The Burrow

The way we pay for things has changed throughout history, and it will change again. In times of old, we traded and bartered all manner of goods, then coins made of precious metals were used.

Modern technology has given us the credit card and debit card, and now we can have our banking cards stored digitally in our phones and pay for things with the touch of a button or wave of the hand.

So, what payment methods do we prefer? Have businesses started forcing customers to use completely digital forms of payment? Do people want more legally accepted forms of payment, such as cryptocurrency?

As experts in business insurance and understanding cyber liability for digital payments, we surveyed more than 3,000 adults across Australia, Canada and the USA to find out. We also asked if people feel that the COVID-19 pandemic has changed how businesses accept payment, and whether people have changed the way they purchase things.

Here is what we’ve found.

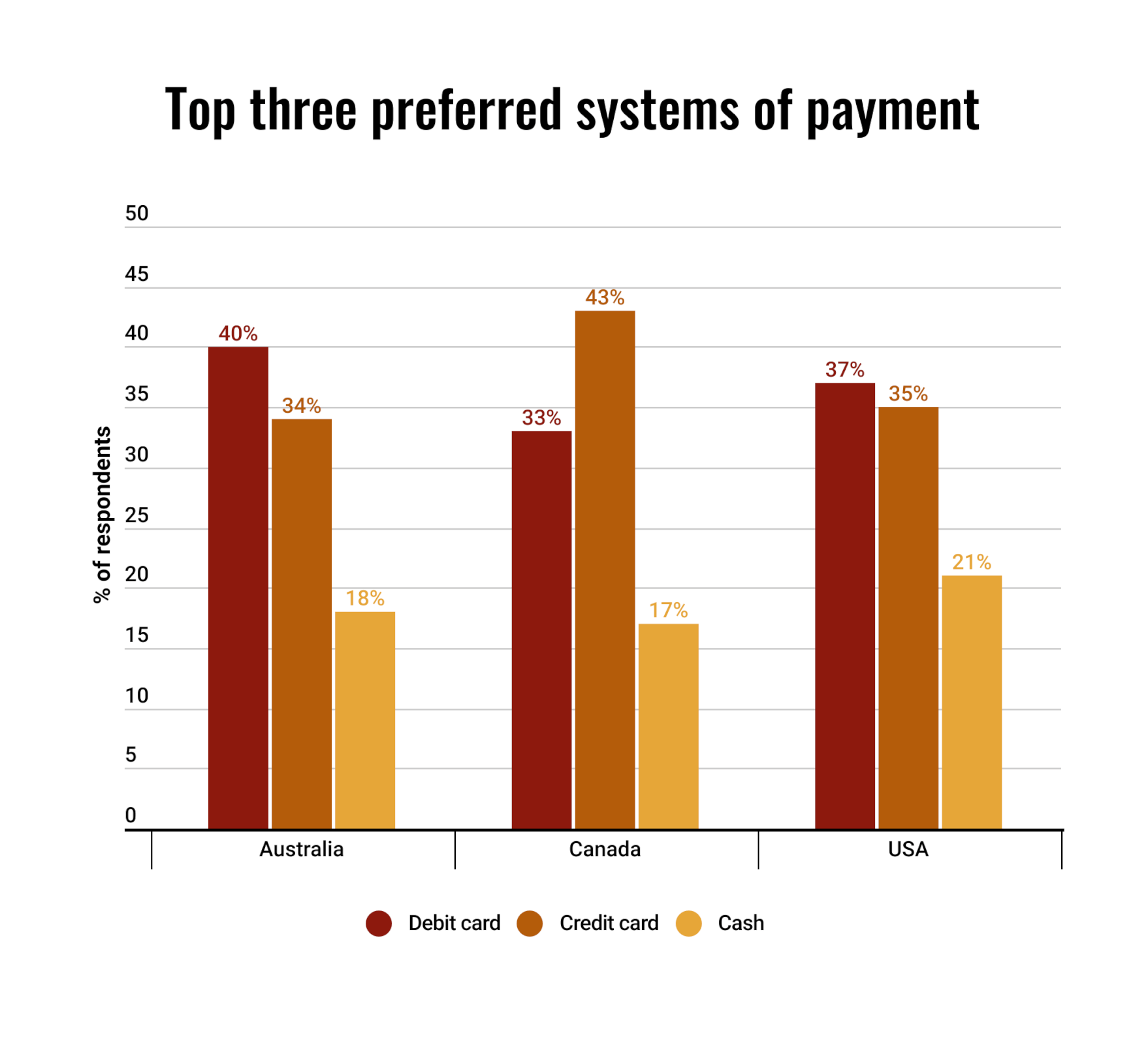

The debit card was the number one choice to pay for things in Australia and the USA, and number two in Canada after credit cards. Credit cards were likewise the second-most popular choices in Australia and America as well.

