The Burrow

Managing household finances can be a stressful task. With mortgage or rental repayments, internet, water, electricity and gas bills constantly appearing, it can be overwhelming to keep track of it all.

For many of us, a simple solution is to share the responsibility of finance management between multiple people – be it a partner, family members or housemates.

But how many of us are honest when it comes to the state of money matters and cost of bills? As experts in home loan interest rate comparison, refinancing and managing household finances, we ran a survey of more than 3,000 adults across Australia, America and Canada to expose just how many people are dishonest about money when asked by those closest to them.

Read on to learn what we discovered.

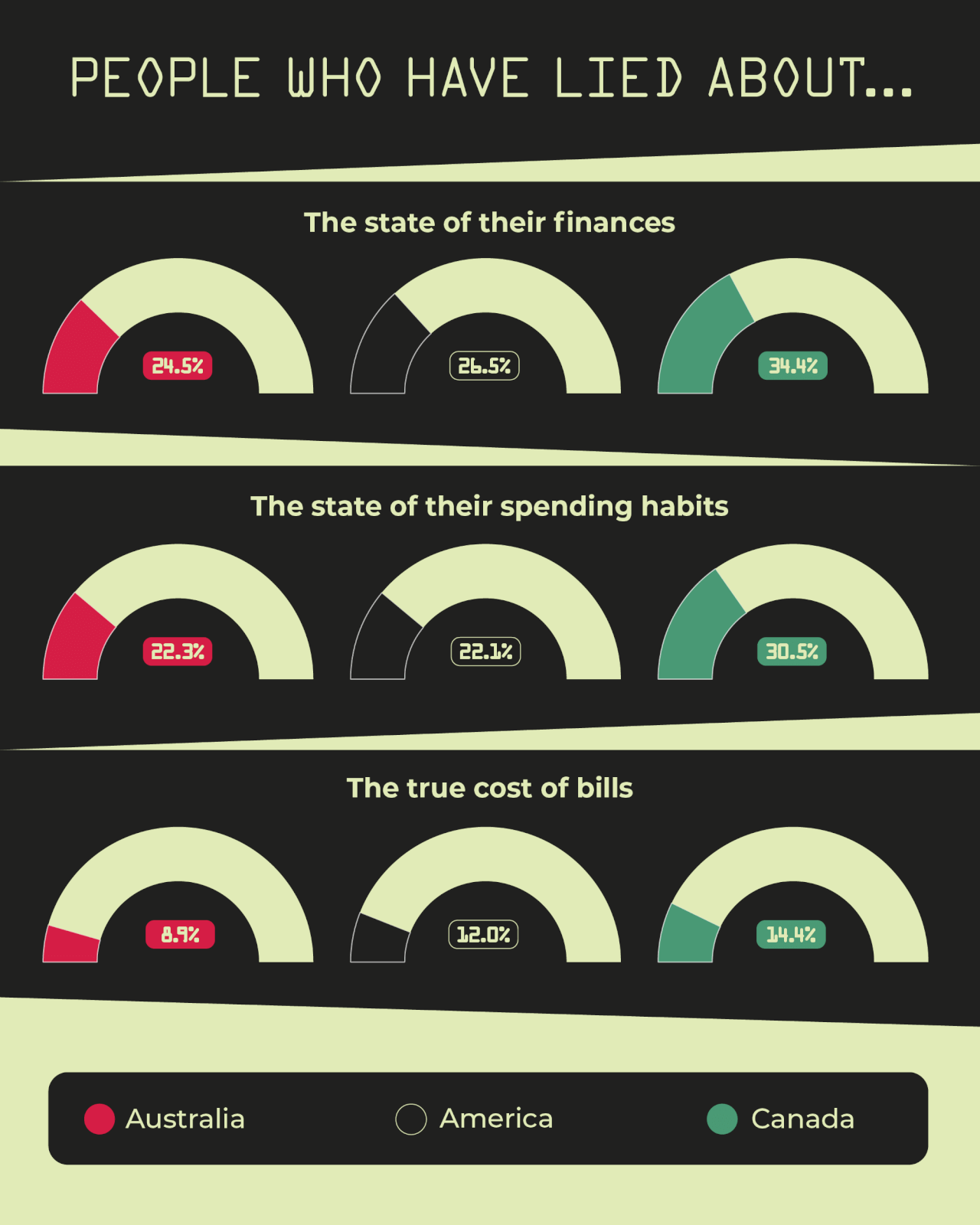

We asked survey respondents if they have ever lied to those close to them about the true state of their finances.

