The Burrow

Travelling is an exciting adventure. Packing for travelling… less so. However, imagine that you finally finished packing your suitcase with everything you need for your flight and holiday, only to arrive at your destination and stand around in the airport, waiting anxiously for your suitcase to trundle its way out on the conveyor belt – and that’s when you find out your suitcase was lost before you even took off.

As experts in travel insurance, we know that losing your luggage can completely derail a vacation. There’s the chance you’ll get it back later that day or during the week, but in the meantime all you have to take with you to your accommodation is your carry-on and the clothes on your back.

This situation is a travel nightmare, but how common is it? To find out, Compare the Market surveyed more than 3,000 people across Australia, Canada and the USA to find out.

As it turns out, it’s more common than we would like.

According to the survey, almost one in three Canadian respondents said they had lost their suitcases and baggage while flying (32.1%). It was slightly less common for Americans, with 27.6% losing their luggage. In contrast, one in four Australians (24.5%) have had luggage go missing while travelling with an airline.

| Have you lost luggage when flying? | Australia | Canada | USA |

| Yes | 24.5% | 32.1% | 27.6% |

| No | 75.5% | 67.9% | 72.4% |

There are all sorts of reasons why people might have their baggage go missing while flying. Airline baggage handlers may have misplaced it once you have checked-in for your flight, or someone may have beaten you to luggage pick-up and accidentally taken yours in their jet-lagged, travel weary state – especially if you use a similar suitcase. It’s also plausible that someone may have stolen your luggage deliberately before you could get to baggage claim.

Thankfully, most people had their luggage returned to them by some point. Almost the same number of Australian and Canadian travellers had retrieved their lost luggage (93.5% and 93.3% respectively), compared to 90.2% of Americans. This means 9.8% of Americans, 6.7% of Canadians and 6.5% of Australians surveyed never saw their belongings again.

Across all three countries, it typically took a few days for travellers to have their lost items returned to them. The time it took survey respondents to get their luggage back is shown in the table below.

| Was your luggage eventually returned? | Australia | Canada | USA |

| Yes, within a matter of hours | 14.6% | 20.1% | 28.4% |

| Yes, within a matter of days | 62.2% | 57.1% | 49.6% |

| Yes, within a matter of weeks | 12.2% | 13.0% | 9.7% |

| Yes, within a matter of months | 4.5% | 3.1% | 2.5% |

| My luggage was never returned | 6.5% | 6.7% | 9.8% |

Generally, an airline will become aware when luggage has gone missing and notify you (if you don’t notify them first), and they will be able to rectify the problem by shipping it to your destination on another flight.

Should you have your baggage misplaced, the airline may compensate you for the lost, damaged or delayed luggage – even if it’s eventually returned to you. However, you may not be completely compensated for the value of all lost belongings.

According to the Montreal Convention of 1999, international flights are only required to compensate passengers up to 1,288 Special Drawing Rights (SDR) units, which as of 4 January 2023 is US$1,700 (AU$2,489).1 An airline may choose to pay more than this limit but they are not required to do so.

Compare the Market’s General Manager of General Insurance, Adrian Taylor, saw airline liability conventions highlight the importance of travel insurance for your luggage.

“Even if you do get your lost or delayed baggage delivered to you at your holiday destination, it could be days without your gear, forcing you to fork out extra for vital travel essentials,” Taylor explains. “While the airline might pay a claim, you might not be compensated for the full value of your belongings.”

“Getting travel insurance can help because you could get a policy for your luggage that covers you against loss and theft, including cash and travel documents. It has higher coverage limits than the limits required on airlines by international conventions, so you can have greater peace of mind if you need to make a claim.”

In the event where people lost luggage, more Canadians reported being reimbursed by the airline (37% of those surveyed) than Australians and Americans. Only 25.2% of Australians reported being reimbursed, followed by 23.4% of Americans.^

Canadians also had to wait the least amount of time before receiving compensation from the airline. On average, they had to wait 18 days, while Americans had a 21-day average wait. Australian respondents had the longest wait for reimbursement, at 28 days. Likewise, Canadians also received the biggest compensation, getting US$734 on average, while Australians typically received a mere $512.

According to our survey results, when respondents made a claim with their travel insurer, they received a bigger payout in a faster time than with the airline – except for Canada, where the average payout amount was less than what airlines paid.