Much has been said about the inevitable slow death of physical money, but as our survey shows, cold hard cash is still very much in use alongside the fantastic plastic banking cards.

Cash remains popular across all age groups in each country. Although, breaking down the results by age-group does show an age specific trend.

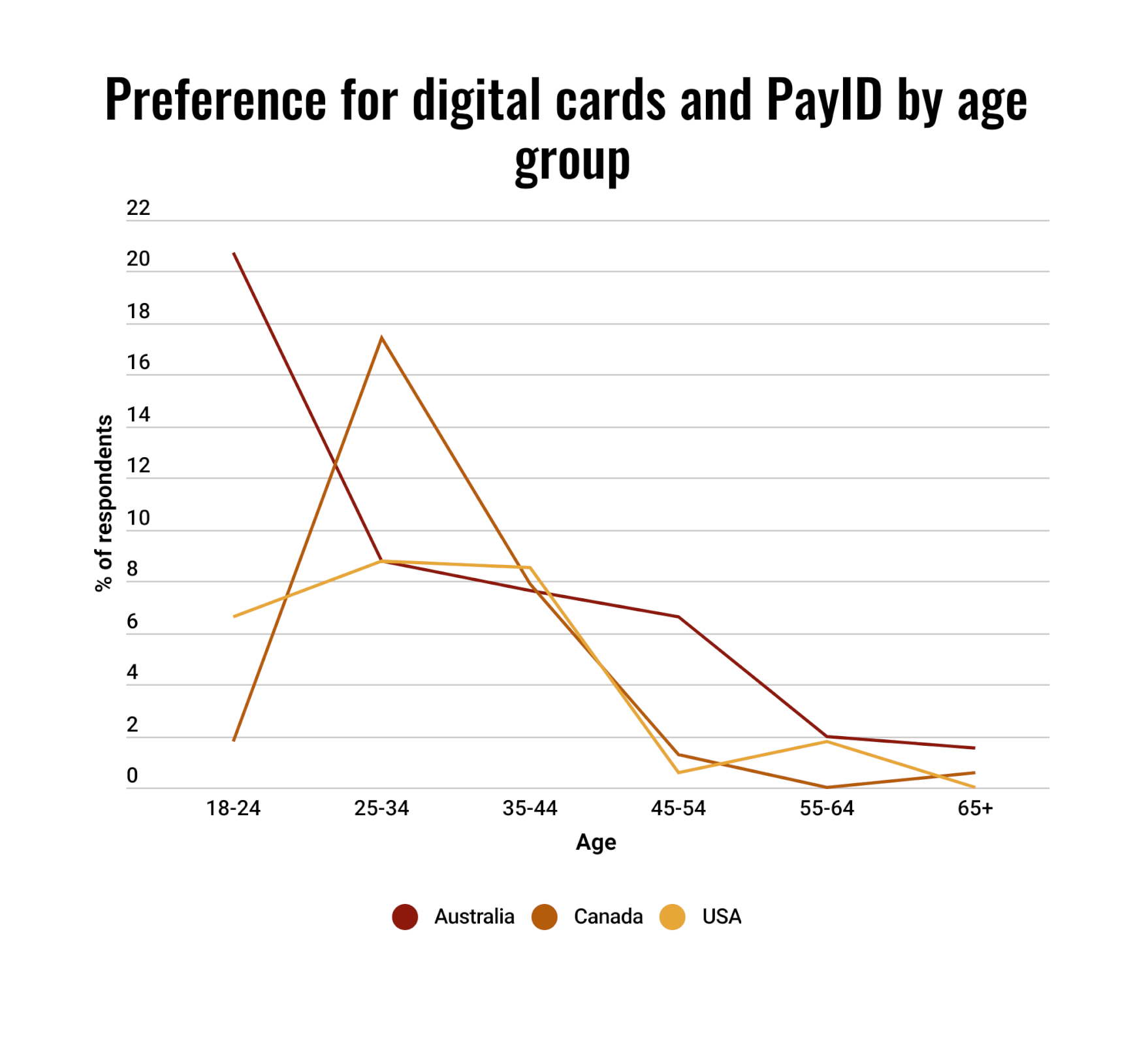

Digital cards such as ApplePay or Google Wallets, as well as PayID, were more popular with younger age groups than older age groups, with the proportion of respondents who said it was their preferred method peaking in Australia amongst 18-24-year-olds. Digital card payments and PayID reached peak popularity amongst 25-34-year-olds in Canada and the USA.

Other payment methods like buy now pay later, personal cheques, online bank transfers and cryptocurrency barely got a look in, with few respondents saying it was their preferred method of paying for things. This isn’t to suggest they aren’t used at all, just less used than physical bank cards and cash.

New technology has added more ways to pay for things, and one of those is the form of using an entirely digital payment system – no cash or physical debit/credit card required. A common example these days is a restaurant or bar asking you to scan a QR code to order off the menu and pay from your phone.

Businesses are taking advantage of this new technology and nearly half of all people surveyed have been forced to use it by a business they were shopping with, and card or cash weren’t an option.

Forty per cent of Australians and Canadians have been made to pay for a product or service using a digital form of payment, while in America it was slightly less at 39%.

