The Burrow

Buying your first home is one of the great milestones of adulthood. However, with rising and falling economies, fluctuating prices and ever-changing interest rates, property hunting can feel overwhelming at the best of times.

The seemingly unending travel restrictions and a healthy bout of procrastination may have you twiddling your thumbs, wondering how does your country weigh up to others? How liveable are other nations? And, is it economically wiser to buy property in other countries as a first home buyer?

It can be difficult to navigate through the property-scape of a foreign country, which is why the home loan experts at Compare the Market have put together a list that outlines the top countries for first home buyers from a data-perspective.

So, the question stands…

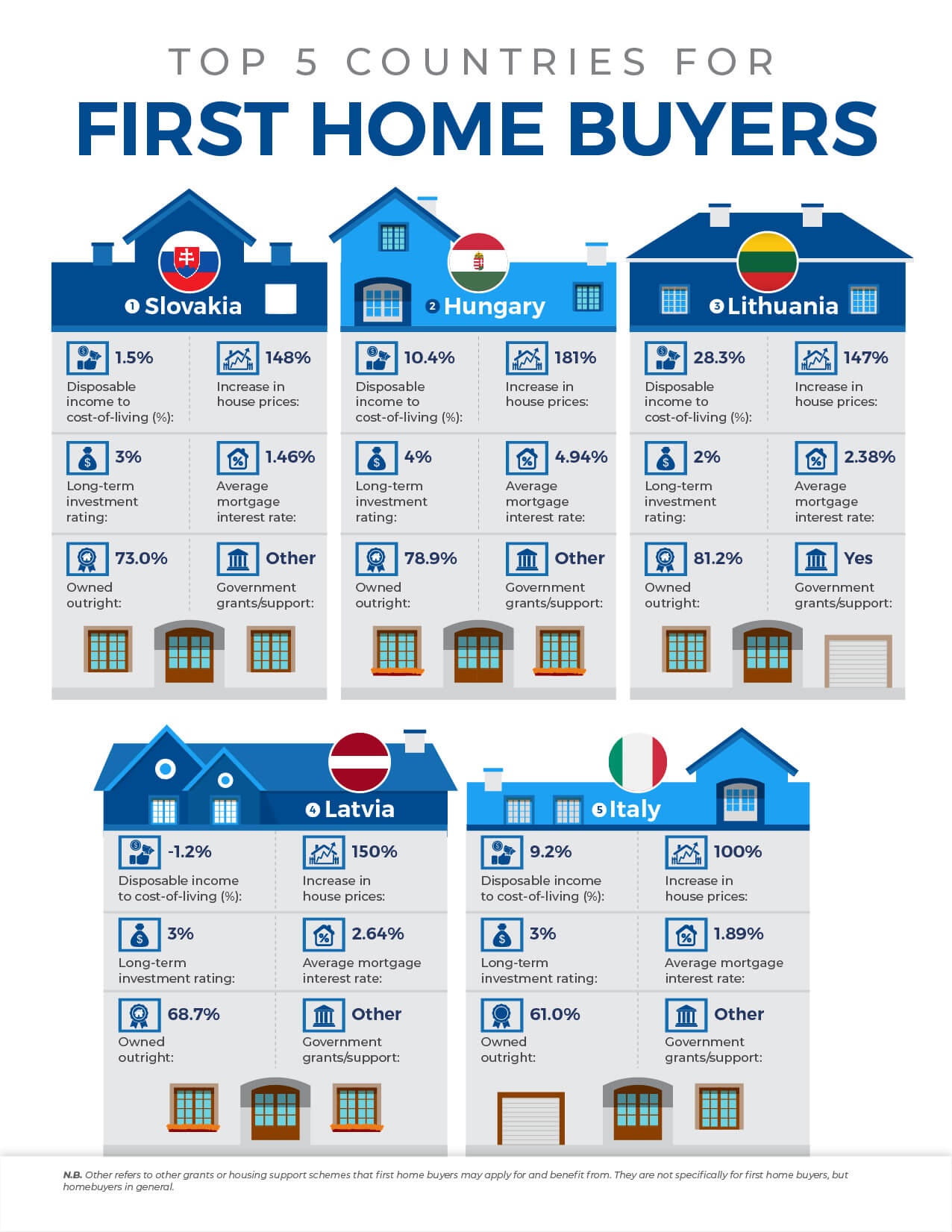

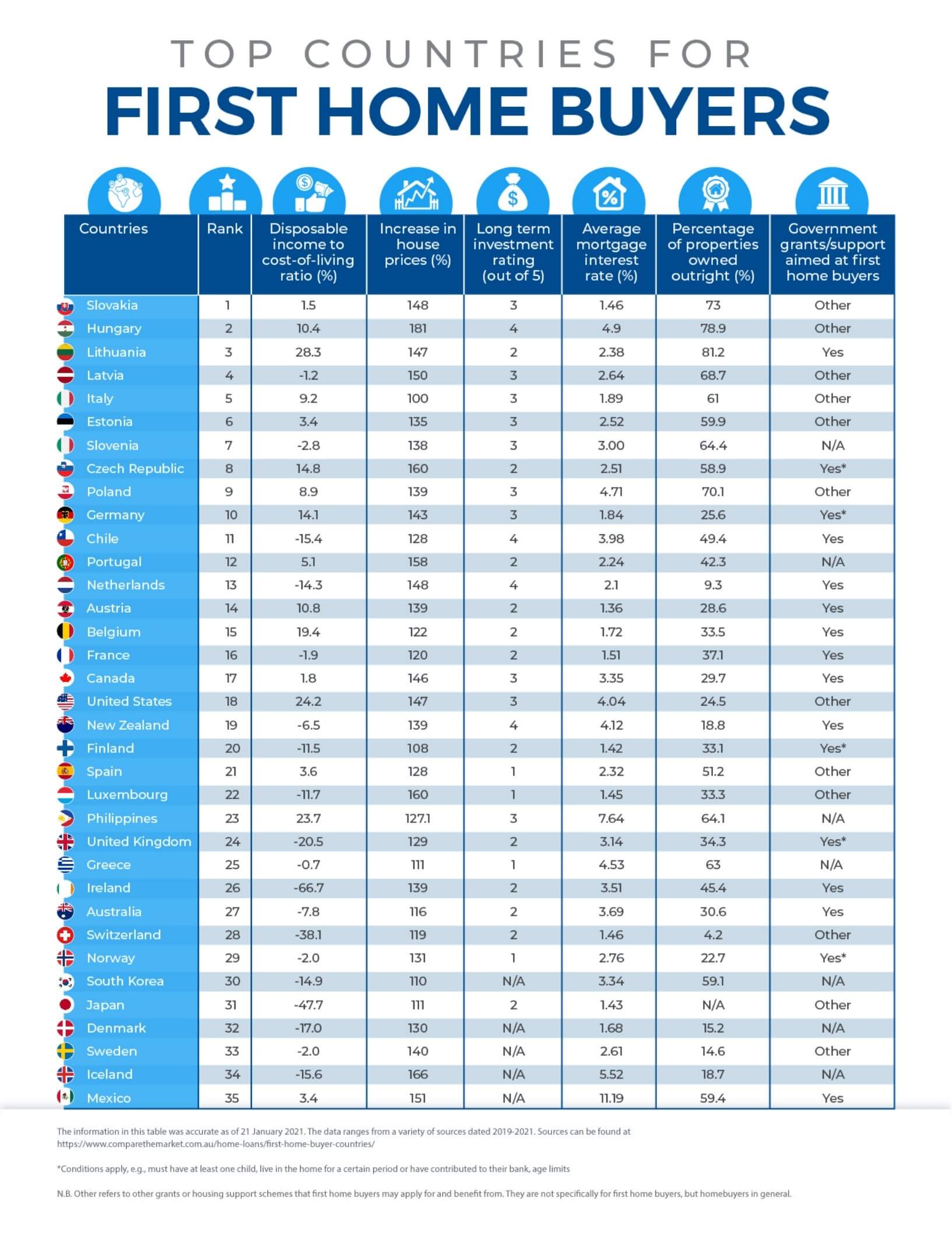

We’ve compiled a list of the top five countries for first home buyers. Click through the below set of images to see what factors contributed to our ranking.

Disposable income to cost-of-living ratio

This figure represents the percentage of the average disposable income (income after taxes and other social contributions) that isn’t spent on cost-of-living expenses.

Increase in house prices

The percentage of increase in house purchase prices since 2015. High increases don’t necessarily represent high purchase prices, but rather, high demand potentially due to factors like affordability and low mortgage interest rates.

Long-term investment rating

Based on Global Property Guide’s 5-star rating system. This rating indicates the potential to profit off the property over time, with a 5-star rating being the most attractive.

