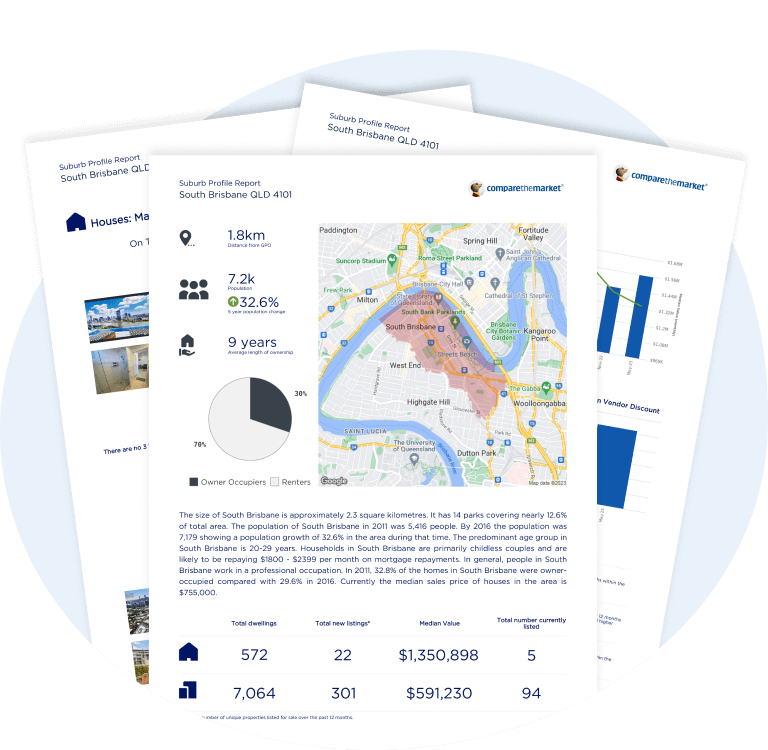

Before you can start your property search, you’ll need to decide where you want to be searching. That’s where our free suburb reports come in.

You’ll be sent any suburb profiles you’ve requested within minutes.

We’ll show you a suburb’s population, the number of dwellings in it, median property values and more.

There’s no need to be stingy with your suburb shortlist – we’ll help you research as many suburbs as you need to.

Our suburb profiles are completely free to access. No matter how many you need, they’ll always be free.

We'll arm you with the tools you need to make the right choice for you. From property reports to credit scores, let's work together to make your property dreams come true.

Dreaming of owning a property? Let's find out how much you can potentially borrow to put towards your new purchase.

Get the same credit information that lenders, telcos and utility providers use to assess your creditworthiness without impacting your actual score.

Buying, selling or being a nosey neighbour? Get valuable insights about the property, view recent sales and more.

Ready to buy or refinance? Apply online via a single application and we'll instantly check your eligibility for a home loan from a wide variety of lenders on our lender panel.

Don't know whether it's worth getting a suburb report? Selling Houses Australia host, Andrew Winter, explains why it's an option worth considering.

Andrew Winter shows you how to use Compare the Market’s new free suburb and property report tool.

Decide which areas are right for you and those which are not with the help of our free suburb reports! Research as many different suburbs as you like at no cost, thanks to Compare the Market.

Get your free suburb report

A suburb profile is a summarised report of a particular area, including the suburb in question and surrounds. Suburb profiles give buyers access to recent property market data for that area, including crucial market insights points like recent buyer activity and average house prices.

Suburb profiles differ from property reports in that they don’t contain information on specific properties in the area. They’re more designed to provide a baseline understanding of an Australian suburb’s local real estate market to help prospective homebuyers figure out if they might want to buy in that area or not. So, if you’re looking for information on a specific property, you’d be better off accessing a property report.

You can get unlimited free suburb profiles using Compare the Market’s new home loan comparison tool, which you can also use to check your credit score, look at property reports and compare home loans before applying for the one you like best – all in the one place

The information in a suburb report can potentially help you analyse the area’s market movements to determine whether there’s currently a strong demand for property there. The property value data can also help you understand reasonable price ranges for properties in the area.

It’s not so much a question of good or bad, but whether or not a suburb suits your needs, and what you require on both a lifestyle and affordability basis. There’s no one-size-fits-all suburb for everyone – each suburb is different!

For example, are you a younger, higher-income individual who wants to be close to the action on any given evening? You might consider looking at inner-city suburbs, which will likely be full of one- and two-bedroom flats perfectly suited to young and affluent singles.

Are you a middle-aged individual with a family of five and two cars? You might be more interested in suburbs that lay further out, as these will generally be leafier, more spacious and have a greater selection of larger family houses appropriate for you and your loved ones.

If you’re having trouble deciding what suburbs or types of homes might be right for you, you may want to arrange to speak with a real estate agent.

This is arguably the most fundamentally important piece of property data in any suburb profile, because it tells you whether property values in the area are likely to be within your borrowing power or not.

A suburb’s median value for houses will help you figure out what sort of range its home prices will fall within, and subsequently help you decide whether you can afford to live there or not.

The median price is typically used due to its stability – an average house value can be swung wildly by large outliers in any given single-month period, whereas the median house value is less susceptible to these and is a more reliable indicator of an area’s true property values.

The number of available properties in a suburb will give you an idea of how active the property market is there. If there’s plenty of properties available, it may signal that the area is less in-demand, which may point to issues with the area.

Conversely, if there’s a shortage of available properties in the area with few recent sales, that generally indicates that competition for property is high in that suburb and the residents may not be in any hurry to leave.

A suburb report will usually contain insights pertaining to recent buyer interest in the area, generally in the form of online activity such as interactions with property listings and accessing/viewing floorplans.

The level of buyer activity in an area can help give you an idea of how competitive the property market is there, and how desirable it is.

A suburb profile should always tell you how many days on average it takes to sell a property in the area. This is crucial information for both:

In highly competitive areas, properties can spend mere days on market before getting snapped up, so it’s crucial information to have if you’re looking to buy in such a suburb.

Not all house-hunters are looking to live in the house they buy; some are looking for the perfect property investment opportunity in a well-positioned suburb. That’s why a suburb profile will usually give at least some indication of how much rent is being charged for rental properties in the area, as this is crucial information for any prospective property investor.

Stephen has more than 30 years of experience in the financial services industry and holds a Certificate IV in Finance and Mortgage Broking. He’s also a member of both the Australian and New Zealand Institute of Insurance and Finance (ANZIIF) and the Mortgage and Finance Association of Australia (MFAA).

Stephen leads our team of Home Loan Specialists, and reviews and contributes to Compare the Market’s banking-relating content to ensure it’s as helpful and empowering as possible for our readers.

Our General Manager of Money, Stephen Zeller knows that a suburb report can be an invaluable tool for prospective homebuyers to have – but they have to know how to read them and use the information they contain. He’s got some top tips for decoding suburb reports:

Not sure on which areas you might want to live in? Click the button below to start narrowing down your shortlist today with our free suburb reports!

Get your free suburb report