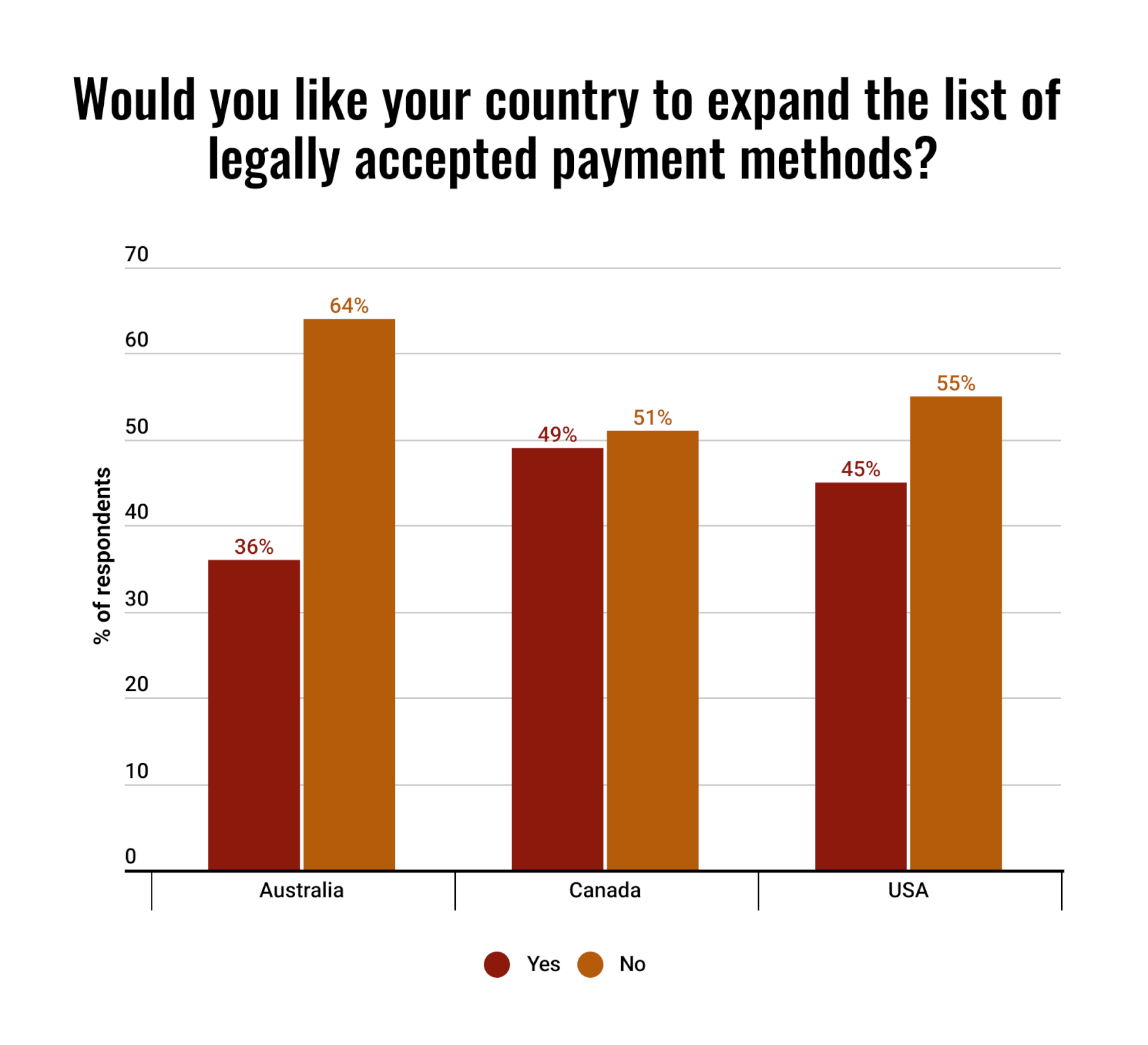

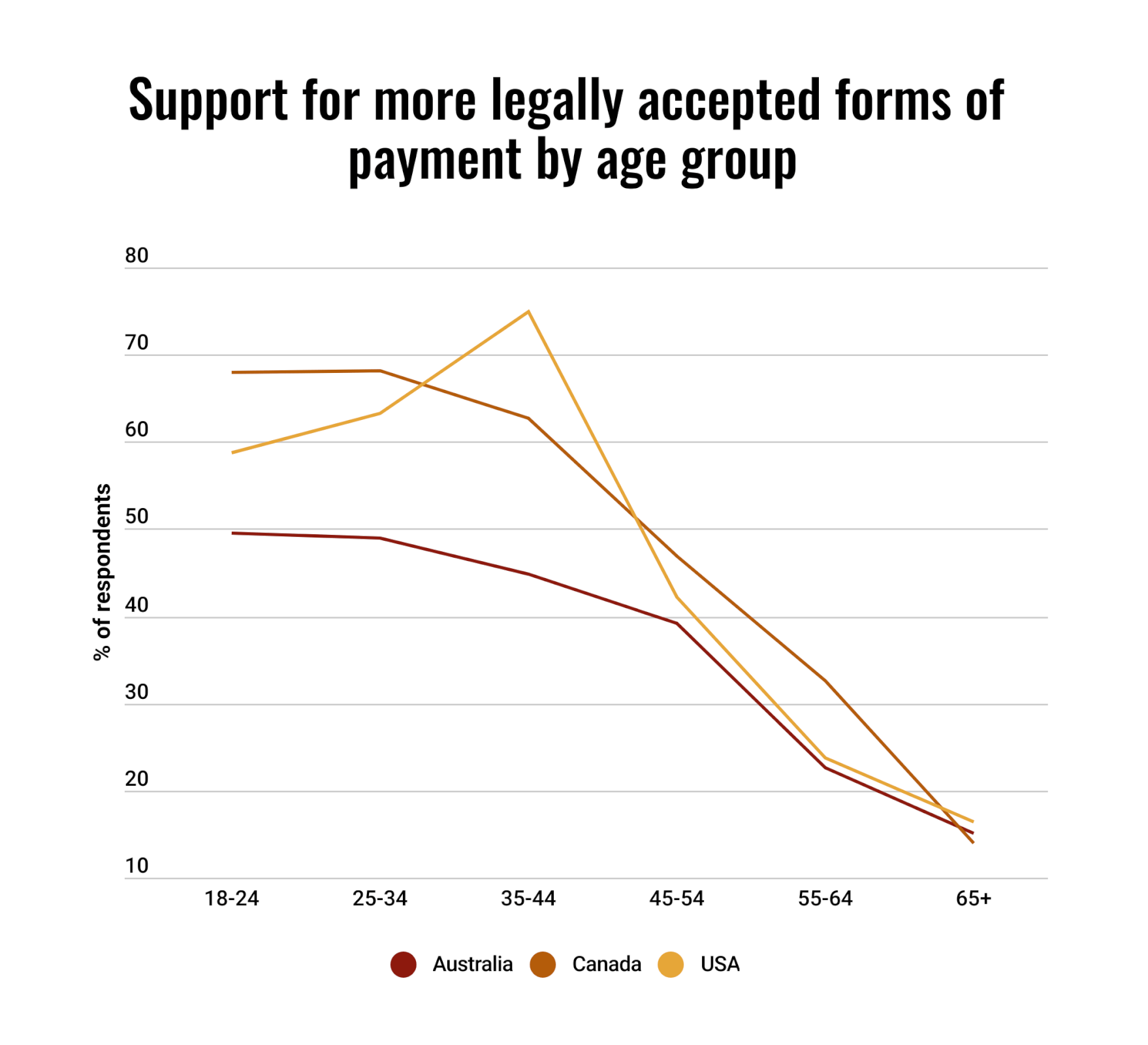

The survey asked if people would like their country to consider expanding their list of legally accepted payment methods, such as accepting cryptocurrency. The results were pretty split among respondents from North America, but less so in Australia.

Canadians were the most likely of the three nations to say they wanted additional forms of legal tender, with 49% agreeing. Americans followed at 45%, while Australians were much more likely to say no, with only 36% saying they wanted more legally accepted ways to pay.

However, when we break the responses down by gender, there was a noticeable trend where men were more likely to want additional payment methods recognised than women.

America had the biggest split with 51.9% of men in favour, compared to only 38.1% of women – a difference of 13.8%. In Australia, the difference was 12% (42.1% of men were in favour, compared to 30.1% of women) while Canada had the smallest gap between men and women. For Canadians, 52.4% of men and 44.9% of women supported expanding the list of legal tenders, a difference of only 7.5%.

Another clear trend across each nation surveyed was that younger generations were more likely to want additional forms of legal tender recognised. While Australia still had the lowest interest overall, those aged 18-24 were almost 50% in favour of accepting more payment methods (49.6%). The highest support by age group in Canada was among those aged 25-34, who were 68.2% in favour, while in the USA as many as three quarters of those aged 35-44 were in favour.

Interest in extra payment methods quickly dropped off amongst the older age-groups, as highlighted in the chart below.

When asked if they think the COVID-19 pandemic changed how businesses handle and accept money, the overwhelming majority of Australians, Canadians and Americans had noticed a difference.

Fifty per cent of Australians said it had changed significantly across the board, while 41% believed it had only changed for some businesses. Just 9% said they hadn’t noticed any difference at all. In Canada 38% said it had changed significantly, followed by 46% who said it had changed for some businesses, and 15% said they hadn’t noticed any difference. In the USA, 17% hadn’t noticed any difference, compared to 41% who felt it had changed for some places and 42% said it had changed a lot across the board.

