- 21% of Australians stress about money every day, 24% feel pressure at least once a week

- 92% have noticed cost of living rise while 78% have experienced bill shock paying for everyday expenses

- There’s been an 8% lift in people cutting back on discretionary spending since September

More than three quarters of Australians have been shocked by the cost of everyday expenses like fuel and power bills over the past three months according to Compare the Market’s latest Bill Shock Survey.

The latest edition of the quarterly report paints a troubling picture of households struggling to make ends meet, with more respondents scrimping and saving to afford everyday expenses.

Despite any efforts to save, Australians say they are spending more at the bowser and the checkout.

Average household spend on living expenses

| Living cost | September 2021 | April 2022 | $ difference |

| Petrol (per month) | $117 | $189 | ^ $72 |

| Energy bills (quarterly) | $412 | $413 | ^ $1 |

| Groceries (per week) | $170 | $180 | ^ $10 |

Source: Compare the Market’s Bill Shock Survey April 2022 and September 2021

Compare the Market’s Chris Ford said concerns had been on the rise since the end of last year.

“Just under half of Australians stress about their finances on a weekly basis, while one in five feel anxious about money every day. That figure is up 6% since the last time we ran our survey in December.

“The figures show the rise in living expenses is starting to impact our spending behaviour, with more consumers cutting back on discretionary spending and shopping around in attempts to save.”

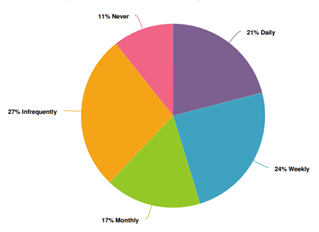

How often do you feel stressed about your finances?

Source: Compare the Market’s Bill Shock Survey of 1,000 Australians conducted by Pure Profile, April 2022

The vast majority (92%) of Australians had noticed an increase in the cost of living with 78% reporting shock over products like fuel (65%), electricity and gas (38%), and water bills (21%).

Additionally, 57% had been dealing with unexpected expenses such as home repairs (24%), vehicle repairs (28%), medical emergencies (9%), pet emergencies (9%) and unexpected travel (8%).

In order to afford rising costs, 59% said they had starting to cut back on discretionary spending on things like dining out (49%), entertainment (57%) and holidays (28%).

About 35% said they were reigning in spending at the supermarket with 26% planning cheaper meals, 15% switching to home brands and 21% looking harder for discounts.

Other saving tactics include eating less meat (16%), only buying in-season fruits and vegetables (12%) and buying more frozen foods (11%). Sadly 6% reported skipping meals to reduce costs.

People have also been shopping around to save money on petrol (60%), energy plans (21%) and insurance products (25%).

It’s just the start of what’s likely to be a difficult year according to Mr Ford who said rising rents and mortgage rates would likely add more pressure to household budgets in the coming months.

Of the 1,000 people surveyed, 36% were paying off a mortgage and 32% were renting.

66% of mortgage payers said they were concerned about how a home loan rate rise would impact their ability to afford repayments.

A similar number of renters (65%) said they could not afford an increase in their rental payments.

“The forecasted rate rise could come as a shock to the hundreds of thousands of homeowners who have never experienced higher rates,” Mr Ford said.

“Our figures show there’s already a lot of nervousness. It’s important mortgage payers start to plan now to make sure they’re prepared for a change.”