The Burrow

There’s a familiar narrative you’ll hear as you get older: healthcare doesn’t get any cheaper.

While health insurance can help you save you money, if you don’t have an up-to-date policy or a policy that really suits your needs, it can also quickly become unaffordable.

Here’s what over 50s need to know about private health insurance in Australia.

Every one of us has a different background and family history, which means we’re all susceptible to different conditions.

However, there are some trends. For example, large numbers of ageing Aussies are particularly susceptible to teeth decay and vision impairments. You will also have to look out for issues with joints, chronic illnesses, and more – all of which can be expensive to treat.

Based on your family history and your current health status, you probably already know what to look out for, including things like diabetes, prostate cancer or breast cancer and high blood pressure.

Compare health insurance policies that include cover for things you’re likely to need.

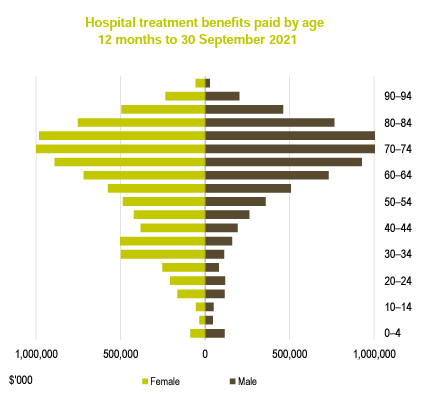

Private health insurance is an investment, one that can pay off when you need it most. Indeed, older Australians tend to use their health insurance more often than younger generations, which is consistently shown in the Australian Prudential Regulatory Authority’s (APRA) statistics.[1] According to the latest figures, the number of Australians over 50 with hospital membership increased by more than 115,000 in the year to September 2021, compared to just over 47,500 for those under 50.

According to APRA’s official stats, older age groups are more likely to claim on their health insurance.

Some operations can cost tens of thousands of dollars. Excesses and out-of-pocket expenses pale in comparison (when paying for these using a private hospital insurance policy) to the full cost of treatment paid for outright without the policy.

While you can simply seek out treatment as a public patient, you won’t have as much control over your healthcare. For example, a private hospital policy:

An extras policy, on the other hand, covers treatment outside of a hospital, which you aren’t able to claim on Medicare anyway. Depending on your level of cover, extras can reduce your medical expenses for a range of treatments such as:

For surgeries where you are treated as a private patient in a private hospital, Medicare covers 75% of the Medicare Benefits Schedule (MBS) cost, which is a price for various medical treatments the Government considers adequate for providing the service.

Typically, your health insurance covers the remaining 25% of the MBS for treatment and services that are included on your policy, but doctors, surgeons and other health professionals can choose to charge more than the scheduled fee for their services. This then leaves patients with an out-of-pocket cost, which is also known as a gap payment.

The cost of medical treatments varies based on what procedure you’re having done and who’s performing the operation. Let’s take a look at a couple different treatments as examples, such as a single hip replacement, colonoscopy and gall bladder removal.

| Treatment | Percentage of privately insured patients with out-of-pocket expense | Median doctors’ fees | Average out-of-pocket expense paid by patients* |

| Gall bladder removal | 71% | $2,700 | $350 |

| Colonoscopy | 19% | $1,300 | $170 |

| Hip replacement (single) | 82% | $5,000 | $590 |

| *This figure is calculated after Medicare and private health insurance payouts were received and doesn’t include any costs charged by the hospital. Source: Medical Costs Finder, Department of Health, Australian Government. 2021. | |||

As the table shows, doctor’s fees can vary widely, and the number of people with private health insurance who must pay out-of-pocket differs by surgery as well, but these out-of-pocket costs are significantly less expensive than if you paid for private treatment outright.

If older generations use their health insurance more, you might think their premiums cost more. But this typically isn’t the case. Unlike other insurance products, health insurance is community rated, meaning that your individual risk factor and probability of making a claim doesn’t impact the cost of your policy. This is different to something like life insurance, which takes things like your occupation, health history and more into consideration before settling on your premium.

This means if you take out the same level of cover as someone in their 30s, your base premiums cost the same – though lifetime health cover loading and the Australian Government rebate on Private Health Insurance can affect what you pay too.

Of course, if you claim, you will also have to consider the cost of out-of-pocket expenses.

Everyone’s health status is different though, so your best course of action is to speak to an expert to see how a private insurer would help pay for services you’ll likely need to rely on.

While health insurance is generally more likely to represent good value to someone over 50 than under, that isn’t a guarantee you’ll be getting a good deal. This is even more likely to be the case if you haven’t compared policies in a while.

Our experts are well-equipped to help you shop around. All it takes is one phone call or a few minutes of comparing on our website.

1. Medical Costs Finder, Department of Health, Australian Government. 2021.

2. Quarterly Private Health Insurance Statics: September 2021 (released 24 November 2021.

3. Department of Health, Average annual price changes in private health insurance premiums. 23 December 2021.