The Burrow

Would you go into debt to pay medical bills?

Health is a human right, but it’s not free – even in countries with universal healthcare systems.

Each person only has one body, but would we go into debt to pay for our own medical care, or the treatment of those that we love? Just how much would we spend for urgent life-saving care?

To answer these questions, the health insurance extras cover experts at Compare the Market commissioned a survey of more than 3,000 adults across Australia, Canada and the USA. We examined whether people had gone into debt to pay medical bills, how much debt they went into, what they would spend in an emergency to save their life, and what ongoing health treatments people spend their money on.

Read on to discover the results.

Health insurance can be the difference between sinking or swimming if you require significant medical attention. It can help pay for expensive care and reduce the costs you need to pay. It’s designed to help you get non-emergency medical care when you need it, while also providing more choice around which available doctor you see and avoiding public waiting lists.

Having health insurance does cost money, but it can reduce your out of pocket expenses for many surgeries. To encourage people to take out health insurance, the Australian Government has a number of incentives such as the Australian Government Rebates and age-based discounts for younger Australians.

The more people who are on private health insurance, the less strain there is on the public system. Having health insurance primarily benefits you as the customer, but it also benefits the country as well.

Not everyone has health insurance or the time to spend on a publicly funded waiting list (such as in Canada and Australia), possibly going months with a serious medical issue before being treated. This means some people go into debt to pay for healthcare – and perhaps unsurprisingly, Americans are more likely to get into debt than Canadians and Australians.

The USA has a much-derided healthcare system (which we’ll get to in a minute), and in our survey 27.3% of American respondents said they have gone into debt to pay for medical bills for themselves or a loved one. In contrast, only 17.5% of Canadians and 15.5% of Australians said they have done the same.