The biggest difference was in the USA. Americans compensated by their travel insurance received US$1,031 on average, US$363 more than what the average airline payout was. Americans also went from an average 21-day wait for airline compensation to 15 days with a travel insurer. Canada went down from 18 to 11 days, while Australia had a marginal difference, with travel insurers being just two days faster.

However, as Taylor points out, some of those respondents received a payout from the airline and from their travel insurer.

“It is possible to receive compensation from your airline and your travel insurer. Your insurer will ask you to make a claim with the airline (if you haven’t already) and ask how much they compensated you. Your insurer will then pay you the difference between the reimbursement from your airline and the value of your things,” says Taylor.

“This further highlights the importance of having travel cover, as it can help provide extra coverage and a better overall monetary payout so you can continue your travel and make your way home with replaced clothing and travel gear.”

| Compensation waits and payouts | Australia | Canada | USA |

| Average wait for compensation from airline (number of days) | 28 | 18 | 21 |

| Average compensation amount from airline (USD) | $512 | $734 | $668 |

| Average wait for compensation from travel insurer (number of days) | 26 | 11 | 15 |

| Average compensation amount from travel insurer (USD) | $569* | $560* | $1,031* |

| Note: Survey respondents answered in their local currency. Prices were converted into USD on 23/01/23 using Google’s currency converter tool. * Some survey respondents were compensated by both their airline and their travel insurer. | |||

