The Burrow

If you’ve ever had a side hustle, like freelancing, delivering goods, tutoring, rideshare driving, blogging, or anything else that provides money for labour on a temporary as-need basis, you’ve likely dipped your toes into the gig economy.

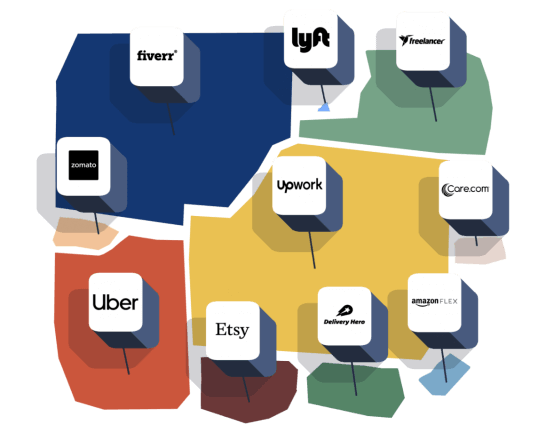

The gig economy is an ever-growing market that has flourished in the wake of the digital world. Uber, Etsy, Freelancer and Fiverr are all online gig platforms that provide users the ability to earn money on their terms.

Although we have records of this type of employment being around since the 18th century,1 the modern-day gig economy has exploded with a wealth of opportunities in the last decade, disrupting and changing traditional employment models for many businesses.2

But how does a gig economy role look from an insurance perspective? As experts in business insurance, we’re here to tell you.

As a sort of self-sustaining business, it’s important for gig workers to be insured. The specific aspects they need to consider when taking out a policy are typically quite similar to other sole traders and businesses. For example, it’s worthwhile thinking about:

And that’s just the tip of the iceberg! If you are looking to purchase business insurance to cover you while you work in the gig industry, use Compare the Market to compare policies in just a few clicks.

We know that in recent years the gig industry has surged, particularly in line with increased digital adoption. But here’s the big question…

Just how big has the online gig world become in the short period that it’s been around?

One of the biggest problems with measuring the growth of the modern gig economy is that there is no clear consensus of what a gig job is.

Furthermore, out of the limited number of studies available, most will conflate full-time workers who have picked up one gig job over the last year with those who count on gig jobs as their main source of income.

To gain some measure of just how big the online gig economy has become, we’ve laid out the revenue per year for the ten largest publicly listed online gig platforms in the world. Most of these companies have become publicly listed within the last five years.

For the most part, these companies have been founded within the last five to 15 years, and yet they’re already operating in an average of 30 countries each.^

Uber has hit over USD$14billion in revenue in 10 years, and Upwork has hit USD$300million in revenue in four years. The sheer growth of these gig giants in such a short period brings light to how lucrative these online industries are.

The growth in revenue of Uber, Upwork and the other companies listed above suggest that the online gig economy as a whole is expanding as well. Afterall, the supply must be growing because of an increased demand. Although, according to the Ai Group, the role that gig workers play is so diverse that it’s difficult to predict how the future workforce will shape up.30

That being said, these major gig companies are arguably normalising job insecurity.31 Their high profiles and extensive marketing tactics are boosting the phenomenon of insecure work by appealing to those who’re struggling with the increased rates of underemployment and casualisation.30 So much so that certain gig jobs, such as food delivery workers, have become essential to the function of many restaurants, as well as our daily feeding rituals.32

^ Excluding Fiverr and Upwork, which is used in all countries around the world except for a few restricted countries.

Recent events have highlighted our dependence on the online gig economy. With COVID-19 lockdowns forcing many restaurants to close, restaurant owners have begun relying on food delivery contractors to continue business as usual.31

The lucrative ridesharing market has the potential to continue growing due to global auto sales dropping by over 40% on the previous year in March 2020, with some countries in Europe dropping by up to 85%.33 With fewer people purchasing private vehicles, it’s more likely that they’ll depend on other ways to get around, such as public transport and rideshare apps.

Furthermore, major companies have had to let go of their employees or reduce contracted hours due to the crashing economy, putting many workers in a financial predicament. Cheryl Carleton, assistant professor in economics at Villanova University, described how rehiring and replacing workers can come at a high cost – a cost that many companies can’t afford coming out of a major global recession.34

She suggests that an alternative fix for firms is to hire fewer permanent employees, and instead rely more on contract workers.32 So, there’s a good chance that more people will be seeking gig jobs coming out of COVID-19.

The demands for autonomous and flexible work, driven by a greater hunger for freedom and entrepreneurship, have impacted the way companies organise their employees.29

The source of this demand is difficult to pin down. In any case, digital marketplaces have better equipped individuals to pursue the benefits of working independently – whether they’re looking for a side hustle or a change from the usual nine-to-five.

Not only that, technological advancements have made it easier for customers to create demand. For example, instead of calling a taxi service, you can order the closest available rideshare driver at the click of a button. Not only is it faster and easier, it’s also a cheaper alternative. These cheaper and more convenient alternatives have disrupted demand in existing markets.

We’ll likely see a continued expansion of the online gig economy, but there’s no way to know for sure how it’ll progress in future.

Running a business comes with risks like accidently giving a client the wrong advice or your customer data gets stolen. Thankfully, a suitable level of business insurance can financially protect you from these unexpected events and more! Whether you’re just starting out or have been around for years, you can compare a range of policies through our free service.

Compare business insurance policies from some of Australia’s top insurers today and protect your livelihood.

Brought to you by Compare the Market: Making it easier for Australians to search for great deals on Business Insurance.