The Burrow

There’s a lot of pressure to buy a house. As housing becomes increasingly unaffordable and further out of reach, one might feel guilty for regretting any aspect of owning a home.

But nothing is ever perfect, and sometimes a home – perhaps the biggest investment of your life – could be something you deeply regret.

As home loan comparison experts, we recently surveyed Australians, Americans and Canadians to see if there was anything homeowners regretted about their house.

Here’s what people had to say.

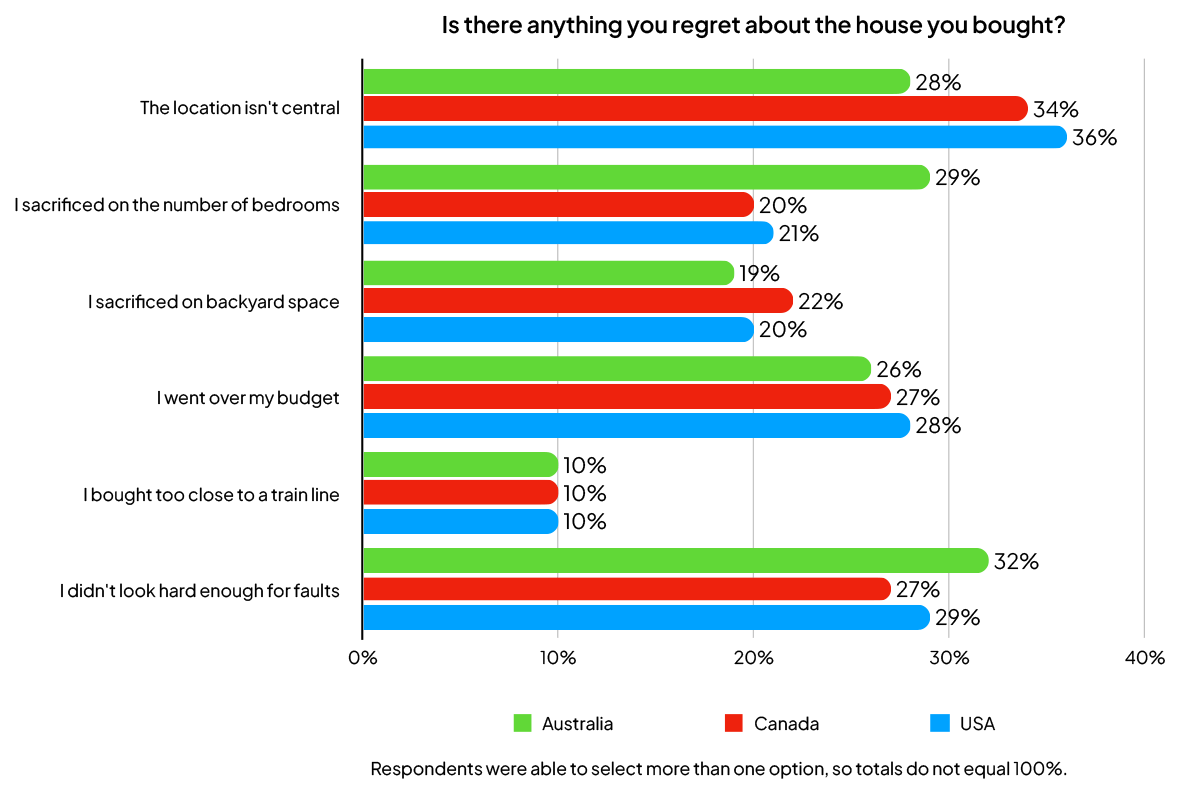

For Canadian and American homeowners, their top house buying regrets were the same, while Australians were more regretful about other things.

Over a third of Americans and Canadians said their number one regret was that the location they bought in was not as central as they would have wished (36% for Americans and 34% for Canadians). Their next big regrets were not looking hard enough for faults (29% and 27% respectively) and going over budget (28% and 27% respectively).

On the other hand, Australians were more likely to say their number one regret was not looking hard enough for faults, with 32% of homeowners picking this option. Sacrificing on the number of bedrooms was second (29%), followed by location (28%).

On the other hand, almost half of Australians surveyed said they didn’t have any regrets about buying their home (48%). There were fewer American homeowners that were satisfied, with 39% saying they had no regrets, while Canadians were the least likely to be completely happy with their homes. Only 34% of Canadians could say they had no regrets about their house purchase.

Younger homeowners in Canada and the USA were more likely to say that they wish they’d bought in a more central location, while older homeowners wished they’d looked harder for faults in the home. Australian homeowners in different age groups all had a differing number one regret.

Australians aged 35 to 44 and 55 to 64 said they wish they’d bought in a more central location, while 45 to 54 and those aged 65 and above said they wished they’d looked harder for faults in the building.

