy in place can be a game changer in making things more comfortable for you and your loved ones.

“It’s important that you have a policy in place before receiving any sort of news, which is why we encourage people to be prepared and get a policy even if they feel they are young, healthy, and feel well.

“Not only can it help you financially if the unexpected were to happen, but it can give you peace of mind and security so you can focus on your life dreams.”

Compare the Market commissioned PureProfile to survey 1,000 Australian respondents, 1,101 Americans and 1,101 Canadians in July 2023.