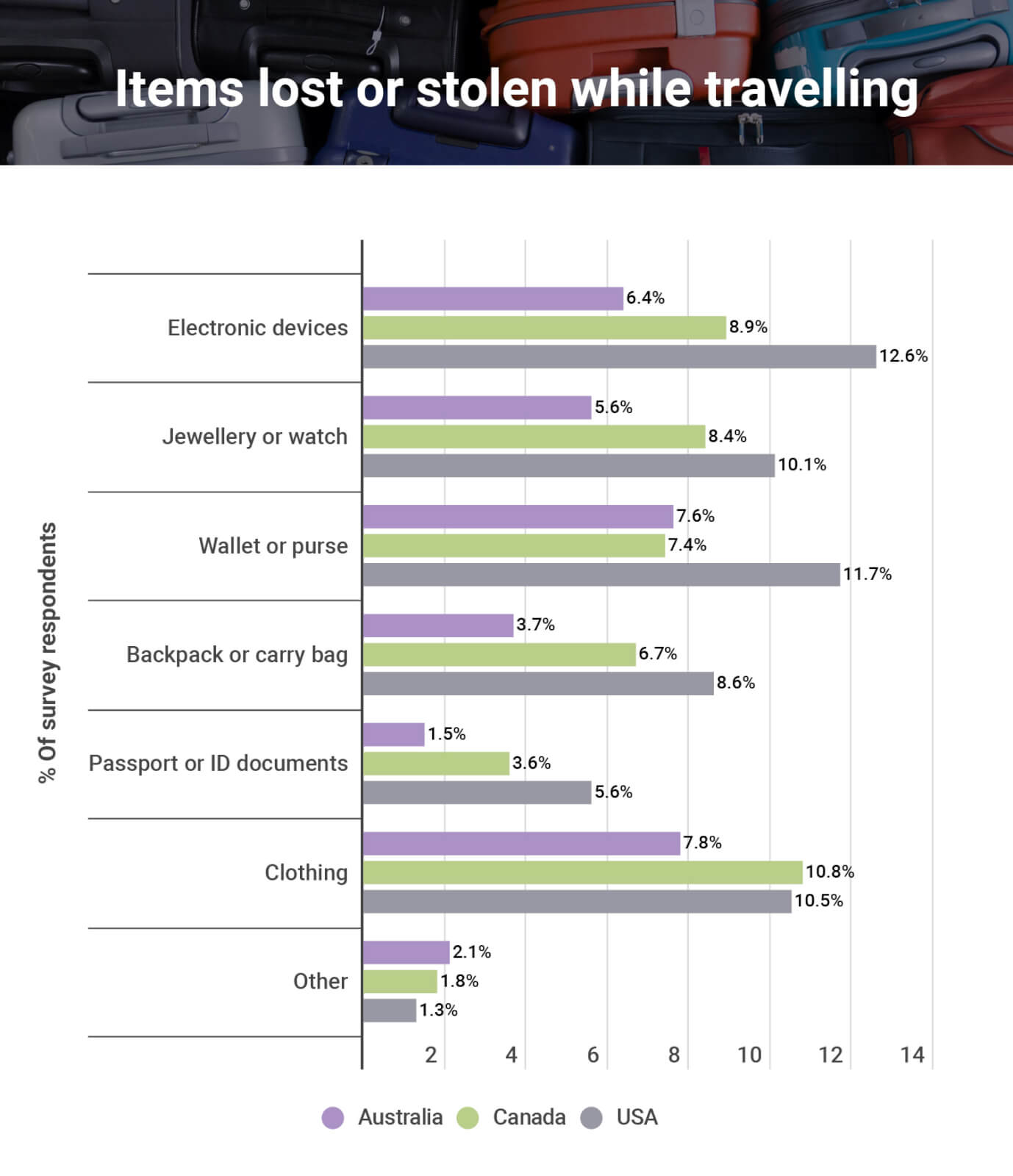

Theft and pickpocketing can occur when travelling, and some parts of the world are more infamous for it than others. Fortunately, the majority of travellers surveyed have not lost an item or had it stolen once they had reached their destination (excluding any mishaps with the airline). Almost 72% of Australians had never had anything stolen or lost, compared to 63.5% of Canadians and 59.9% of Americans.

Americans were more likely to have several types of items disappear or be misplaced compared to Australians and Canadians. The most common lost or stolen item for US travellers were electronic devices, while the most common things Canadians and Australians had lost or stolen on holiday was clothing.

There are many different methods that holidaymakers use to prevent their stuff getting stolen or lost while travelling. For Australians, the most popular method is to take out travel insurance, while the most popular for Canada and America is keeping valuable items on their person at all times.

The table below highlights which methods were most popular with survey respondents.

| How people protect their things while travelling | Australia | Canada | USA |

| Taking out travel insurance | 58.2% | 35.6% | 21.9% |

| Using special bags/pockets that are hard for pickpockets to access | 15.4% | 15.9% | 17.5% |

| Keeping valuable items on their person at all times | 53.1% | 53.7% | 49.7% |

| Making use of hotel safes | 31.0% | 28.3% | 21.4% |

| Separating cash into small amounts and storing them separately | 16.4% | 19.4% | 17.5% |

| Keeping their backpack on the front of their body at all times | 12.5% | 14.6% | 17.4% |

| Storing copies of documents separately to the documents themselves | 24.7% | 19.3% | 12.9% |

| Using a secure cash belt/bumbag | 14.5% | 11.6% | 9.7% |

| Using a travel money card rather than cash | 20.4% | 13.1% | 13.4% |

| None of the above | 9.1% | 9.9% | 16.6% |

Taylor notes that using multiple methods can help keep your belongings secure, but travel insurance should always be at the top of the list.

“It’s always a good idea to get travel insurance, not just for your luggage and possessions, but for a range of things. Travel insurance can cover medical expenses, travel delays and emergency accommodation, your rental car excess and more,” says Taylor.

“Coverage will differ depending on what policy you get, so it’s important before you buy, but travel insurance can provide a huge amount of coverage and give you peace of mind in case things go wrong on your journey.”

Taylor stresses that coverage can differ between policies and not every policy can cover the same thing, so that it’s important to compare details beforehand.

“Policies can be quite different, so it’s critical to view the Product Disclosure Statement or PDS before purchasing to see what’s covered, what the limits, exclusions and restrictions on coverage are.”

Sources:

1 Lost, Delayed or Damaged Baggage. U.S. Department of Transport. 2023.

Monetary values are rounded to the nearest dollar and are subject to change. Special Drawing Right unit values were converted into USD on 23/01/23 using the International Monetary Fund’s calculation (up to date as of 20/01/23) and converted into AUD on 23/01/23 using Google’s currency converter tool.

^ Not all people who lost luggage made a claim with the airline, and some people may have been compensated without needing to make a claim with their airline.

Compare the Market commissioned Pure Profile to survey 1,004 Australian, 1,008 Canadian and 1,009 American adults in November 2022.