The Burrow

Car mishaps on the road are a daunting possibility for everyone. As car insurance experts, we wanted to look at who has had a car kerfuffle on the road, and look at how quickly it happened after driving out of the showroom.

To do this, we ran a survey across Australia, the United States, and Canada with more than 3,000 respondents to find out just how many people have gotten into their own car blunders.

Here’s what we found.

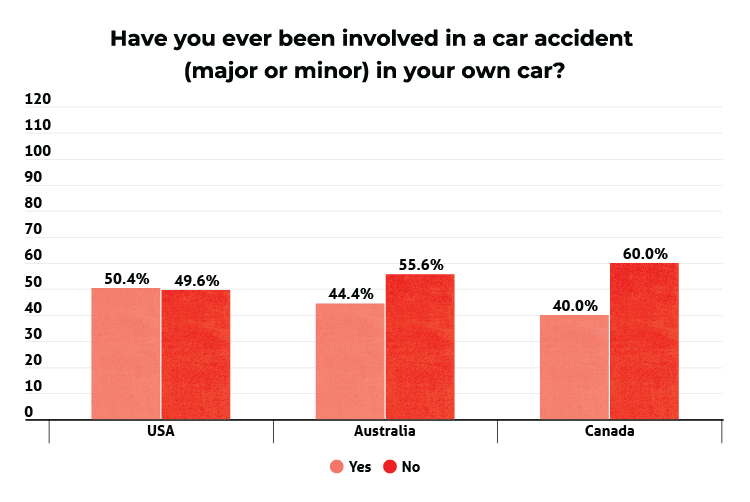

Fifty-five percent of road users we surveyed have not been involved in a vehicle accident in their own car, either minor or major. Drivers in the USA were the only group who reported a higher than 50.0% rate of car accidents.

Conversely, Canadian drivers came in as the safest, with 60.0% of respondents not being involved in car accidents in their own car.

Interestingly, of those surveyed, Australia tended to have the most reckless young drivers, with 36.5% of Generation Z drivers (18-26 years old) being involved in an accident with their own car – a big leap from young drivers in both America and Canada (26.2% and 27.0% respectively).

Within the first two years of ownership, Canadian drivers who had been involved in a car mishap were the only drivers who had a higher than 50% propensity to be involved in a car accident.

Country-by-country data shown in the tabs below.

Conversely, young drivers (18-26 years old) had a much higher propensity to be involved in a major or minor car accident within the first two years of ownership when compared to every older age bracket.

The tabs below show the data sorted by age brackets.

The majority of crashes that respondents were involved in were minor fender benders, with the vehicle still being usable after repair.

The tabs below reveal the country-by-country results.

Conversely, American drivers surveyed were more likely to have their car written off, at 23.7%, than those in Australia and Canada, at 18.2% and 19.2% respectively.

The vast majority of drivers across each country surveyed were covered for their bumper bumps by their comprehensive car insurance. Each country’s drivers were covered at a rate above 80%, though Australia came in as the lowest with a rate of 83.6%. Consequently, Australian drivers were also the surest about the insurance status of their vehicles.

The tabs below reveal the results for each country.

Young drivers in both Australia and Canada tended to have some of the lowest rates of insurance coverage for their car blunders, with 20.4% of Australian drivers aged between 18-26 years old not being covered, the highest rate of any age bracket in Australia. Similarly, 18–26-year-old drivers in Canada came in as runner-up for lowest rate of comprehensive cover, at 10.5%, second only to drivers aged 42-57 years old who weren’t covered at a rate of 10.9%.

Young American drivers bucked this trend, with drivers aged between 18-26 years reporting the second highest rate of covered crashes at 86.5%.

Compare the Market’s Executive General Manager of General Insurance, Adrian Taylor, notes the importance of car insurance to ease the potential financial pain associated with car accident repairs.

“Anything can happen on the roads, so having car insurance can provide peace of mind when driving,” Mr Taylor said.

“While important for helping drivers after a car blunder, depending on your insurer and the terms of your policy, comprehensive car insurance can also cover your vehicle for storm damage, as well as towing and car hire among other things.

“Be it comprehensive or third-party cover, car insurance is important to consider when buying your next car.”

Always read the Product Disclosure Statement (PDS) and Target Market Determination (TMD) to check for the inclusions, limits and restrictions before purchasing to make sure the product is suitable.

Compare the Market commissioned PureProfile to survey 1,005 Australian, 1,005 American and 1,005 Canadians adults in September 2024.