The Burrow

With the onset of the pandemic, the world experienced a global computer chip shortage due to an increase in computers used for remote working purposes. This meant that the number of new cars available has been reduced, while vehicle manufacturers wait for chips that are being redirected to other industries. This in turn has meant that the likelihood of drivers that find themselves purchasing a second-hand vehicle has increased.

As new car sales have become harder to come by their demand has increased, as well as that of second-hand cars. This has meant that the market value of cars, both new and old, has increased significantly and people will likely be paying more than they used to for either type of vehicle.

This has, in turn, put more onus on vehicle owners to ensure their car is adequately covered. As experts in comprehensive car insurance, we’ve taken the liberty of explaining the key difference between two common policy terms – agreed value and market value.

These two terms to relate to how much you will be paid out if your car gets written off as the result of a claim. In the case of market value, your insurance provider will determine your vehicles’ probable value in the current market, which may not always be the same as local sale prices. Different insurers calculate this value differently, so it’s worth contacting your provider to understand how they do so. In many cases however, they determine this based on the make, model, age and condition of the car immediately prior to the accident, among other factors. This is typically the most common type of insurance people opt to have, as they should receive a payout equivalent to the market value of their car.

Agreed value car insurance, however, means that you and your insurer agree to a set value for your car at the time you take out your policy. The value you agree to will naturally impact the cost of your premiums, but it also means you have a little more control over the payout you will receive if your car is written off. It’s important to note that the agreed value of your vehicle will not be included in your Product Disclosure Statement (PDS), rather, it can be found in other documentation such as your Certificate of Insurance.

There are pros and cons to each type of policy. With a market value policy, it’s generally understood that the ‘value’ of your car will fluctuate over time depending on a range of factors including what is happening in the used car market. Meanwhile with an agreed value policy, your vehicle will be insured for a set value when the policy is taken out, which can allow you to avoid the impacts of market fluctuations.

Going with an agreed or market value policy can affect the price you pay, however it’s important to keep in mind that both options are not always available. There can be criteria that is attached when an agreed value option is made available to a customer (such as, the year of manufacture).

Also, be sure to read the PDS before purchasing to ensure you understand any limits, restrictions or exclusions of the policy you’re interested in.

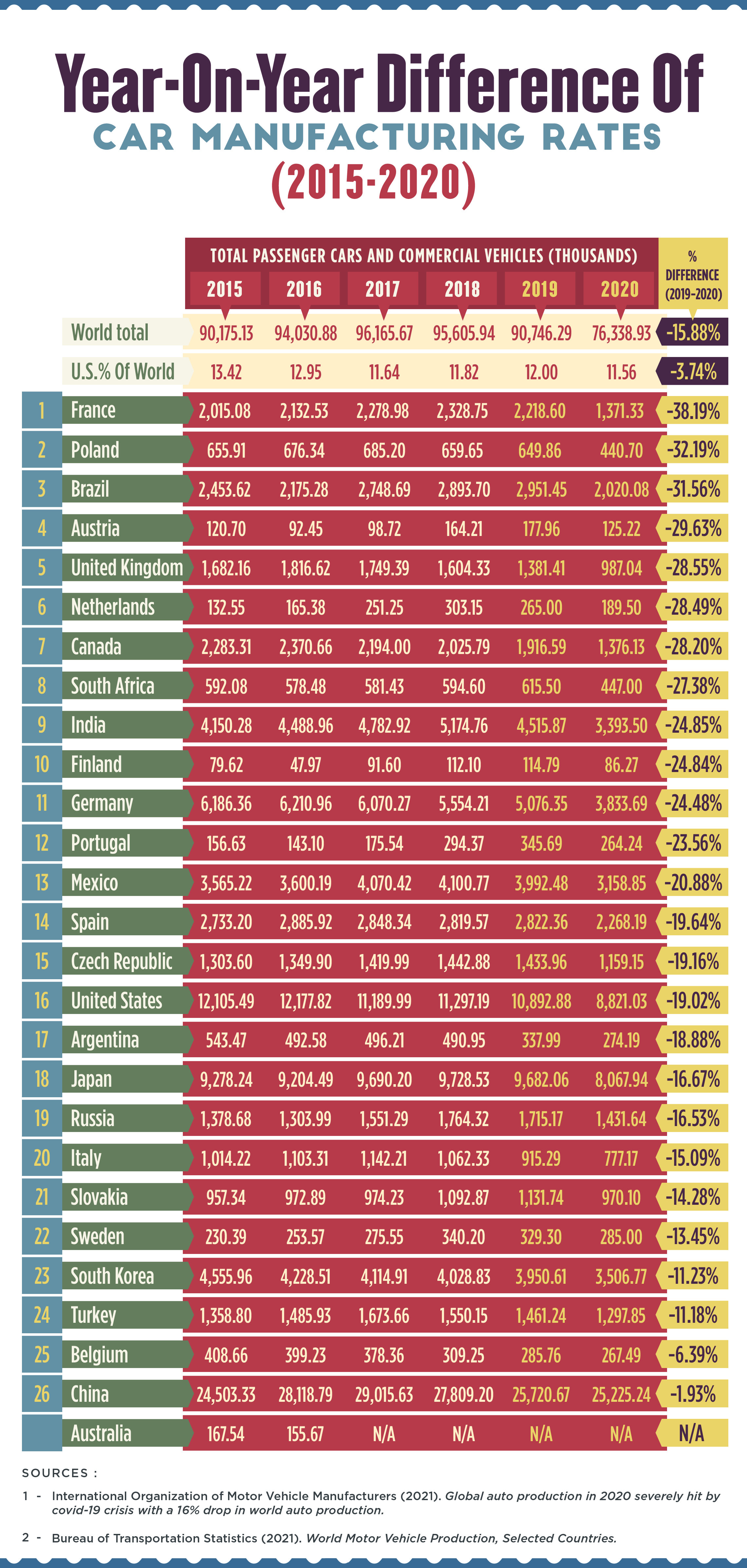

So now you should have an understanding of how the car sales market can impact your car insurance, and how the used car market has changed since the pandemic begun. In following global car trends, we also considered how the demand for used cars has peaked because of global supply chain issues, which has disrupted vehicle manufacturing around the world. Below, we explore the countries most affected, and how their industries suffered as a result.

In 2019, car manufacturing dropped by five percent and ended a ten-year boom in the industry. Following on from the disastrous nature of COVID-19 and its impact on many manufacturing industries, production of cars reduced a further 11% in 2020, meaning that there was a drop of more than 16% in auto manufacturing globally in the last two years.1

According to data obtained from the US Bureau of Transport Statistics (BTS),2 from 2015 to 2020 passenger car manufacturing has overall been on the decline. The manufacturing of commercial vehicles such as trucks and light trucks has also mostly been on the decline in those past five years. In 2020, the level of car manufacturing was as low as it had been since 2010, which was low as a result of the 2008 recession.1

So, what does that mean for those that want to buy a new car? With manufacturing numbers dwindling and the future uncertain, this may mean reduced car availability in the short term. We can only wait and see.

Brought to you by Compare the Market: Making it easier for Australians to search for great deals on their Car Insurance.