The Burrow

Owning your own home is a big step in anybody’s life but getting onto the property ladder seems to be getting increasingly hard, especially for first home buyers.

To dry and debunk the theory that the home ownership dream is unattainable, the home loan experts at Compare the Market have gathered some statistics on ownership rates in Australia and overseas, as a comparison point.

To kick things off, the Australian Institute of Health and Welfare published statistics claiming that in 2021, around 67% of the 9.8 million households in the nation were home owners, compared to just 31% which were renters.1 To provide an idea of what it was costing to be a home owner at the time, the mean price of a residential dwelling in the last quarter for 2021 was $920,100, which was an increase from the previous period.2 The year finished on a cash rate set by the Reserve Bank of Australia of 0.1%, which had been consistent since November the previous year.3

Around the same time (November 2021), the capital city average for weekly rent prices on a house was $595.4

But we’re missing an important factor – the world has been experiencing a pandemic, which has significantly impacted spending and savings habits. Although, that has been felt not just in Australia, but globally, as well. So how does that picture vary around the world? For those who are interested in moving to Europe, we have some answers for you.

As home loan experts, we’ve taken a look at which European countries have the highest and lowest proportions of homeowners, as well as how this relates to the average property prices.

Read on to find out how the property market looks in a few different markets.

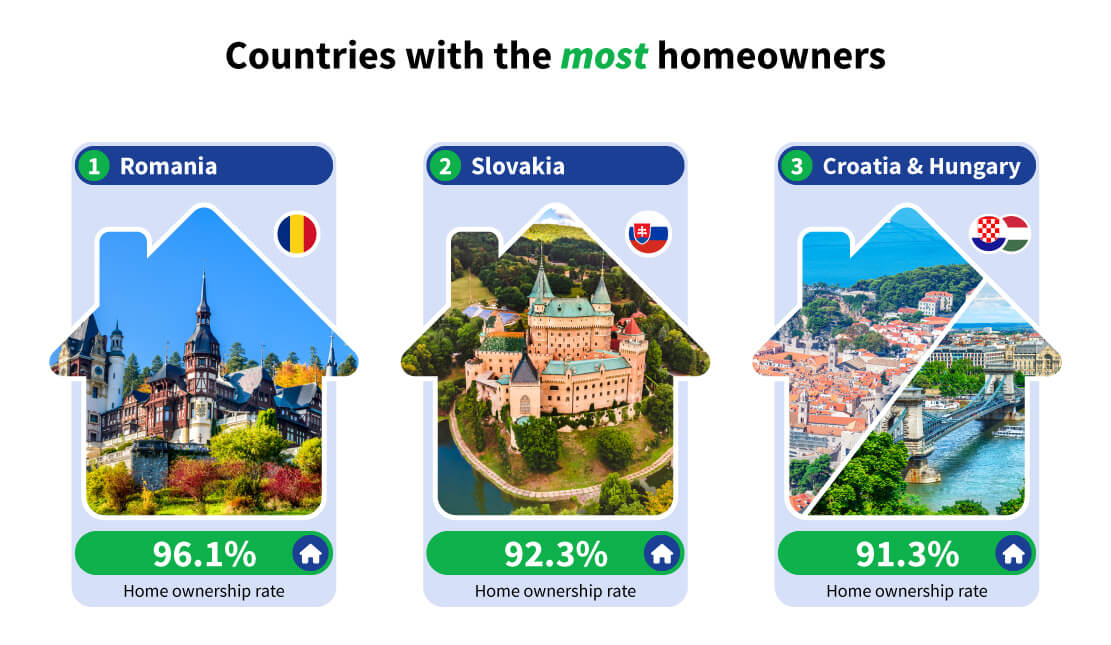

The country with the highest rate of homeowners is Romania, where a staggering 96.1% of people own their property.

That’s just under four percent more than Slovakia in second, and over 45% higher than in countries such as Germany.

In second place is the Central European nation of Slovakia, with a home ownership rate of 92.3%.

Home ownership in the country stood at around 50% during the 1980s but has skyrocketed since, with the real estate market booming following the fall of communism and no real rental market emerging.

Two countries were tied in third place, both with home ownership rates of 91.3%. Like Slovakia, both Croatia and Hungary are located in Central Europe and also share a border with one another.

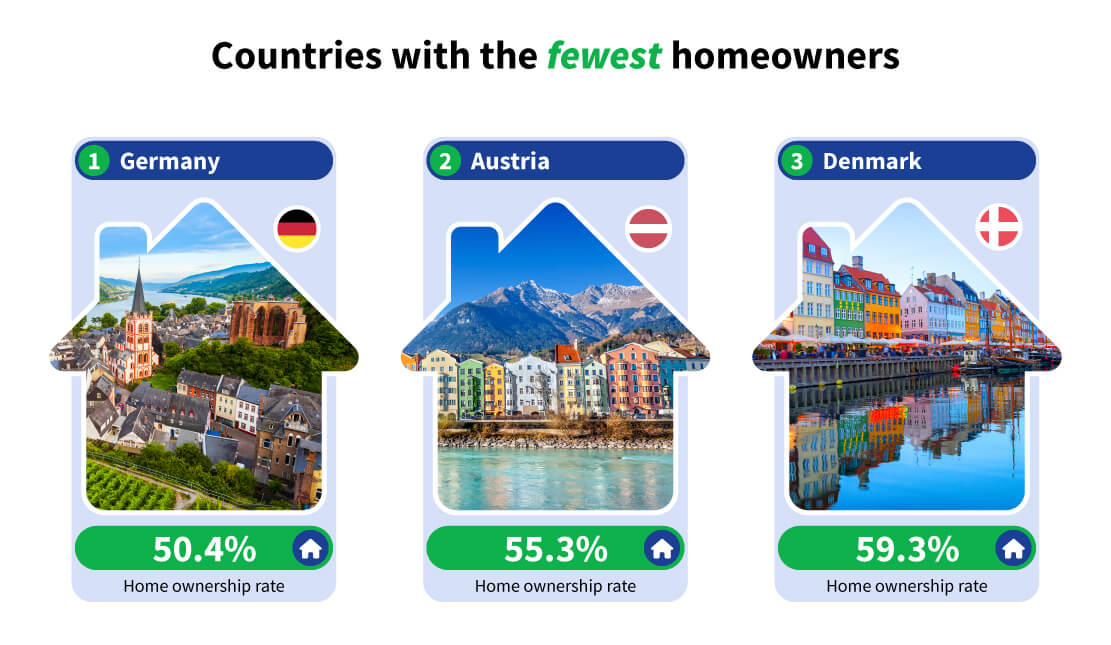

At the other end of the scale, only around half of the people in Germany own their own home, the lowest rate on the continent.

Unlike the countries with the highest home ownership rates, Germany has a strong rental economy, with policies such as high transfer taxes on real estate purchases and no mortgage interest tax deductions making it harder to buy.

Germany’s neighbours in Austria have the second-lowest home ownership rate on the continent, at just 55.3%.

Like in Germany, there’s a strong culture for renting rather than buying in Austria, with many of the same factors at play. Renting in Austria is also relatively affordable due to extensive social housing.

In third place is the Nordic nation of Denmark, with a home ownership rate of 59.3%.

Denmark has high property prices averaging $4,900 per square metre, which could go some way to explaining why so few are able to buy their own homes.

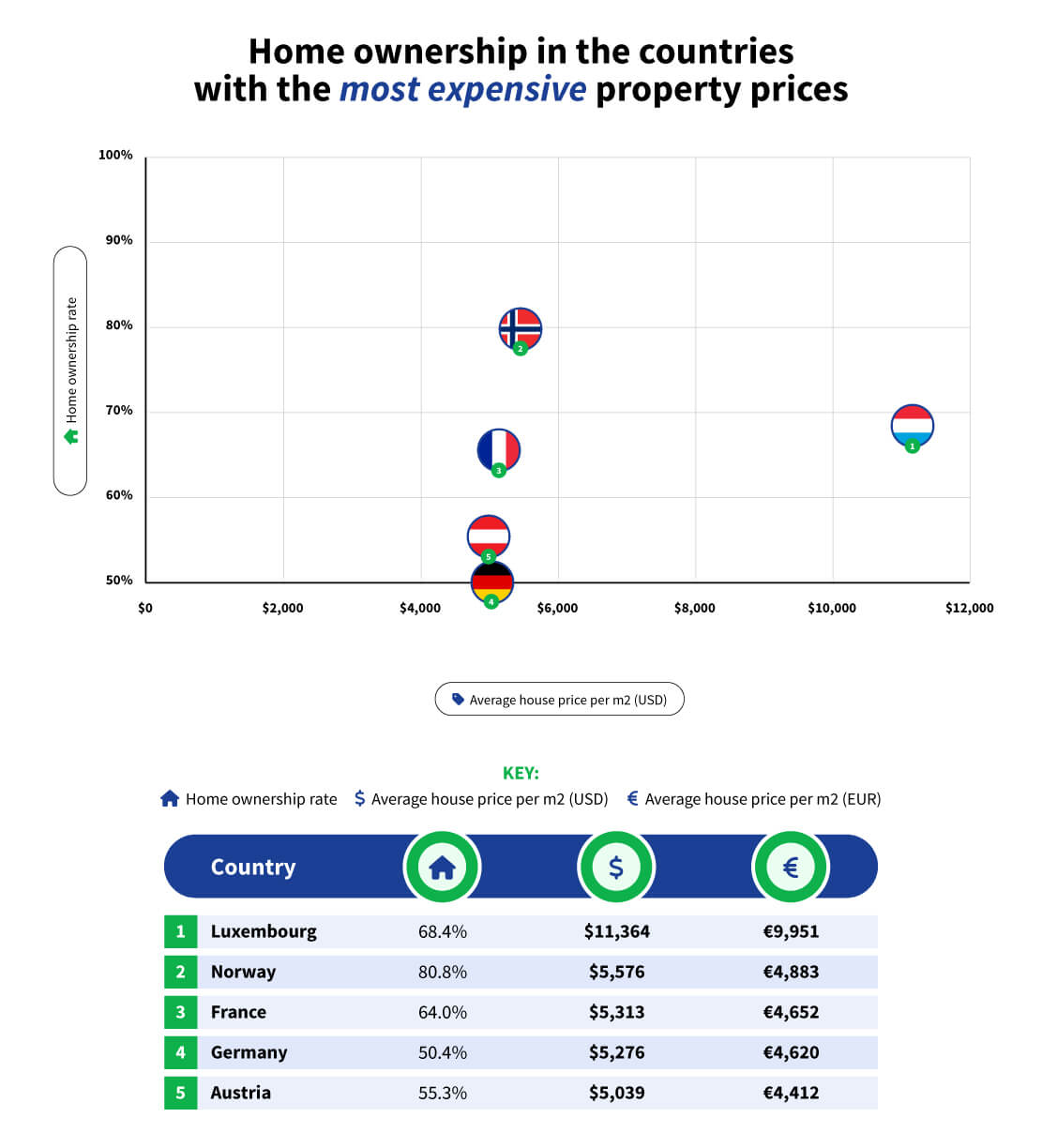

As we can see, the rate of people who own their home varies considerably, but how big of a role does the cost of property play in this?

When we compare the average property price per square metre with home ownership rates, we can see that there’s a definite trend for people in the more expensive countries to be less likely to own their homes.

Luxembourg, France, Germany, and Austria are all amongst the most expensive countries and also have the lowest rates of owner-occupancy; Norway is a notable exception to this.

And the opposite is broadly true for the more affordable nations; Romania is the second cheapest with an average cost of $1,443 per square metre, as well as the country with the highest ownership rate.

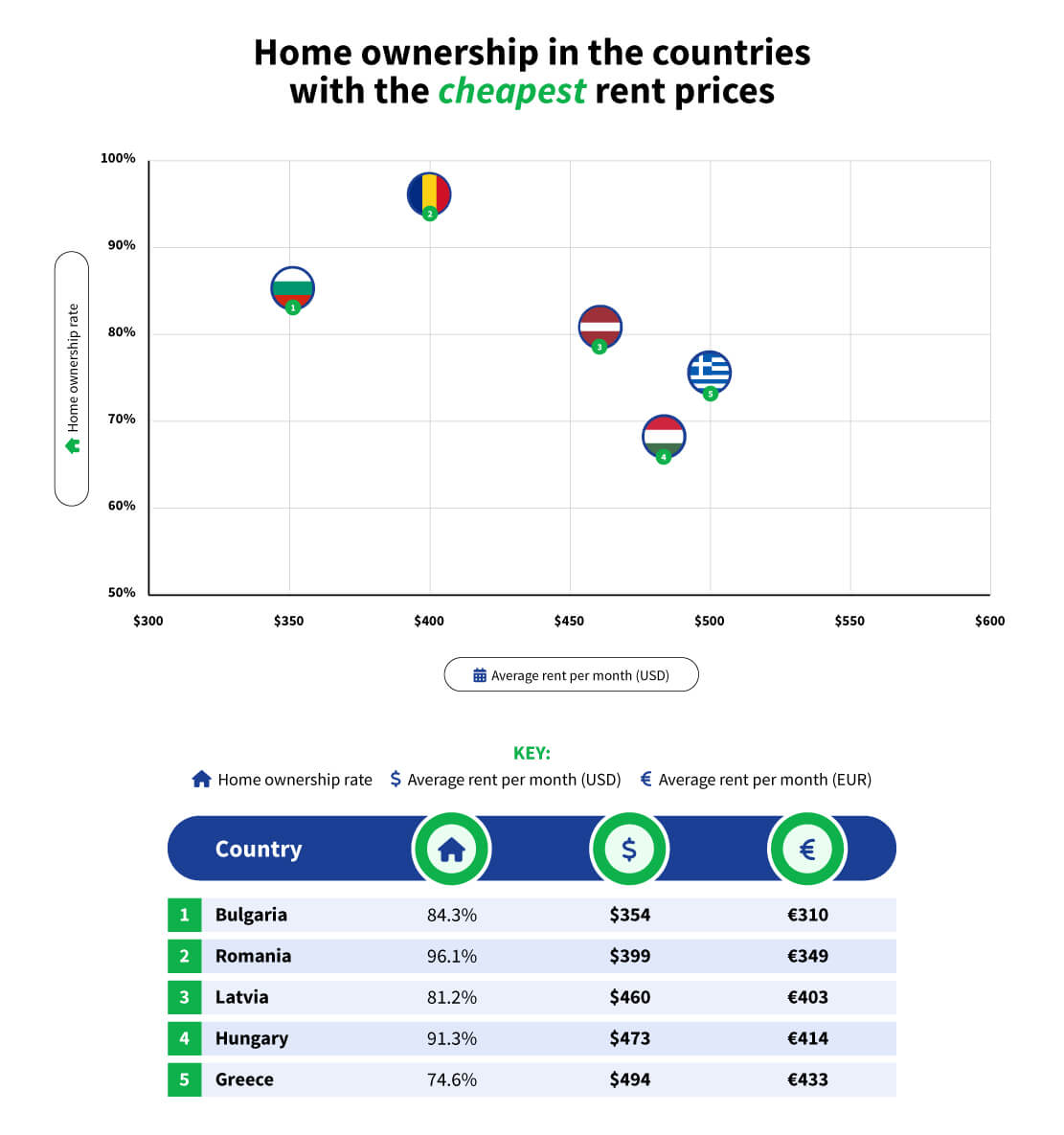

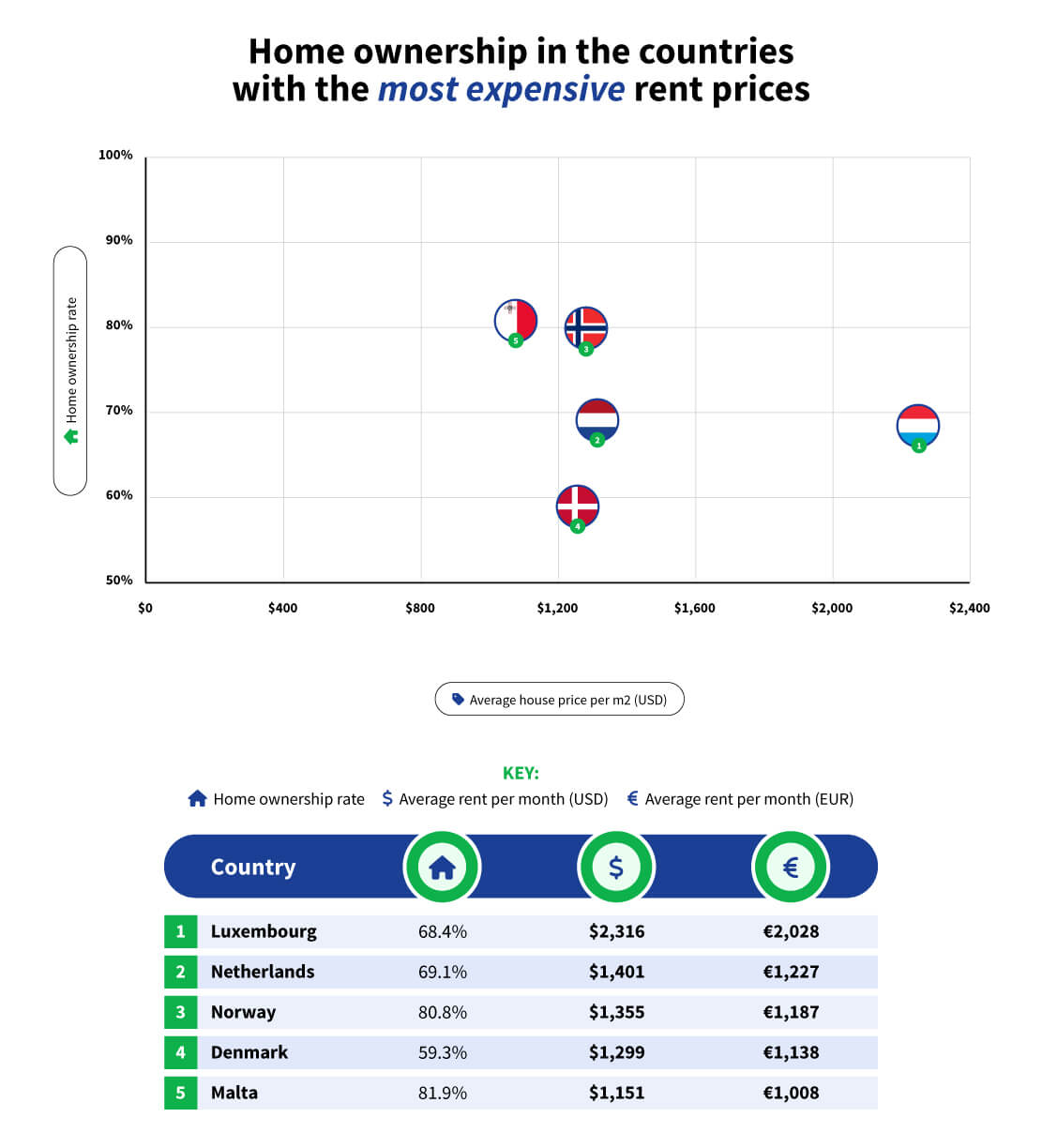

The correlation between average rent prices and home ownership is very similar to that of property prices, which suggests that in countries such as Luxembourg, the Netherlands and Norway, where rent is the highest, people are still happy to rent despite these high costs.

The fact that rent prices are so high in these countries where home ownership is low could illustrate why it can be so hard to get out of the cycle of renting, when average rents in these prices take up such a large share of people’s budgets.

Home ownership rates for each country were sourced from Statista and show the share of dwellings that were owner-occupied as of 2020.

The average property price per square metre and monthly rent for each country were both sourced from Numbeo.

The average property price is the average of the square metre costs of properties both in city centres and outside of city centres.

Average monthly rent prices are an average of prices for one- and three-bedroom apartments, both in city centres and outside of city centres.

All prices were converted from US dollars to euros using XE as of February 17th, 20222.

Brought to you by Compare the Market: Making it easier for Australians to search for great deals on Home Loans.