The Burrow

How people keep unwanted guests out

Our homes are our sanctuaries – they’re places where we should feel safe and secure. However, as the places where we live, they’re also the places where we store our belongings – making them ideal targets for thieves.

In a perfect world, we wouldn’t have to worry about thieves and burglars breaking into our homes, but it’s something that can happen; even to people living in ‘safe’ neighbourhoods.

As experts in understanding what can influence one’s ability to make a claim on their home insurance and contents insurance policy, Compare the Market ran a survey asking more than 3,000 Australian, Canadian and American adults whether they’re concerned about break-ins, have experienced break-ins in the past, and what security measures they have in place to prevent them.

Here’s how people responded.

Of the three nations surveyed, Australia had the highest proportion of respondents who were concerned about their home being broken into, with 67.4% of Aussies worried about thieves breaking in.

This may have to do with the fact that Australia also had the highest number of people who said they had experienced a break-in before (39.2% of respondents).

On the other hand, Americans were the least concerned of the bunch, with 54.4% of US respondents indicating they were worried about being burgled. Interestingly, while less Americans said they were worried about break-ins than Canadians, more Americans had been robbed than their northern neighbours (30.8% vs 29.9%).

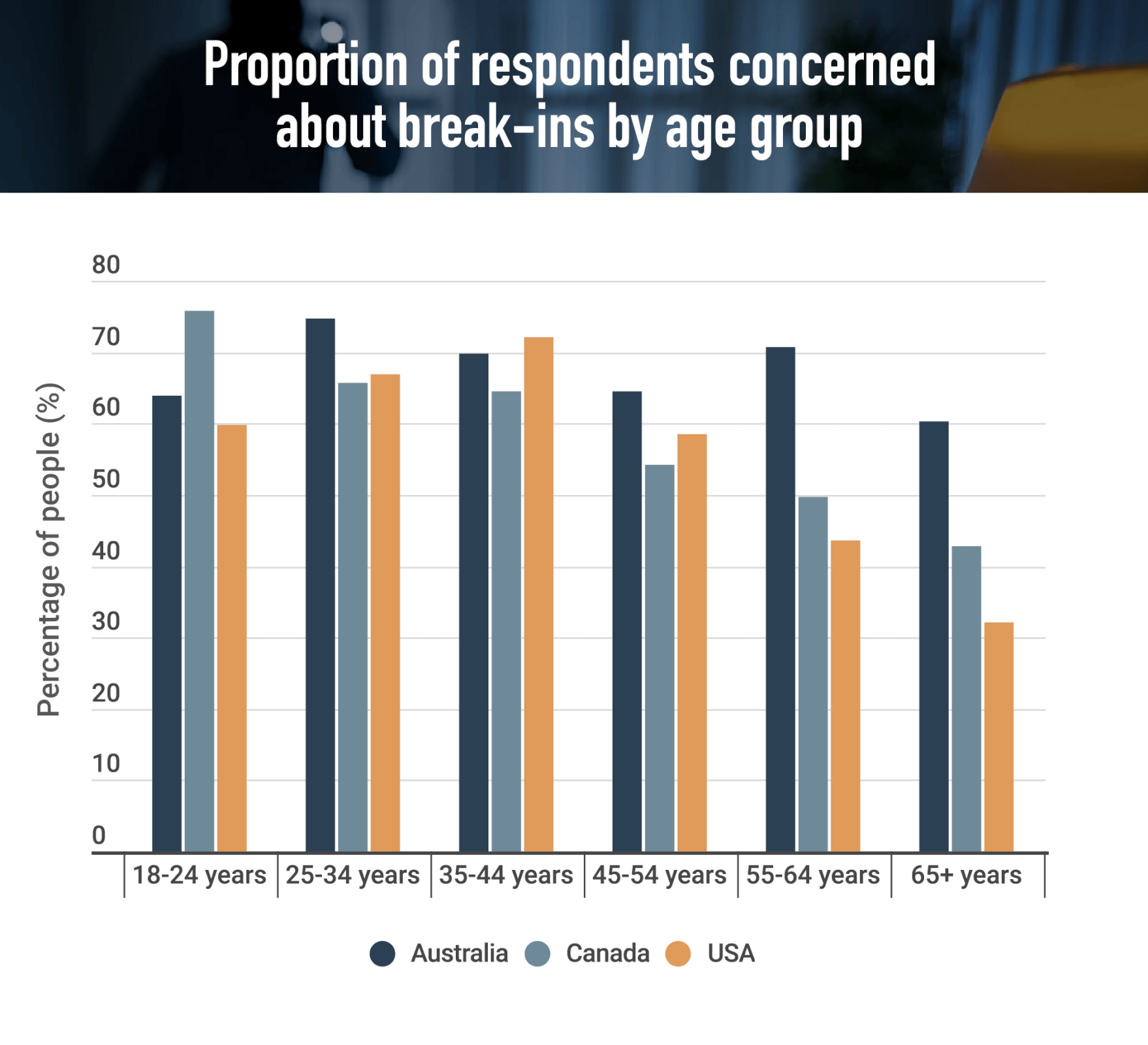

When the survey responses are broken down by age group, it was the younger generations who were most concerned, though the specific age-groups with the highest proportion of people concerned about burglars differed for each country.

In Australia, it was younger Millennials who were most concerned, with 74.7% of Aussies aged 25-34 saying they were worried about home break-ins. In Canada, it was Generation Z who was the most worried while American Millennials aged 34-44 who were the most concerned.

More women in Australia were concerned about B ‘n’ Es than men (68.5% of women compared to 66.1% of men), but this wasn’t the case with the North American countries surveyed. Both American and Canadian men were more concerned with people breaking in than women; 60.3% of Canadian men compared to 55.8% of Canadian women and 61.5% of American men compared to 47.1% of American women respectively.

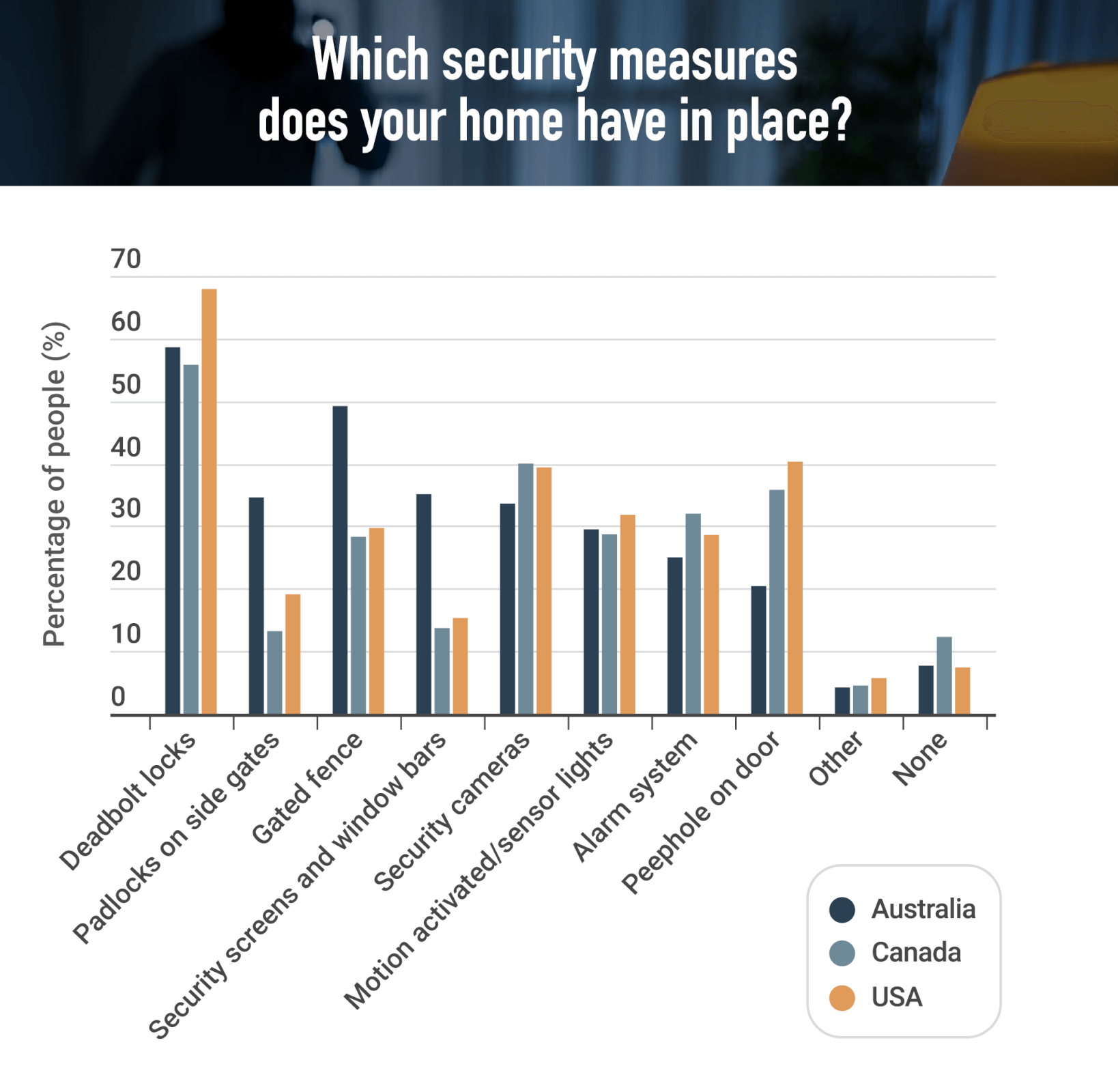

Next, we asked what kind of security measures people had in place to protect their home and contents against theft and break-ins.

Deadbolt locks were the most common form of home security across Australia (58.6%), Canada (55.8%) and the USA (67.9%). Beyond that, preferences for different security measures vary depending on location.

Gated fences and security screens on doors and windows were the next most common means of protection among Australians. Security cameras and peepholes on doors were the next most common means in Canada, while it was the other way around in America, with peepholes being more popular than security cameras.

Within the “other” category of security measures, many survey respondents listed dogs as a means of home security. Additionally, almost 10% of Americans who specified another security measure in the survey listed guns as a means of home defence. In contrast, only one Australian survey respondent listed firearms as a deterrent for thieves, and none of the Canadians surveyed listed guns as a means of keeping burglars away.

Compare the Market’s General Manager of General Insurance, Adrian Taylor, notes that some security devices may have a positive impact on home and contents insurance premiums.

“Some insurers do lower premiums a bit if you have some form of home security, but it depends on what type of security device it is,” Taylor explains.

“The most common types that do make a difference are alarm systems. Security cameras typically don’t make any real difference to the price you pay for insurance, but the footage they provide can be invaluable not just to police investigating a break-in, but to your insurance provider as well.”

When it comes to home security and the price of home and contents insurance, one of the biggest pricing factors is the local crime rate of the surrounding area. If a home is in an area where burglaries are common, then home and contents insurance will typically be more expensive.

Our survey also asked whether respondents had made an insurance claim for theft, broken or stolen goods and package-theft at the home.

While Australians were the most concerned with people breaking into their home of all three nations surveyed and have experienced a break-in previously, Americans were the most likely to have made an insurance claim. Almost one-in-four Americans surveyed (24.4%) had made an insurance claim for stolen belongings, compared to 17.5% of Australians and 16.9% of Canadians.

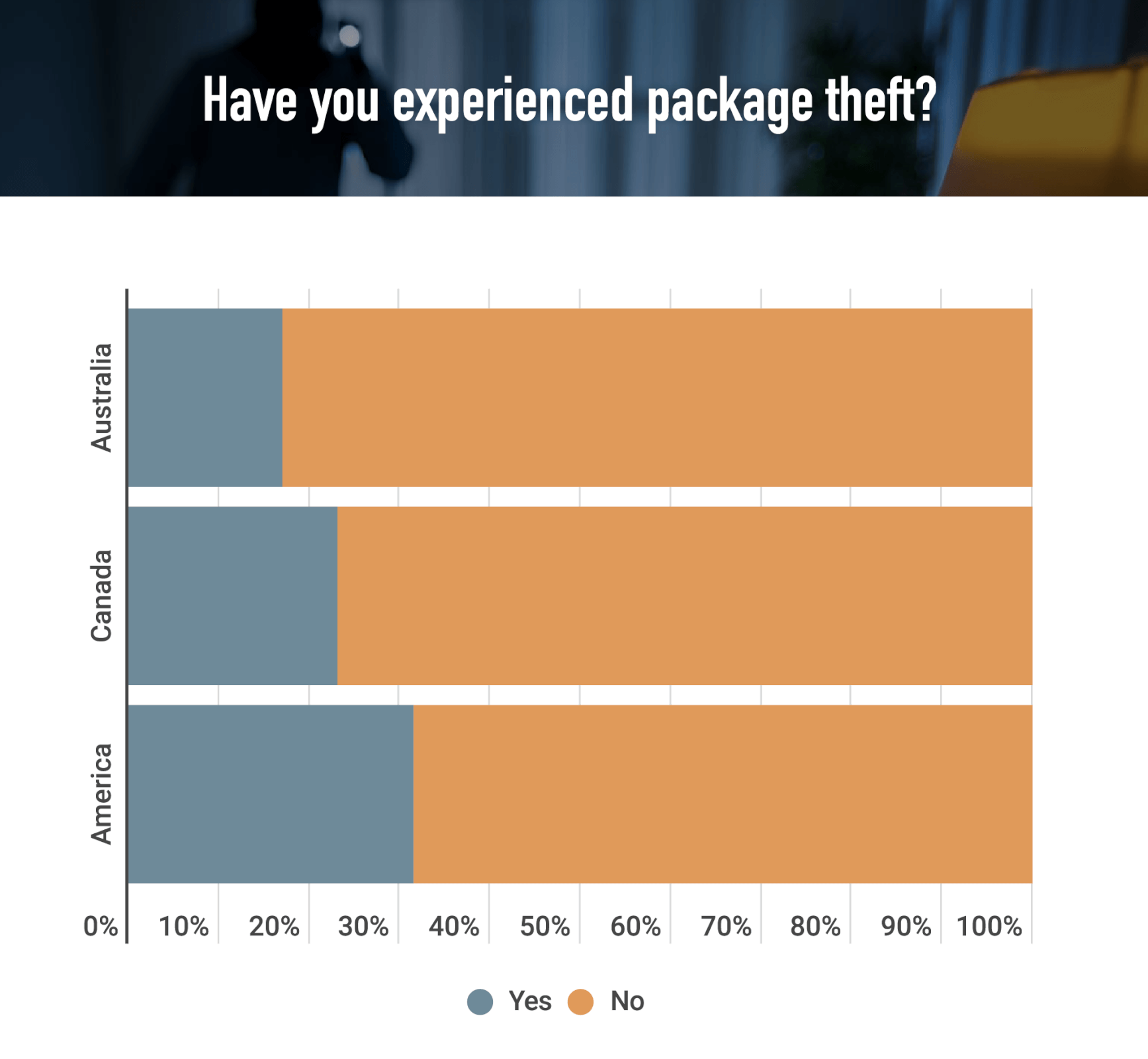

Canadians are the most concerned about package theft. The proportion of people concerned about package theft from their homes was very similar across the board.

Australians were slightly less worried than their North American counterparts, with 59.5% of those surveyed saying they had concerns packages may be stolen from their front door. In the USA this proportion rose to 60.1% of survey respondents, and Canadians were the most worried, with 61.9% of those surveyed saying they had concerns.

As for those who had actually had a package stolen from their home before, almost a third of Americans reported being the victim of porch pirates, while Australians were the least likely to be victims of package theft, with less than one-in-five survey respondents reporting a stolen parcel.

Brought to you by Compare the Market: Making it easier to compare home and contents insurance in Australia

Compare the Market commissioned Pure Profile to survey 1,006 Australian, 1,010 Canadian and 1,012 American adults in October 2022.