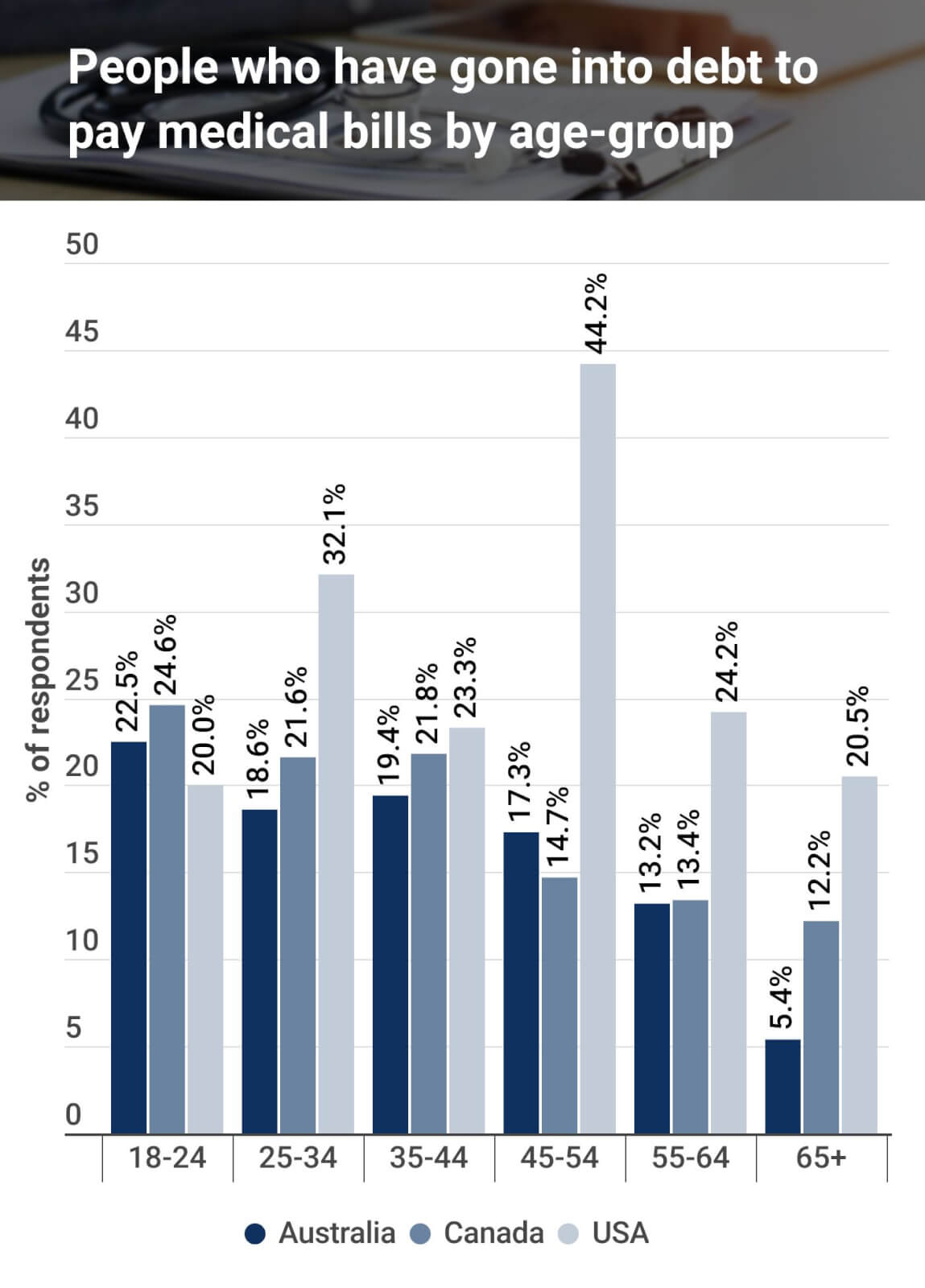

When breaking the answers down by age-group for each country, it was younger Australians who were more likely to go into debt for own or their loved one’s medical care.

Canadian responses by age-group followed a similar trend to Australia, with the younger age groups being more likely to incur debt for healthcare bills. However, while the likelihood of going into debt for medical bills lessened steadily for older Australians, Canadians in the 45-54 age bracket plateaued out between 12% and 15%.

Responses from America, however, were completely different. Most age-groups stayed within the 20% to 25% range, but there were big spikes for those aged 25-34 and 45-54. Over 32% of those aged 35-44 had gone into debt, but this rose to 44.2% for Americans aged 45-54.

Breaking down the data by gender, women were more likely to have gone into debt than men in the USA and Canada, but the opposite was true in Australia (though the difference was negligible). In the USA, 28.5% of women surveyed had gone into debt, compared to 26% of men. The difference was bigger in Canada where 20% of women had gone into debt for medical bills, compared to around 15% of men.

There was barely any difference between the sexes in Australia, where 19.2% of men had gone into debt for their own or a loved one’s medical bills, compared to 18.7% of women.

Looking at the data for each country, most people aren’t needing to put themselves in debt to pay for their own medical care, or that of a loved one, which is a positive thing. Those that have gone into debt, however, were in the red to the tunes of thousands.

Americans who went into debt had the highest average figure of all three nations surveyed (which will come as no surprise to anyone familiar with the US health system). The average debt for US respondents was US$9,358 (AU$13,756). Canadians had an average medical debt of US$6,022 (AU$8,789).

Meanwhile, Australian respondents had the smallest average debt for healthcare bills at US$2,082 (AU$3,062).

Compare the Market’s survey also asked people “in the event of your own life-threatening medical emergency, how much would you spend in order to survive and return to full health?”

The answers were… interesting.

It was clear some people were ready to embrace the end, saying they wouldn’t pay a cent to save themselves. Others, however, others would spend quintillions – more money than currently exists in the world.1

A more useful and helpful statistic is the modal number – the most frequently occurring answer. The most common amount Australians said they would pay was US$6,800 (AU$10,000), the smallest amount of the three nations. In Canada, the most common answer was US$7,400 (AU$10,800). The most common response from American respondents was US$10,000 (AU$14,700), the highest modal figure across the board.

Australia is renowned throughout the world for its healthcare system. It isn’t perfect, but it helps provide quality medical care to Australian citizens, permanent residents and other eligible people who are listed on the system, which is called Medicare.

Medicare is jointly operated by local, state and the federal government, funded by taxes of all Australian citizens and permanent residents. It provides free hospital care in public hospitals and also subsidises a range of other medical treatment costs.

Complementing Medicare is Australia’s private health insurance system, where people can pay for policies to cover specific treatments in hospital, as well as ancillary treatments from specialists outside of a hospital setting.