We discovered that Canadians are significantly more likely to lie about the state of their finances when asked by those closest to them. As many as 34.4% of Canadians admitted to doing so, compared to 26.5% in America and a smaller 24.5% in Australia.

It gets even more alarming.

Those in Canada are also the most likely to lie about their spending habits, as well as the true cost of bills in order to benefit themselves financially.

Across all three nations, the likelihood of lying about financial matters decreases with age, with Baby Boomers being the most honest generation.

Here’s how the stats compare on a national level.

Click through below to see a detailed breakdown of results per country.

Around one quarter of Australians (24.5%) admitted they have lied to those closest to them about the state of their finances, making them the most honest nation we surveyed. Within these figures, women are slightly more likely to admit dishonest behaviour.

New South Wales is the most dishonest state, where 26.8% of residents have admitted to lying about money, compared to a more respectable 16.7% in Western Australia – the smallest number within the country.

When it comes to lying about spending habits, as many as 22.3% have done so. It’s even higher in South Australia, where almost one in three (28.8%) conceal their spending behaviours. Western Australia was again the most truthful state, with only 20.6% admitting to hiding their spending.

In both cases above, Gen Z are more than twice as likely to lie about finances and spending habits than Baby Boomers, indicating that older generations have a much stronger tendency to uphold financial honesty.

The survey also explored whether people have lied about the true cost of bills to benefit themselves financially – which is the case for 8.9% of Australians. For this behaviour, men are more likely than women to have done so (10.1% vs 7.7% respectively) and once again, the likelihood of lying steadily decreases with age. More than one in ten people in New South Wales admitted to concealing the real cost of bills, higher than the national average.

Behaviours | Australian Statistics |

| Lied about the state of their finances | 24.5% |

| Lied about their spending habits | 22.3% |

| Lied about the true cost of bills to benefit themselves financially | 8.9% |

More than one quarter of Americans (26.5%) have lied about the state of their finances when asked by those closest to them, which is slightly higher than Australia. The nation performs slightly better in relation to their spending habits, with around 22% admitting they have hidden things from loved ones, and better again when it comes to inflating bill costs to benefit themselves – just 12% have done so.

Generationally, younger people have the highest tendency to lie about monetary topics. In fact, when it comes to lying about the cost of bills to benefit themselves, Gen Z is more than six times more likely to lie than Baby Boomers (30.5% vs 4.6%). It’s even worse in regard to the general state of their finances – more than half of this age group (54.2%) have been deceitful, and 49.6% have concealed some sort of spending.

When broken down by gender, it was revealed that the US is the only nation where men are more likely to lie about money matters in every regard.

Behaviours | American Statistics |

| Lied about the state of their finances | 26.5% |

| Lied about their spending habits | 22.1% |

| Lied about the true cost of bills to benefit themselves financially | 12.0% |

Of all three nations surveyed, Canada had the highest number of deceitful people across every question asked.

When asked how many have lied about the state of their finances, a whopping 34.4% admitted to doing so, with women considerably more likely than men (39.9% vs 28.8%). Similarly, around a third (30.5%) of the country has concealed their spending habits from those closest to them, with women once again more likely to engage in this behaviour.

Considering the data geographically, Ontario is the province most likely to lie about finances and spending, with British Columbia at the most honest end of the scale.

Looking at both behaviours between age groups, more than half of Gen Z were guilty – considerably more than any other generation, particularly Baby Boomers.

The survey also explored whether people have lied about the true cost of bills in order to benefit themselves financially, and more than one in ten of Canadians fell into this bucket (14.4%). Again, Gen Z is the age group most likely to do so. In fact, the age group is eight times more likely than Baby Boomers.

Once more, Ontario is the province of biggest deceit, meanwhile Alberta is the most honest.

Behaviours | Canadian Statistics |

| Lied about the state of their finances | 34.4% |

| Lied about their spending habits | 30.5% |

| Lied about the true cost of bills to benefit themselves financially | 14.4% |

Knowing how many people have lied to others, we were curious to learn how many have been lied to themselves, particularly in relation to household finances.

As it turns out, Canadians are the most likely nation to experience dishonest feedback (26.1%), closely followed by America (25.8%), with Australia further behind (17.4%). Across all three nations, women are more likely to experience this than men.

Click through below to see a detailed breakdown of results per country.