Average mortgage interest rate

The average interest rate for long-term mortgages.

Percentage of homes owned outright

A high percentage of people owning homes outright may indicate more favourable conditions in which homebuyers may have some level of ease in obtaining and paying off a home.

Government grants/support aimed at first home buyers

Any government financial aid targeted at first home buyers provides some indication of governments recognising the difficulty of purchasing a first home and actively providing extra support.

For more detailed information on how we’ve determined the top countries for first home buyers out of our list of 35 countries, see our methodology at the bottom of this page. Once there, you can also read how we’ve considered the impact of the COVID-19 pandemic on the housing market.

N.B. These numbers are based on citizens and permanent residents of each country and may not reflect the interests of expats or foreign buyers.

Slovakia has seen a recent housing boom, with property values increasing by 148% since 2015. This indicates a healthy demand of active home buyers, reflected by the higher outright ownership rate.

Although it’s difficult to predict how the housing market will fare in the coming years, Slovakia had strong fundamentals for their residential markets to develop prior the COVID pandemic.1

The high increase in house prices and long-term investment rating indicates a strong potential for the growth of the property’s value, while the low mortgage interest rate encourages homebuyers.

For the average Slovakian, 1.5% of their disposable income isn’t spent on cost-of-living expenses, meaning that the average Slovakian is likely to be able to afford all necessities needed to live comfortably.

The Slovakian national and federal government also offers a State Housing Development Fund, which is limited to people with disabilities, young families under 35, single parents with dependents who are 15 years or less, children in foster care or orphanages. This fund offers a home loan with a low-interest rate (1-2%).

Despite the pandemic, Slovakia’s demand for housing has remained strong.2 In fact, the total outstanding dollar amount of house loans rose by 9.5% in June 2020.2 Slovakia has one of the lowest mortgage debt to GDP ratios in Europe, meaning that if you’re a citizen or permanent resident, you’ll probably be able to pay off your mortgage at a faster rate.2

Hungary’s high increase in house prices indicates a rapidly growing housing market buoyed by favourable conditions, including:

In other words, the housing market is supported by a healthy economy in which homebuyers are actively purchasing properties. The increase in demand has seen significantly affected purchase prices. To date, there’s been an 181% increase since 2015.

For the average Hungarian, 10.4% of their disposable income isn’t spent on cost-of-living expenses, meaning that the average Hungarian should be able to afford all necessities to live comfortably, and more. The high long-term investment rating coupled with the steep increase in house prices also indicates a great potential for the property’s value to continue increasing over time.

The Hungarian national and federal government offers subsidised interest on mortgages to families with children.