Canada also has a public healthcare system that is taxpayer funded and is also called Medicare. It is designed to pay for emergency medical care and most healthcare costs. However, each of Canada’s 13 provinces and territories has its own Medicare, in comparison to Australia’s national Medicare.2

Like Australia, there is private health insurance in Canada that can complement the public health system. However, a key difference is that private health in Canada is used to cover treatment not included in Canada’s Medicare, whereas in Australia private health insurance can be used for treatments that are covered by Australia’s Medicare system, as well as some treatments that aren’t covered.

Another key difference is that in Canada, health insurance is typically provided by employers as a part of a worker’s remuneration, whereas in Australia health insurance is typically bought privately by customers from health insurance providers, also known as health funds.

The USA does not have a universal healthcare system like Canada or Australia. America does have a system called Medicaid, which is designed to provide health insurance coverage to low-income citizens, the elderly and people with disabilities. Like Canada’s Medicare, America’s Medicaid is managed at a state level, though the US federal Government does help supply funding.3

This means that in most cases almost all medical treatment will incur a cost to the patient. Even those on Medicaid may be required to pay a co-payment or deductible, which differs depending on their state and their income.4

Medical care is quite expensive in the USA, and so many employers provide some level of health insurance for their employees to help cover some of the cost.5 This is generally deducted from people’s pay and is similar to how private health is typically provided in Canada.

Besides big one-off surgeries, a major portion of household healthcare spending is actually regular ongoing expenses like medication, check-ups and gym memberships.

In Australia, the most common health services people pay for on a regular basis, based on our survey, are prescription medications, dental check-ups and gym memberships, though the second most common response to the question was “none of the above”. In Canada, dental check-ups was in number one followed by prescription medications, then “none of the above”, followed by gym memberships.

Similarly to Canada, the USA had dental check-ups followed by prescription medications and gym memberships as the most popular ongoing health expenses – “none of the above” was the fourth most-common answer.

Conversely, the least common across all three nations was acupuncture. In Australia and Canada, blood glucose devices were the second least-common, while in America the second least-common was physiotherapy.

| Health service with ongoing costs | Australia | Canada | USA |

| Prescription medication | 45.6% | 43.3% | 46.7% |

| Dental check-ups | 43.0% | 46.5% | 47.3% |

| Gym membership | 20.4% | 21.7% | 29.1% |

| Physiotherapy | 11.4% | 8.5% | 5.7% |

| Mental health appointments | 10.3% | 11.2% | 17.4% |

| Remedial massages | 8.8% | 10.5% | 6.1% |

| Chiropractor | 6.1% | 10.6% | 10.0% |

| Blood glucose devices | 4.9% | 6.3% | 5.9% |

| Acupuncture | 2.3% | 4.5% | 2.3% |

| None of the above | 23.4% | 25.9% | 21.3% |

Compare the Market’s Head of Health Insurance, Lana Hambilton, notes that, if you meet relevant criteria, health insurance extras can help cover costs related to these services, as well as a number of others.

“In Australia, a health insurance extras policy can cover some of the cost of a huge range of different services and treatments outside of the hospital that you may need on a regular basis,” Ms Hambilton explains, “or it can just cover a few, depending on what policy you choose and what your individual needs are.”

“Besides prescriptions, dental and physio, a health insurance extras policy can also cover prescription glasses, hearing aids, occupational therapy, speech therapy and more. By insuring your health with an appropriate policy for your needs, you can help reduce these expenses to make it easier to get treatment with a private provider, subject to the terms and limits of your extras cover.”

“Private health insurance provides us with greater choice and can provide great value and peace of mind for people concerned about specific health issues,” Hambilton continues. “Health insurance helps us prioritise and take charge of our health.”

1 World. The World Factbook, Central Intelligence Agency of America, United States Government. 2023.

2 Health care in Canada: Access our universal health care system. Government of Canada. 2021.

3 Medicaid. Centers for Medicare & Medicaid Services, United States Government. 2023.

4 Cost Sharing Out of Pocket Costs. Centers for Medicare & Medicaid Services, United States Government. 2023.

5 Healthcare in the United States: The top five things you need to know. MITMedical. 2023.

Compare the Market commissioned PureProfile to survey 1,006 Australian, 1,004 Canadian and 1,004 American adults in January 2023.

Survey respondents responded to questions in their local currency, which was converted into USD and AUD on 24/02/23.