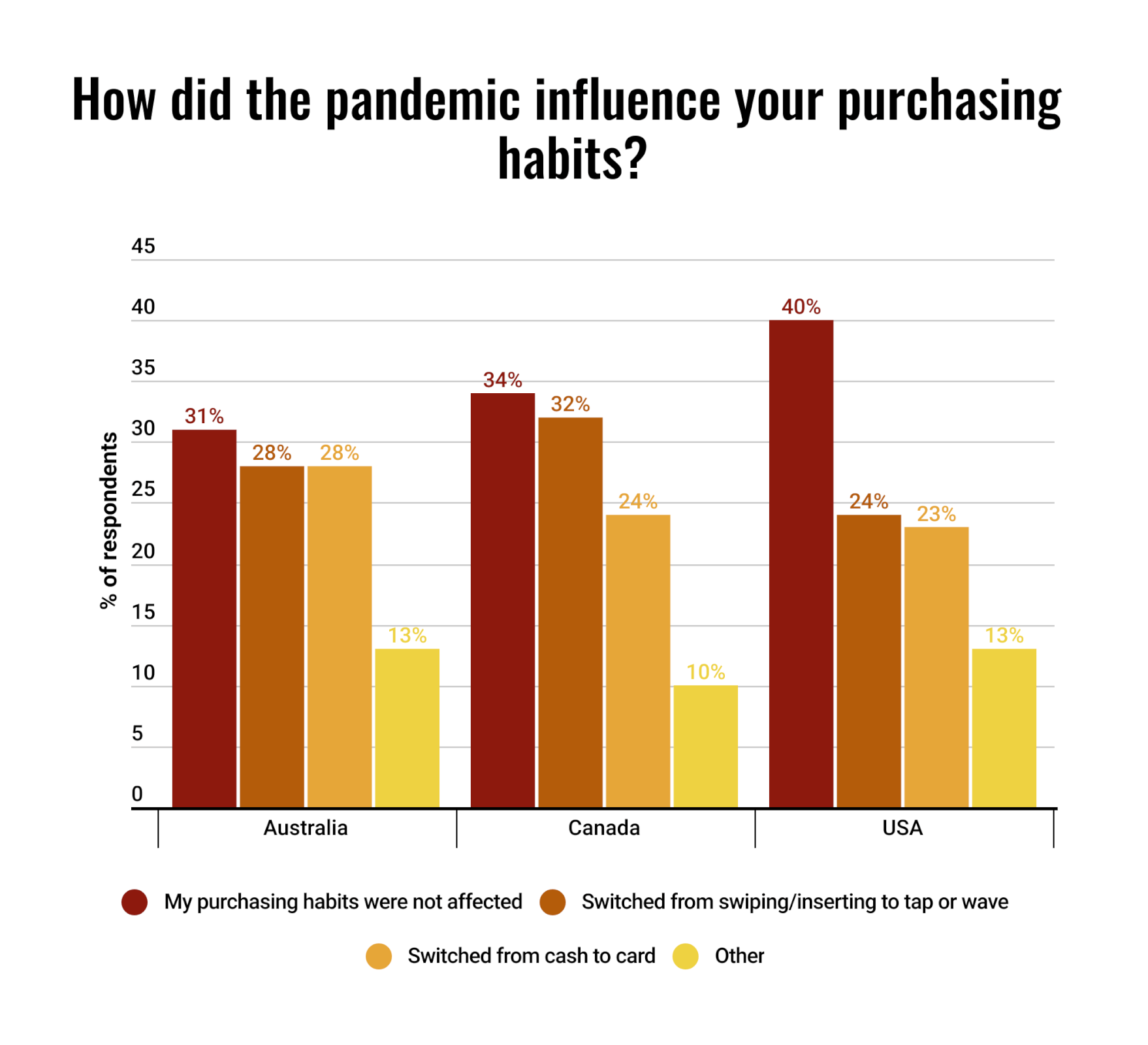

But did it change the way we, as customers, pay for goods and services?

For a large portion of us it did, but not in the same way…

The most common response from respondents was “my purchasing habits were not affected.” This was the case for 40% of Americans, 34% of Canadians and 31% of Australians. However, overall most people did make some kind of change (60% of Americans, 66% of Canadians and 69% of Australians). For those that did make a change, the most common was to still primarily use a bank card, but to switch from swiping or inserting it to tap and wave payments.

The next most popular choice was to switch from mostly cash payments to mostly card payments.

N.B. due to low responses the results for those who said, “I made the switch from card to cash,” “I use cryptocurrency more frequently,” “I use Buy Now, Pay Later more frequently,” and “I use By Now, Pay Later less frequently” were combined under “Other” in the bar chart.

Compare the Market’s General Manager of General Insurance, Adrian Taylor, notes that it is important that businesses adapt to new payment technology, and that they consider how this could impact their business insurance needs.

“Business insurance can cover money kept in the building or while it is in transit to the bank in case of an incident like a fire or theft, but as technology changes and digital methods become more popular, it’s important to consider if you need cover for gadgets and tech like EFTPOS machines or Square card readers and other point of sale systems,” explains Taylor.

“If you have an online store and take orders from the web or through apps and social media, it’s well worth considering cyber liability insurance. If your system gets hacked and criminals get access to customer information, you could be liable for damages.”

“Business and technology is an evolving landscape,” Taylor continues. “If you own a business it pays to make sure you regularly review your insurance needs as tech changes the way we do business.”

Compare the Market commissioned PureProfile to survey 1,008 Australian, 1,008 American and 1,006 Canadian adults in May 2023.