However, the market has been plunging over the last year because of the COVID-19 pandemic.4

Demand in Lithuania’s housing market is moderately high with a purchase price increase of 147% since 2015. While the investment rating is lower than the other countries, the average Lithuanian spends 71.7% of their disposable income on cost-of-living expenses – the lowest percentage out of all the countries included. With 28.3% of their disposable income leftover, the average Lithuanian should be able to comfortably afford their cost-of-living expenses, and more.

The average mortgage interest rate is also low at 2.41% and 80% of homes are owned outright. The high percentage of homes owned outright indicates that people may be able to own homes with a greater level of ease compared to other countries.

After the major COVID-19 lockdowns in 2020, the housing market in Lithuania started moving upwards in the second half of the year, which compensated for the market activity losses and stimulated frozen prices.5

In fact, while there were significant decreases in market activity during the peak of COVID mid-2020, this only slowed the increase in apartment prices, and no negative changes were recorded.5

Latvia’s increasing home values (150%) are one of the highest percentages out of all the countries included in our global account of observations. This percentage is indicative of a stable housing market that’s growing at a steady pace.

They also have a low mortgage interest rate, which could be one of the many reasons why the outright ownership rate is higher compared to other countries.

The long-term investment rating for Latvia coupled with the increasing house prices also indicates a strong potential for property value growth. What’s more, the average Latvian uses 101.2% of their disposable income on cost-of-living expenses, meaning that they should be able to afford most necessities to live comfortably.

According to the State Land Service Republic of Latvia, the number of transactions decreased during the first COVID-19 wave in March 2020, but quickly surged again after restrictions lifted.6 That’s to say, interest in housing has remained high, which shows promise to Latvia’s housing market.7

Italy’s cost of living to disposable income ratio sits at a comfortable 90.8%, which suggests that the average Italian may have additional disposable income (9.2%) to spare after paying for their daily expenses.

They have a moderate long-term investment rating of three, and their average mortgage interest rating 1.89%. These statistics combined yield a positive outlook, which is supported by the percentage of properties owned outright (61%).

The only downside to the Italian housing market is that house prices haven’t increased at all since 2015, according to the OECD. This indicates a stagnant housing market. On the other hand, Idealista has indicated a minor price variation of 1.4% over the past year from April.8

It’s possible that this increase has occurred as a result of the COVID-19 pandemic, despite the devastating impact it’s had on Italy’s people and economy. According to Global Property Guide, people have been more committed to investing in property due to:

It’s difficult to establish a timeline that details when we’ll be COVID-free, let alone how fast the global economy will recover post-COVID. However, experts from the OECD have projected that the economy in many countries will decrease by five per cent on average by 2022 compared to pre-COVID times.10 In contrast, a few countries in Asia are expected to come out the other end with an increase, including China, which has the highest expected increase of 14.7%.11

Developing nations have been hit the hardest due to lack of economic resources and reduced demand for the trade of their raw materials.11 This is primarily due to the substantial and permanent COVID-related costs that can’t be afforded by developing nations, such as government subsidies to prevent mass unemployment and the purchase of vaccines.11

Therefore, economic recovery, as well as the housing market of each country, will likely occur at different rates.

Beyond that, it’s difficult to predict the future of the global housing market due to the varied conditions and the unstable state of the economy. The only definitive statement we can make is that it’s clear that COVID-19 has impacted the housing market in almost all countries with some countries being more severely affected than others.

With that in mind, we’ve compiled this list in hopes that after COVID, our efforts to preserve what has been taken away will succeed and the economy will stabilise and resume from a state that hasn’t been irreparably affected.

While the data throws in some hard facts, the economic, political, and cultural landscape around property is ever-changing. Whether you’re purchasing a home to move by yourself or with family, consider the area in which you plan to move and how it may affect your quality of life.

It’s not every day that you get to start life anew in a new abode!

We’ve deliberated several factors to narrow down our list of the top 5 countries for first home buyers.