Australians were the least likely of all nations surveyed to have experienced someone else lying to them about the state of finances, with just 17.4% having been in this position. The groups most likely to fall victim to dishonesty are Gen X and those residing in Queensland (24% and 20.1% have been lied to, respectively).

Around a quarter of Americans (25.8%) have been lied to by another individual about the state of finances or bills, which is higher than Australia but not quite as high as Canada.

The survey revealed that Gen Z falls victim the most – as many as 40.5% of the generation admitted to having been in this position. The likelihood of experiencing dishonesty from others seemed to decrease with age.

Canadians were most likely to have been lied to by others about the state of finances, compared to the other countries surveyed. While more than a quarter (26.1%) declare they have fallen victim, it is Gen Z that experiences it more than any other age group – in fact, 36.2% of this group has been lied to. Like America, the likelihood of falling victim to financial dishonesty decreased steadily with age.

Further, Alberta residents feel the sting of betrayal more than any other region, with 28.1% of locals admitting as much.

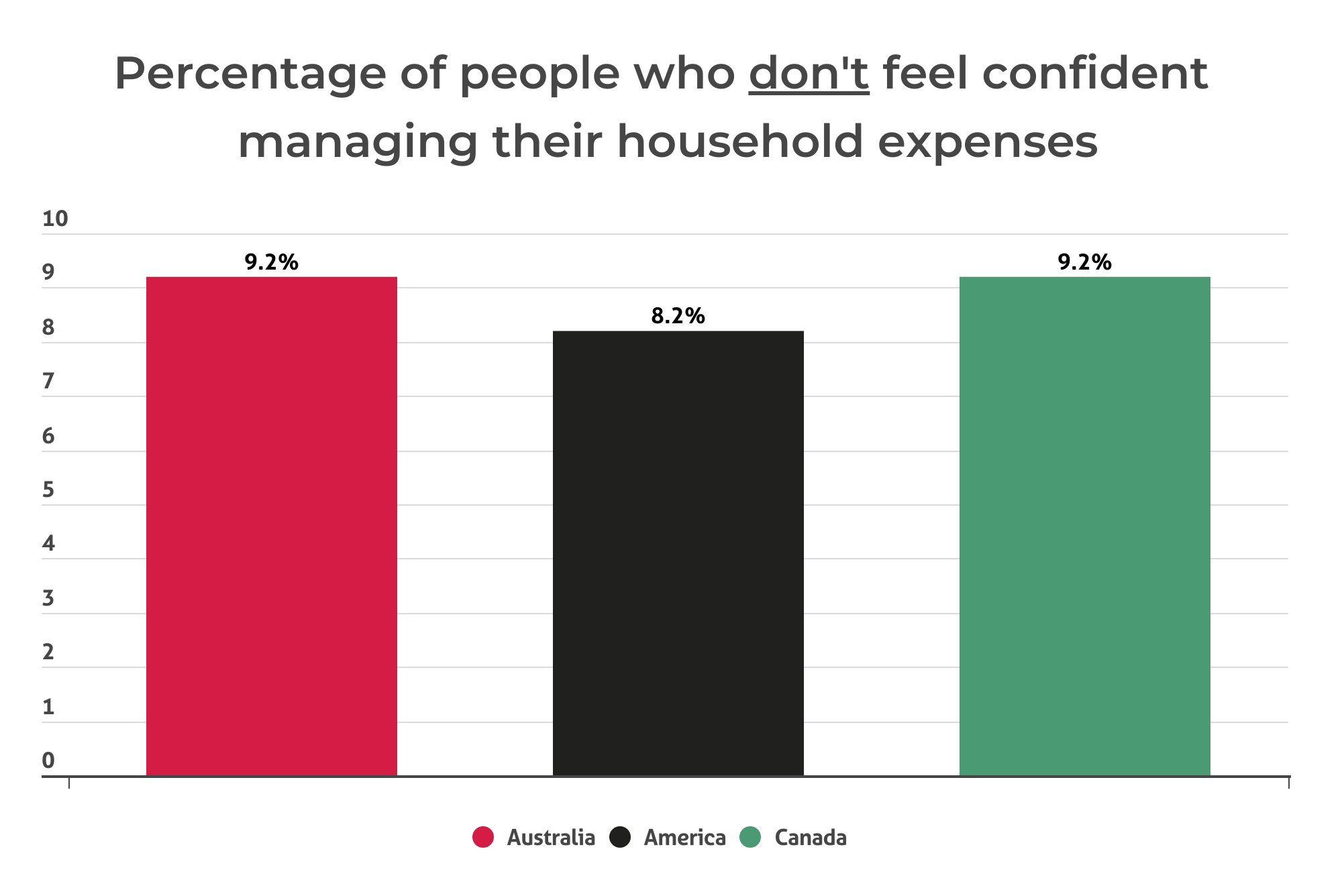

Finally, we asked respondents if they feel confident managing and paying their bills and expenses, regardless of whether they are responsible for doing so.

