The Burrow

To err is human. Accidents happen. Nobody’s perfect – there are half a dozen mantras to console yourself with after dropping or breaking something you didn’t mean too.

But positive thinking won’t fix that new hole in the wall, or a broken window, or a ruined shaggy rug.

You might be feeling like a bit of a klutz, but don’t worry – you’re not the only one! As experts in home and contents insurance (which comes in handy if there’s accidental damage), we were curious just how common such home mishaps are.

We surveyed more than 3,000 adults in Australia, Canada and the USA, asking them how many times they had accidents at home, what they’d broken, and whether they were insured.

Here’s what we found.

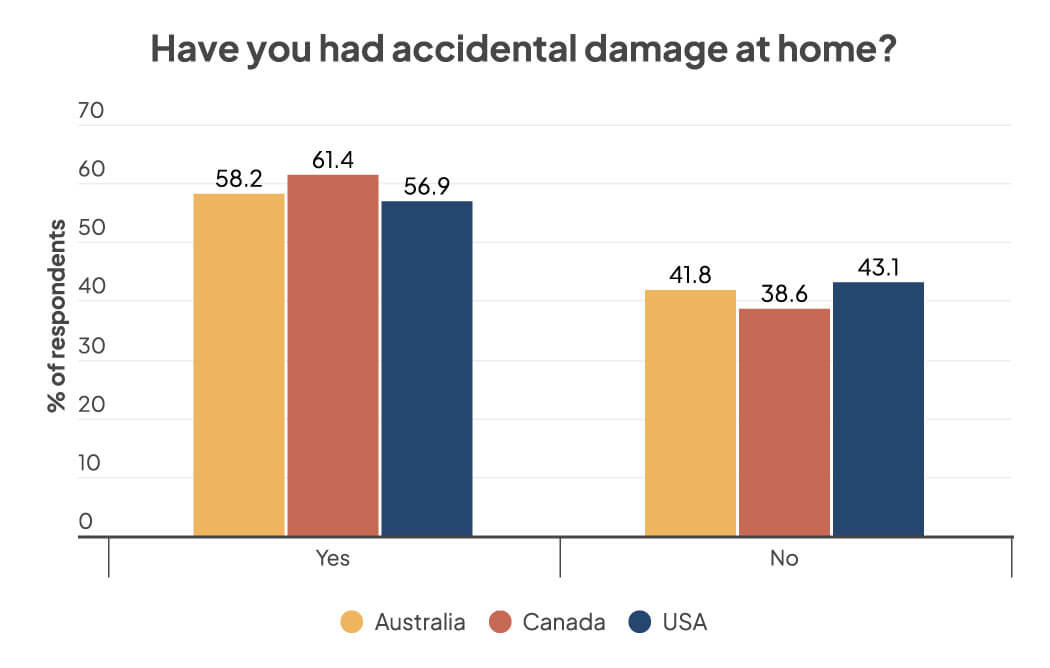

The difference wasn’t much, but Canadians were more likely to have accidents at home than Australians and Americans. Almost two-thirds of Canadian respondents – 61.4% – had experienced at least once incident of accidental damage compared to just 58.2% of Australians. Americans were the least likely to be clumsy. Only 56.9% of Americans had a mishap at home.

More broadly, most people in each nation admitted to being clumsy or experiencing accidental damage at home.

Looking at the number of accidents that have occurred, Australians were ahead, with most people having had between two and six incidents at home. In comparison, Canadians were more likely to have had 10 to 12 accidents, and more Americans had seven, 19 and 20 accidents at home than the other countries surveyed.

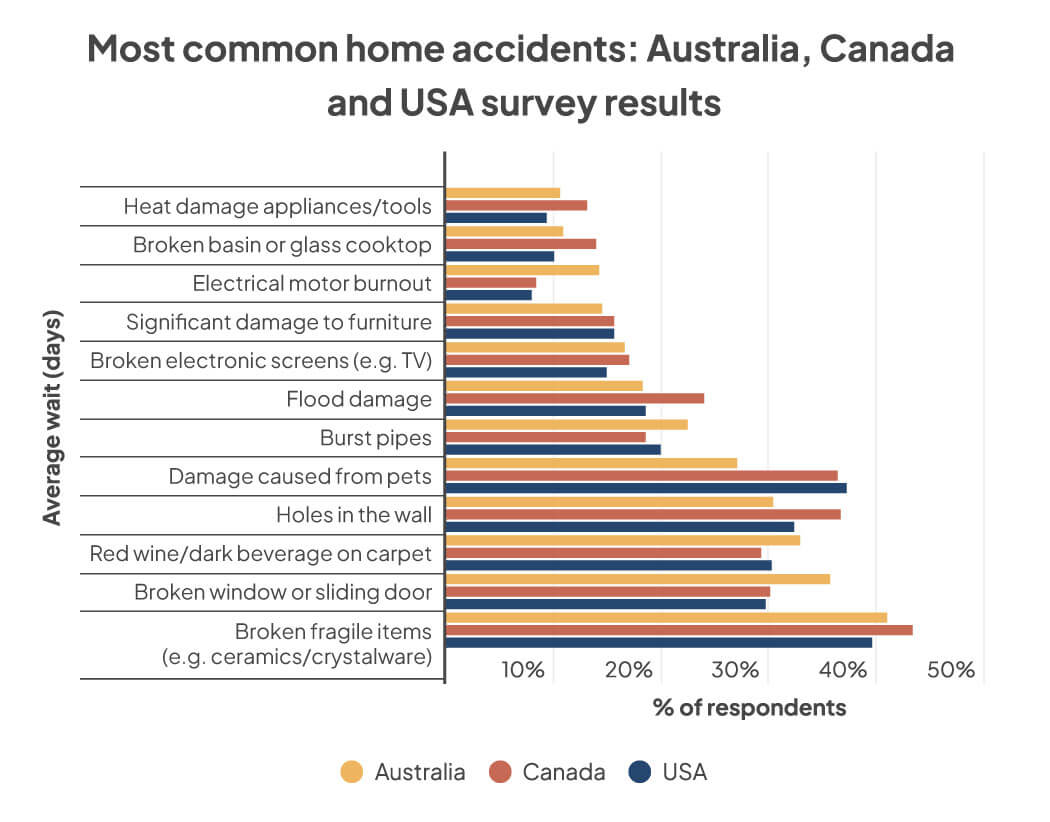

The survey asked respondents to list each type of damage and what was impacted, with the number one casualty from all three countries being broken fragile items like ceramic dishes and crystalware.

Canada was in the lead here slightly, with 43.3% of adults surveyed saying they’d broken fragile items, followed by 41.0% of Australians and 39.5% of Americans.

Interestingly, the next most common types of damage were different for Australians and their North American counterparts.

The second-most common type of accidental damage in Australia was broken windows and sliding doors at 35.7%, followed by red wine or dark beverages spilled onto carpets at 32.8%. For Americans, it was pet damage at 37.2%, then holes in the wall at 32.3%. For Canadians, holes in the wall were number two at 36.6%, with pet damage right on its tail at 36.3%.

The least most common kinds of slip-ups were heat damage from appliances, broken basins and ceramic cook tops, and electrical motor burnout.

When asked if they had insurance cover for accidental damage, over half of respondents in each country said that they did, with Canada being the highest at 59.9%, while Australians were at 53.9% and Americans at 53.5%.

Americans were the most likely to be unsure, with 15.6% saying they didn’t know if they had the appropriate type of cover. Australians had the highest proportion of people who said they didn’t have accidental damage cover at 31.7%.

| Do you have home and/or contents insurance that covers accidental damage? | Australia | Canada | USA |

| Yes | 53.9% | 59.9% | 53.5% |

| No | 31.7% | 26.5% | 30.8% |

| Not sure | 14.3% | 13.6% | 15.6% |

Compare the Market’s Executive General Manager of General Insurance, Adrian Taylor, notes that home and contents insurance can cover accidental damage, but it isn’t always included as standard.

“Some policies include cover for accidental damage, but others won’t. Some might not cover it in the standard policy, but the insurance provider might offer to add that coverage for an additional price,” Mr Taylor said.

“It’s crucial you read through the Policy Disclosure Statement (PDS) and Target Market Determination (TMD) to get the details of a policy, including what it does and doesn’t cover, and whether it’s suitable for you and your financial situation. You don’t want to purchase a policy that’s missing the cover you wanted.

“Also, not everything that people listed in our survey falls under the insurance term ‘accidental damage’. Depending on your insurer, events like motor burnout, flooding, and pet damage may not be covered as accidental damage and you may need additional cover if you want to be able to claim for damage caused by these events.

“Flood cover, for example – not all policies include it as standard, and you might have to pay more. Insurance providers typically don’t cover damage from pets – though cover can differ from policy to policy – and burst pipes may be covered in specific situations, again, depending on your insurer and the terms of your policy. That’s why it’s so crucial to read the details of any insurance policy.”

If you break a cheap glass, or even a $200 vase, it might not seem like it’s worth making an insurance claim, especially when you factor in the policy excess.

“When making a claim, you’ll have to contribute your policy excess, which will be deducted from your settlement or paid to a provider. This could be hundreds of dollars – possibly even thousands – depending on what excess you set when purchasing the policy,” Mr Taylor said.

“For small things, the cost of the excess could be more than the value of the item in the first place, making it financially unfeasible to lodge a claim. Furthermore, making a claim could mean that your premium might increase on renewal.”

With this in mind, it’s not surprising that most respondents who had accidental damage hadn’t made an insurance claim.

Only 36.1% of Americans made an insurance claim for accidental damage, with Canada right behind at 31.4%, while only 30.1% of Australians made a claim.

So, if the damage isn’t too bad, no harm no foul, right?

Compare the Market commissioned PureProfile to survey 1,005 Australian, 1,005 Canadian and 1,005 American adults in October 2024.