The Burrow

Our homes are considered a safe place to store our belongings, valuables and memories – but are they protected?

As home and contents insurance comparison experts, we surveyed more than 3,000 Australians, Americans and Canadians to find out which items in their homes were most valued – either financially or sentimentally – and whether those items have a level of insurance cover.

Here are the results.

Combined across the three countries studied, these were the key findings:

The tabs below reveal country-by-country results.

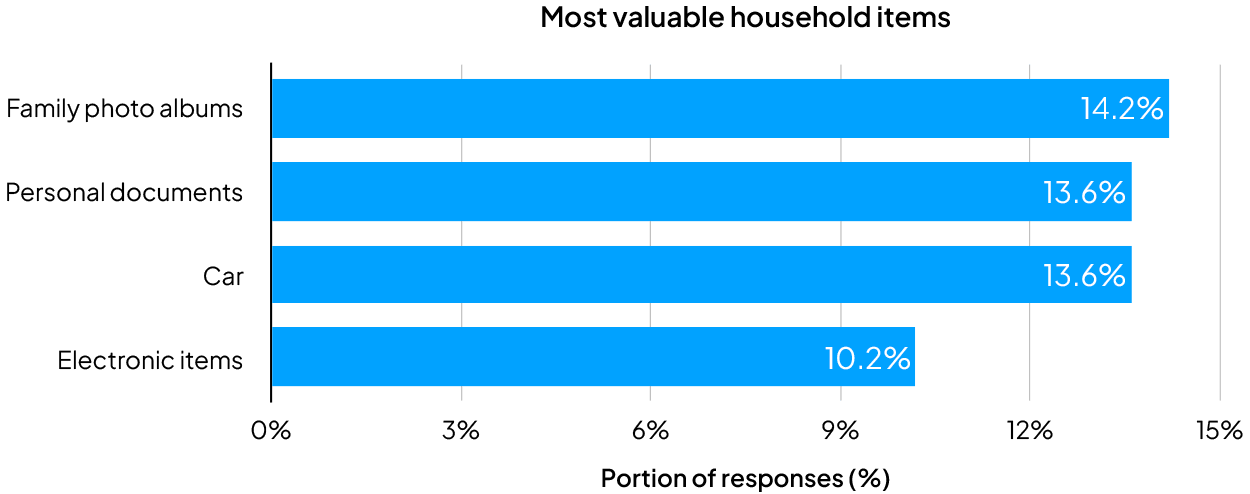

Combined across Australia, the United States and Canada, participants said their valued items are:

Interestingly, a higher portion of Americans said no valued items are insured (30.2%) compared to Canadians (21.7%) and Australians (20.1%).

The tabs below reveal country-by-country results.

Combined, the primary concerns for their valuables being damaged inside the home include:

Notably, a slightly higher portion of Australians were more concerned with theft or burglary (23.9%) damaging their valued items – compared to Americans (18.2%) and Canadians (21.8%).

Compare the Market’s Executive General Manager of General Insurance, Adrian Taylor, said it’s important to consider a home and contents insurance policy to have a level of protection in the event of the unexpected.

“It’s promising to see a significant proportion of households having a home insurance and/or contents insurance policy – but it’s not the majority,” Mr Taylor said.

“Home and contents insurance can help pay for damages and incidents that affect your home or belongings from any listed or defined events such as fire, theft or storm damage.

“Remember to accurately specify the value of your home and valuable items in your policy to ensure they are covered and not risk underinsurance.

“If you already have a home and contents insurance policy, you don’t need to wait for your renewal notice to see if you could save money. Staying loyal to your current insurer could be costing you more.

“You could compare your options now and, if you find a cheaper option that suits your needs, you could cancel your existing policy anytime and any unused premium will be refunded back to you, less any cancellation fees if applicable.”

Always read the Product Disclosure Statement (PDS) and Target Market Determination (TMD) to check for the inclusions, limits and restrictions before purchasing.

Compare the Market commissioned PureProfile to survey a nationally representative sample of 1,005 Australians, 1,001 Americans, and 1,000 Canadians in July 2024.