The percentage of the average disposable income left over after cost-of-living expenses will provide some indication of what the quality of life of a country’s people looks like. The OECD defines disposable income as income after taking into account net interests, dividends, taxes and other social contributions (this may vary from country to country). Cost-of-living accounts for food, housing, utilities, clothes, transportation, personal care and entertainment.12

If the cost-of-living is higher than the average disposable income, this may reflect that the average citizen may not be able to afford necessities, and therefore, may have a poorer-than-average quality of life. Statistics for disposable income and cost-of-living came from the OECD.

Increases in house prices usually occur when there’s a high demand in the market and not enough supply, resulting in market growth. Increases in demand may occur due to, for example, low interest or borrowing rates (in other words, when it’s easier to buy a home).

Low increases in house prices represent stagnation in the housing market, presumably due to low purchase power or unaffordability.

We attained the data that measures the increases in house prices from the OECD. The percentages indicate the changes in price from 2015 to the latest available changes.

A high long-term investment rating indicates strong prospects for profiting off the property over time. This rating was retrieved from the Global Property Guide.13 According to their rating system, a rating of one or two indicates risky or poor returns. A country with a rating of three to five indicates the following:

Countries with higher ratings will have more of the above features. Note that these ratings were taken from one major city per country and may not reflect long term investment prospects for the country as a whole.

A low mortgage interest rate allows homebuyers to pay off their homes quicker without spending more on interest. Low interest rates can encourage people to buy houses and growth in housing markets.

A high percentage of people owning a home outright is likely to indicate that a high portion of the population is able to obtain and own homes or pay off their mortgage quickly.

Governments may provide financial assistance specifically for first home buyers, which demonstrates the government’s willingness to help younger people in what can be a market that’s difficult to navigate. Most countries offer some type of aid for home buyers, which first home buyers can also use. However, many of these have specific eligibility criteria, which we were unable to access.

We didn’t include this criterion to score or rank the countries as government information regarding support for first home buyers was limited due to language barriers. That’s to say, we were unable to find the level of support offered by certain countries.

To determine the top five countries, we first found the aggregate of each criterion. Then we calculated the percentage that each individual figure contributes to the aggregate. These percentages were then added together by country. This score was turned into an index with the largest score ranking first.

For average mortgage interest rates, we turned all the figures into negative numbers so the lowest interest rate had a positive impact on the overall score.

We were unable to get data for some countries, including the long-term investment rating for South Korea, Denmark, Sweden, Iceland and Mexico; and the own outright rate for Japan. This will skew the results.

1 Deloitte (2020). Property Index: Overview of European Residential Markets. Accessed 11 January 2021.

2 Global property Guide (2020). Slovakia’s housing market grows stronger. Accessed 15 January 2021.

3 Global Property Guide (2019). Hungary’s housing market boom continues. Accessed 8 January 2021.

4 Global Property Guide (2021). Hungary’s house prices in freefall. Accessed 7 June 2021.

5 Ober Haus (2021). Real Estate Market Report: Baltic States Capitals Vilnius, Riga, Tallinn. Accessed 31 May 2021.

6 State Land Service Republic of Latvia (2020). COVID 19 and the Real Estate Market in Latvia up to Autumn 2020. Accessed 31 May 2021.

7 Public Broadcasting of Latvia (2020). Interest in housing remained high in 2020 in Latvia. Accessed 31 May 2021.

8 Idealista (2021). Price report for properties for sale in Italy. Accessed 7 June 2021.

9 Global Property Guide (2021). Despite pandemic-induced recession, Italy remains steady. Accessed 7 June 2021.

10 Accessed 11 January 2021.

11 Steven Schifferes (2021). World economy in 2021: here’s who will win and who will lose. Accessed 11 January 2021

12 OECD (2019). Household disposable income. Accessed 11 December 2020.

13 Global Property Guide (2020). Yields in premier cities, investment ratings. Accessed 11 December 2020.

Brought to you by Compare the Market: Making it easier for Australians to search for great deals on their Home Loans.