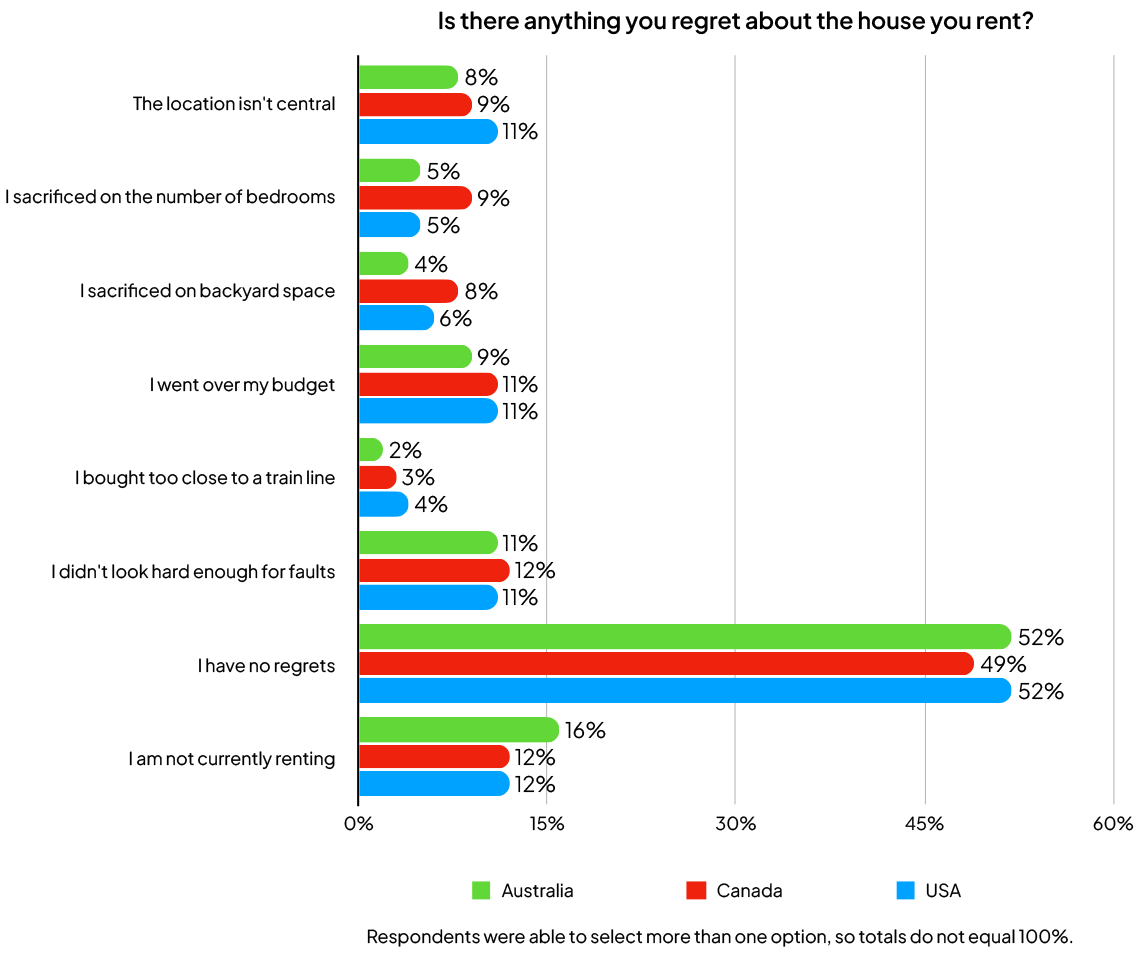

The survey also included those who don’t own the home they live in, and they were asked if they had any similar regrets about their homes.

The top regret for Australian and Canadian renters is that they weren’t vigilant enough about checking for faults in the home beforehand, while Americans were split on location, faults and blowing their budget.

It’s a tough rental market out there, and it can be hard to find your own place. Interestingly, about half of renters say they have no regrets – 52% in Australia and the USA, and 49% in Canada.

The final question of the survey asked respondents: what’s the worst bit of advice they had received about buying a home?

Fortunately, most people said they hadn’t received bad advice – or any advice at all on the matter – but 17% of Australians, 19% of Americans and 21% of Canadians (including homeowners and those who didn’t own their home) said they had received bad advice.

Interestingly, the most common bit of bad advice was different in each country, though the same topics did come up in all jurisdictions.

In Australia, the most common bit of bad advice was “wait for prices to come down”.

A lot of Australians were told that prices were too high at a given moment, and were cautioned to wait for prices to drop. A look at any historical line chart of the past 10 years would show just how wrong those advice-givers were.

However, in Canada it was the opposite, with the most common bit of bad advice being “buy now, before prices rise”. Several even reported they were told to “overpay so you get the house; the price will go up”.

This suggests that many Canadians felt pressured to blow the budget and buy quickly, only to later regret it and not see the quick jump in value they were told to expect.

Bad advice in America covered a diverse range of topics, with one terrible notion ever so slightly rising above the others in frequency: “don’t worry about building inspections”.

Several Americans were told to not bother with inspections, and others were given a further bit of advice that equated to “if there is a problem, you can fix it yourself”.

It’s not surprising then that that almost 30% of American home buyers said they regretted not looking harder for faults with the house before they bought it.

According to the participants, other bits of advice that popped up several times in each country are listed below, with some things directly contradicting each other:

Finding the right home to buy can feel like a strain, let alone organising your finances to purchase the home. Compare the Market can help Australians take the pressure off by helping guide them through the home loan process, from calculating borrowing power all the way to settlement on the house.

Compare the Market’s General Manager of Money, Stephen Zeller, notes that having that expert guidance could help you avoid some potential house regrets later on.

“Our brokerage service can help in several ways. You can download free property and suburb reports to help you learn about a house or particular area before you buy,” Mr Zeller said.

“Additionally, our home loan specialists are on hand to help you review rates and mortgages you can actually apply for, as well as guiding you through every step of the home purchasing journey.

“If you deeply regret the home you’re in and you’re planning on moving to a more suitable home, ensure you compare home loans to look for a competitive rate. We’re here to help turn a hellish experience into a heavenly one as you search for a home you’d be happy to hang your head.”

Compare the Market commissioned PureProfile to survey 1,004 Australian, 1,015 Canadian and 1,008 American adults in December 2024.

Compare the Market commissioned PureProfile to survey a nationally representative sample of 1,004 Australians, 1,008 Americans, and 1,015 Canadians in December 2024.

Participants who did not own a vehicle were excluded in the results.

Note: Percentages were rounded to the nearest whole number and may not add up to 100%.