The results were similar across the board, with just less than one in ten across all nations expressing a lack of confidence with managing their finances. In Australia and Canada, the figure was highest at 9.2%, while it was slightly lower at 8.2% in America.

Of those who aren’t confident with their expenses, around half still manage their finances themselves.

Unfortunately, not having an adequate understanding of household expenses can put one at risk of a range of financial blunders. This means that a significant number of Australians, Americans and Canadians could face higher than necessary spending, miss out on impressive market deals, fail to meet payments, or even find themselves on an inappropriate level of cover for insurance products.

Click through below to see a detailed breakdown of results per country.

In Australia, nearly one in ten (9.2%) confessed they were not confident with managing and paying their household bills. The number was slightly higher for women (10.6%) than men (7.6%).

When considering the results by age, it was revealed that Gen Z is the least confident by a large margin. As many as a quarter (25.6%) of the age group doubt their financial competency skills, which is more than twice as high as the next less confident age group (Millennials), and more than ten times higher than Baby Boomers.

Of all Australians who expressed uncertainty regarding bills, 55.4% admitted to managing their finances themselves, meaning they could be at risk of a range of financial blunders.

When it comes to who is managing the finances, most Australians handle it themselves, while 17.3% share the responsibility between multiple people.

America showed the most confidence of all countries surveyed, with just 8.2% of respondents expressing apprehension over how to manage their household finances. Of this number, around half (52.4%) still tackle their bills on their own.

Women had higher levels of confidence than men, which contrasts both Australia and Canada’s results. Across the ages surveyed, Gen Z was the least confident by a considerable margin – as many as 21.4% doubt their financial understanding, which is more than twice as many as the second-least confident age group (Gen X).

Alarmingly, almost half (45.1%) of those that expressed apprehension admitted they have lied to others about the state of their finances. With such a considerable number of this group managing their own finances, it seems Americans may be less likely to admit to others when they need help managing their bills.

As for who manages the money in the home, most Americans handle it themselves, with around 15% sharing the responsibility between multiple people. Perhaps unsurprisingly, Gen Z is the least likely to manage their own finances – 42% of the age group, compared to 71.4% for the second-least likely age group (Baby Boomers).

In Canada, 9.2% feel a lack of confidence when it comes to managing and paying household bills. It’s considerably higher for women, with as many as 12.3% feeling this way compared to just 5.8% of men.

Of those that don’t feel confident, almost half (47.8%) admit to self-managing bills, putting them at increased risk of financial strife. Additionally, a further 33.7% revealed that they have lied to others about the state of their finances.

Gen Z is the most apprehensive age group – by a long shot – with as many as 24.6% confessing they don’t understand how to manage their finances. It’s a figure that’s more than twice as high than that of Millennials, and eight times higher than Baby Boomers.

Finally, we analysed the data by region to discover that Alberta is the most confident with money management, compared to Quebec as the least confident.

In terms of who is managing the money in the home, most Canadians do it themselves, while around 19% share the responsibility between numerous people.

The vast number of people that admit to concealing household bill costs makes it easy to see how tough they can be to manage. And, for many, one of the biggest and most stressful chunks of the budget is housing costs – whether it be rental or mortgage payments.

If you have an existing home loan or are looking to secure one for a property you have your eye on, comparing your options could ease some stress by helping you find a deal that meets your needs and circumstances. With a competitive rate, you could put more money towards things that matter to you.

When going for a loan, it’s also important to consider your spending habits. While you may be able to conceal certain behaviours from those in your household, you can’t conceal spending habits from a bank. Lenders will closely analyse your monetary habits when considering your application, so it’s sensible to maintain good financial habits and show a history of saving if you want a lender to consider you seriously for a future home loan.

If you’re looking to compare your options now, you can use our free home loan comparison tool to find a range of options within minutes.

Compare the Market commissioned PureProfile to survey 1,003 Australian, 1,002 Canadian and 1,002 American adults in September 2023.

The generations mentioned in this survey were defined by the following age groups: